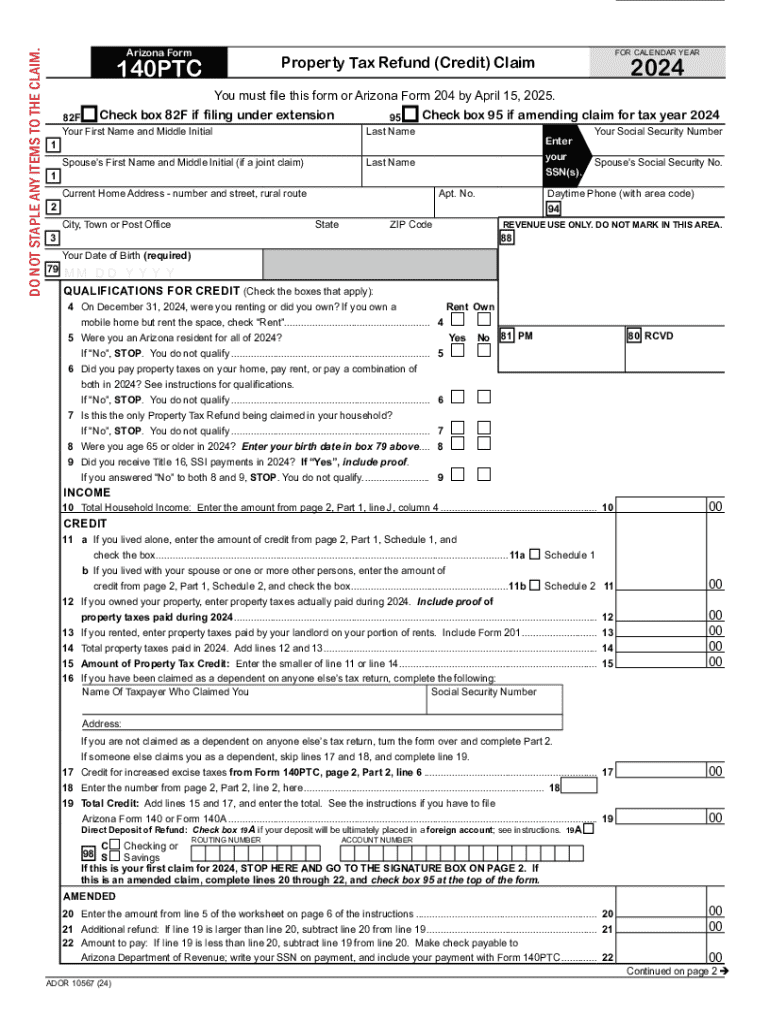

Understanding the Arizona Form 140PTC

Arizona Form 140PTC is a crucial document for residents seeking a Property Tax Refund or Credit. This form is specifically designed for individuals or families with a qualifying income who pay property taxes on their primary residence in Arizona. The main objective of the form is to provide financial relief through a tax credit based on household income.

Key Elements of the Arizona Form 140PTC

The form encompasses several important sections that require precise information for successful filing. These include personal details, such as name and address, and more specific financial data, such as household income and property tax amounts paid for the calendar year. Providing accurate data in these sections is essential to determine eligibility and the refund amount.

Steps to Complete the Arizona Form 140PTC

-

Personal Information: Start by entering your personal details, including full name, Social Security Number, and mailing address.

-

Income Details: Accurately document your entire household income, which encompasses wages, pensions, and any other sources of revenue. This section is critical as it influences the calculated credit.

-

Property Tax Amount: Record the total property tax paid on your primary residence. Ensure this aligns with statements received from the relevant county authorities or mortgage providers.

-

Calculation of Credit: Utilize the form’s instructions to compute the allowable property tax credit based on your income bracket.

-

Sign and Date: Sign the completed form and append any required additional signatures, especially if filing jointly.

Eligibility Criteria

Eligibility for the Arizona Form 140PTC is based on various factors:

- Income Thresholds: Applicants must have a total household income within state-defined limits. Income limits adjust annually based on economic factors.

- Residency Requirements: Claimants must be full-time Arizona residents and should have lived in the property for the complete tax year for which they are claiming a refund.

- Age or Disability Considerations: Certain age brackets or disability statuses can also impact eligibility, offering higher credits or more lenient requirements.

Filing Deadlines and Important Dates

The submission deadline for Arizona Form 140PTC is typically April 15 of the year following the tax year. It is crucial to adhere to this deadline to avoid any rejections or penalties. Marking the calendar for this date and preparing in advance can prevent last-minute issues.

How to Obtain the Arizona Form 140PTC

This form can be acquired through several channels:

- Online Download: The form is available for download in PDF format from the official Arizona Department of Revenue website. This method allows you to print and manually fill out the form.

- Local Tax Offices: Forms can also be picked up at local tax offices across Arizona, where staff might assist with queries related to form completion.

- Request by Mail: Some individuals may also request a mailed version by contacting the Department of Revenue’s customer service.

Who Typically Uses the Arizona Form 140PTC

The form is primarily used by:

- Low-to-Moderate Income Households: Families or individuals with qualifying income within the state-designated threshold.

- Senior Citizens and Disabled Persons: These groups often benefit more significantly from the form due to adjusted eligibility criteria that consider age and disability.

- Homeowners with Primary Residences: Claimants who own and reside in the property for which they pay taxes.

Examples of Using the Arizona Form 140PTC

Consider a retired couple, living on a fixed income from Social Security and a small pension, who paid property taxes of $1,500 on their primary home. By filing the Arizona Form 140PTC, they apply for a potential refund that provides needed financial relief, freeing up funds for other essential expenses like medical care.

Form Submission Methods

Submission options for the Arizona Form 140PTC include:

- Mail: Traditional mailing is still a prevalent option. Ensure all necessary documents are attached and that the envelope is properly addressed.

- Online E-Filing: Some tax software solutions offer services to file this form electronically, provided by the Arizona Department of Revenue for convenience.

- In-Person Submissions: Visit a local tax department office for hands-on assistance and direct submission. This approach is recommended if you have complex queries or require personal interaction.