Definition and Meaning of the Employer Tax Unit, RI Department of Labor and Training

The "Employer Tax Unit, RI Department of Labor and Training" refers to a unit within the Rhode Island Department of Labor and Training that oversees tax-related activities associated with employers. This unit is responsible for processes such as the registration and termination of business tax accounts, ensuring that businesses comply with state tax regulations. The associated form is particularly significant for employers who wish to report the termination of their business registration, providing a structured way to communicate vital information to the state.

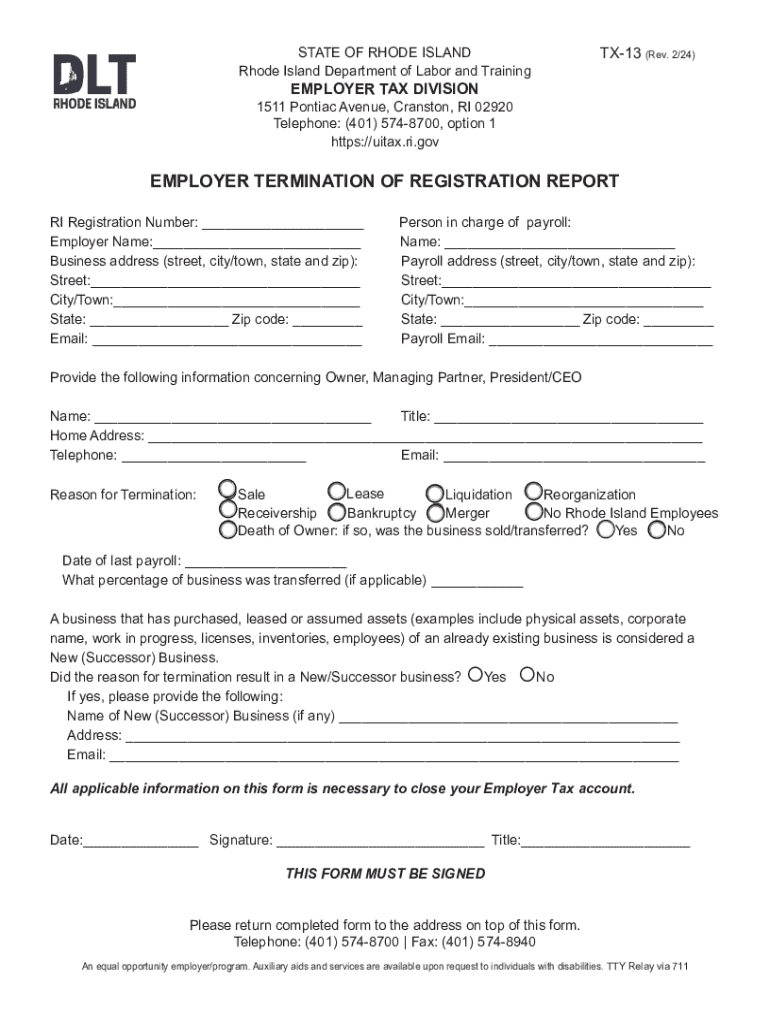

How to Use the Employer Tax Unit Form

Using this form requires a comprehensive approach to ensure completeness and accuracy. Employers must fill in sections detailing their business information, payroll specifics, and reasons for terminating their registration. Each segment of the form is designed to capture critical data necessary for the proper processing of the termination request. Employers should carefully review each section, following guidelines to avoid omissions. Once completed, the form must be signed before submission, confirming the information provided is accurate and true to the best of your knowledge.

Steps to Complete the Employer Tax Unit Form

- Gather Information: Collect all required documentation related to your business, including payroll details and business identification numbers.

- Fill Out Business Details: Complete sections requiring business name, address, and tax identification information.

- Provide Termination Details: Clearly state the reasons for terminating the business registration and include any successor information if applicable.

- Include Financial Information: Thoroughly fill out payroll and any financial obligations necessary for the termination.

- Review and Sign: Ensure all information is correct, then sign the document to verify your provided data.

- Submit the Form: Follow submission guidelines for in-person, mail, or electronic delivery based on your preference or state requirement.

Key Elements of the Employer Tax Unit Form

The form consists of several key sections that collect detailed information:

- Employer Information: Requires the business name, contact details, and tax identification number.

- Payroll Details: Gathers data on employee wages and payroll activities.

- Termination Reason: A narrative description explaining the basis for terminating business registration.

- Successor Information: Details about any entity taking over responsibilities, if applicable.

- Declaration and Authorization: A declaration statement that confirms the information is correct, requiring an employer's signature.

Legal Use of the Employer Tax Unit Form

This form is a legal document that facilitates the discontinuation of a business's tax obligations with the Rhode Island Department of Labor and Training. It must be filled with accurate information to prevent legal complications. Misrepresentation or inaccuracies can lead to penalties or further inquiry by the department. It's advisable for businesses to review all information provided thoroughly and ensure compliance with legal standards.

State-Specific Rules for the Employer Tax Unit Form

In Rhode Island, businesses must adhere to specific state regulations when filing this form. The rules may differ from other states, emphasizing the need for Rhode Island-specific guidelines. It's crucial to follow the exact instructions provided by the state's Department of Labor and Training to ensure compliance. This includes adhering to specific filing deadlines and understanding distinctions in state-specific tax rules.

Important Terms Related to the Employer Tax Unit Form

Understanding terms like "termination of registration," "payroll obligations," and "successor entity" is vital when dealing with this form. These terms dictate how employers approach completing the form and ensure comprehensive data collection. Additionally, knowing definitions surrounding tax obligations can help facilitate a smoother form completion process.

Penalties for Non-Compliance

Failure to properly complete and submit the Employer Tax Unit form can result in several penalties, ranging from fines to possible legal action. Non-compliance may also lead to continued tax liabilities, as the business remains registered in the eyes of the state. It is imperative for businesses to address all elements of the form accurately to avoid these issues.

Form Submission Methods

Employers have multiple options for submitting the form:

- Online: Offers the convenience of digital submission through the official platform.

- Mail: Traditional mailing of physical documents is still accepted and may be preferred by some businesses.

- In-Person: Direct submission at designated offices provides a way to get immediate confirmation of receipt.

Each method offers unique benefits and should be chosen based on the employer's preference and context.