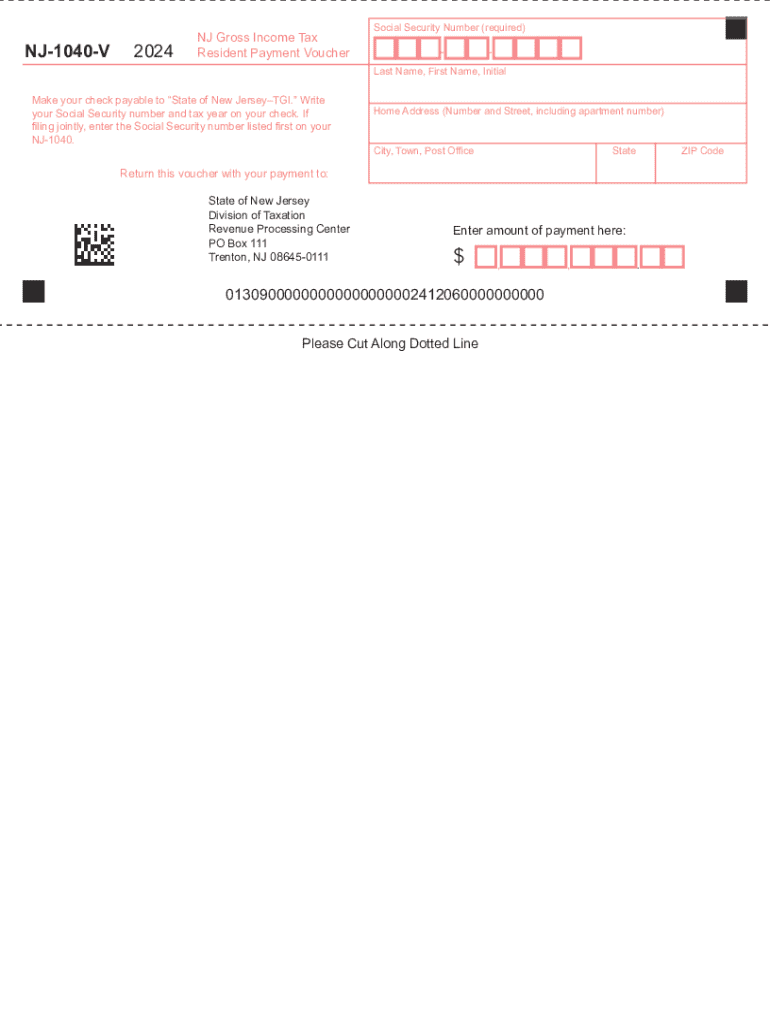

Definition and Purpose of the 2024 NJ-1040-V Resident Income Tax Payment Voucher

The 2024 NJ-1040-V Resident Income Tax Payment Voucher is a form utilized by New Jersey residents to submit payments for their state income taxes. This voucher facilitates the accurate and efficient processing of tax payments by the New Jersey Division of Taxation. It ensures that payments are correctly applied to the appropriate taxpayer's account, preventing issues such as late fees or misallocated funds.

- Serves as a standardized document for submitting payments.

- Provides necessary fields for taxpayer information, such as Social Security number, name, and address.

- Used to submit payments for any balance owed on state tax returns.

How to Use the 2024 NJ-1040-V Resident Income Tax Payment Voucher

To use the NJ-1040-V form effectively, taxpayers need to follow several clear steps. These steps ensure that payments are processed without errors and that the taxpayer's account reflects the correct balance.

- Gather Necessary Information: Ensure you have your Social Security number, name, address, and any other required personal information at hand.

- Complete the Form: Fill out the NJ-1040-V form with accurate information. Double-check for any errors in the entries.

- Determine Payment Method: Decide whether you will pay by check, money order, or electronically, keeping in mind that checks and money orders must be made out to "State of New Jersey - TGI".

- Submit the Payment: Mail the completed voucher with your payment to the address specified on the form. If paying electronically, follow the state’s online payment procedures.

Steps to Complete the 2024 NJ-1040-V Resident Income Tax Payment Voucher

Completing the NJ-1040-V involves a systematic approach to ensure all fields are accurately filled. Here's a step-by-step guide:

- Enter Personal Information: Clearly type or print your full name, address, and Social Security number. This information is crucial for identifying your taxpayer account.

- Correct Amount: Write the exact amount you are paying, ensuring that it matches what is owed on your state tax return.

- Choose Payment Method: Decide how you'll submit your payment, ensuring the method is accepted by the New Jersey Division of Taxation.

- Verification: Review the entire form for any mistakes that could delay payment processing.

- Attach Payment: Securely attach your check or money order to the voucher before sealing it in an envelope for mailing.

Key Elements of the 2024 NJ-1040-V Resident Income Tax Payment Voucher

Understanding the critical elements of the NJ-1040-V form can prevent errors in processing:

- Personal Information: Identifies the taxpayer, crucial for applying the payment correctly.

- Payment Amount: The total that corresponds to the remaining balance owed on your state taxes.

- Tax Period: Identifies the tax year for which you are making the payment, ensuring proper allocation.

- Filing Instructions: Specific directions on how to submit the voucher and payment effectively.

Important Terms Related to the NJ-1040-V

Knowledge of key terms ensures correct completion and comprehension of the form:

- Taxpayer Identification: Refers primarily to your Social Security number in this context.

- Balance Due: The remaining amount owed after deducting any payments made throughout the tax year.

- Remittance: The actual payment being made, often in the form of a check or electronic fund transfer.

- Filing Period: The designated tax year for which the voucher is applicable.

Filing Deadlines and Important Dates

Meeting filing deadlines is crucial to avoid penalties:

- April 15: The usual deadline for filing New Jersey state taxes and submitting the NJ-1040-V, subject to extensions aligned with federal tax guidelines.

- Extensions: Consider an extension if unable to pay by the deadline but ensure to file the voucher with any partial payment to minimize potential penalties.

Penalties for Non-Compliance with the NJ-1040-V

Failing to comply with submission rules of the NJ-1040-V can result in:

- Late Fees: Additional charges applied to underpaid taxes or late submissions.

- Interest Charges: Accumulate on unpaid tax amounts beyond the specified due date.

- Potential Legal Action: For significant and continued non-compliance, the state may take further legal measures to enforce payment.

Digital vs. Paper Version Comparison

Choosing between digital and paper submissions:

- Digital Submissions: Offer quicker processing times and immediate proof of payment receipt; accessible through New Jersey’s online tax portal.

- Paper Submissions: Preferred by those who favor traditional methods; however, they require longer processing and confirmations.

Each of these sections provides practical guidance and insights into effectively managing your tax payment through the 2024 NJ-1040-V Resident Income Tax Payment Voucher.