Definition & Meaning

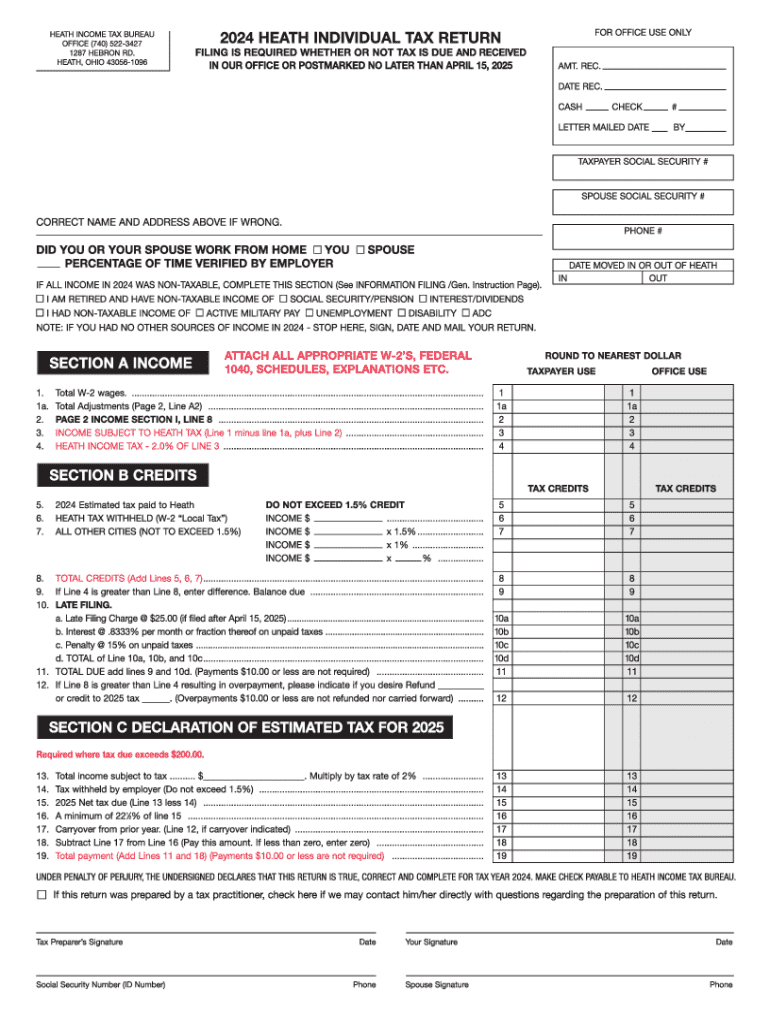

The "Heath Individual Return 24" form is a specialized document primarily used for specific tax purposes within the United States. It is typically connected to individual taxpayer filings and may be utilized for unique scenarios not covered by standard forms. Understanding the purpose and scope of this form is crucial for taxpayers who might need it. It involves specifics related to individual financial activities and obligations, often requiring precise information to ensure compliance with tax regulations. This form ensures that individuals meet their personal tax obligations while adhering to federal guidelines.

How to Use the Heath Individual Return 24

Using this form involves detailed understanding and accurate completion. Taxpayers must collect all relevant personal and financial information prior to filling out the form to ensure nothing is omitted. It's used to report specific types of income, deductions, or credits not typically managed by conventional tax return forms. The completion process requires attention to detail as every section pertains to individual financial details, which directly impact tax liabilities and potential refunds. Individuals should carefully review each entry to ensure accuracy and compliance.

Steps to Complete the Heath Individual Return 24

- Gather Necessary Documents: Collect all personal identification, prior tax returns, and any financial documents that contribute to income estimates or deductions.

- Download or Obtain the Form: Access a digital or paper version of the form from the appropriate issuing body, often a governmental tax office or website.

- Fill Out Personal Information: Enter your personal details such as name, social security number, and address accurately.

- Enter Financial Data: Input detailed financial figures reflecting income, deductions, and other financial activities relevant for the tax period.

- Review and Verify Entries: Carefully check all information entered for accuracy to prevent discrepancies and ensure compliance.

- Submit the Form: Follow submission guidelines to forward the completed form to the relevant tax authority, employing either online submission or traditional mailing methods.

Required Documents

Completing the Heath Individual Return 24 demands comprehensive documentation to substantiate all reported information. Key documents typically include:

- W-2s and 1099s: To report income from employment and other sources.

- Bank Statements: For verification of interest income, dividends, and other transaction records.

- Investment Records: Document income or losses from stocks, bonds, or other securities.

- Receipts for Deductions: For claims related to business expenses, education, or other eligible deductions.

- Having these documents ready facilitates accurate data entry and supports claims made within the form.

Important Terms Related to Heath Individual Return 24

Several technical terms are essential for understanding this form:

- Adjusted Gross Income (AGI): A taxpayer's total gross income minus specific deductions, critical for calculating tax obligations.

- Deductions: Eligible expenses that can be subtracted from gross income to reduce taxable income.

- Credits: Amounts that can be subtracted directly from taxes owed, potentially lowering tax liability significantly.

- Exemptions: Allowances that reduce income subject to tax, possibly lowering the overall tax burden.

Filing Deadlines / Important Dates

Adhering to filing deadlines is vital to avoid penalties or interest on late submissions. The Heath Individual Return 24 should typically align with standard tax filing deadlines unless specified otherwise:

- April 15: The traditional deadline for most individual tax returns.

- October 15: Deadline for those who filed for an extension.

- Keeping track of these dates ensures compliance and avoids unforeseen complications.

Legal Use of the Heath Individual Return 24

The form must be used strictly within the boundaries of U.S. tax law. It serves specific legal functions related to personal financial declarations and tax liability assessments. Misuse, whether intentional or due to misunderstanding, can lead to significant penalties. Consequently, taxpayers are encouraged to consult tax professionals or legal advisors when completing the form, especially in complex financial situations.

Examples of Using the Heath Individual Return 24

Consider hypothetical scenarios where the Heath Individual Return 24 is applicable:

- Freelancer with Diverse Income Sources: A self-employed individual earning from multiple freelance projects might need this form to consolidate varied income streams accurately.

- Taxpayer Claiming Unique Deductions: If a taxpayer incurs costs for rare deductible expenses, the Heath Individual Return 24 might provide the necessary structure for properly reporting these deductions.

- These examples illustrate the form's utility in scenarios requiring specialized tax data reporting.