Definition and Purpose of the U.S. Life Insurance Company Income Tax Return

The U.S. Life Insurance Company Income Tax Return refers to a federal document that life insurance companies use to report their taxable income to the Internal Revenue Service (IRS). This return is designed to capture the detailed financial activities of these entities, including income from premiums, investments, and other relevant financial transactions. The form serves both as a disclosure of a company's financial performance and as a tool for the IRS to assess tax liabilities. Life insurance companies are required by federal tax law to file this return, highlighting the importance of compliance in maintaining legal standing and financial accountability.

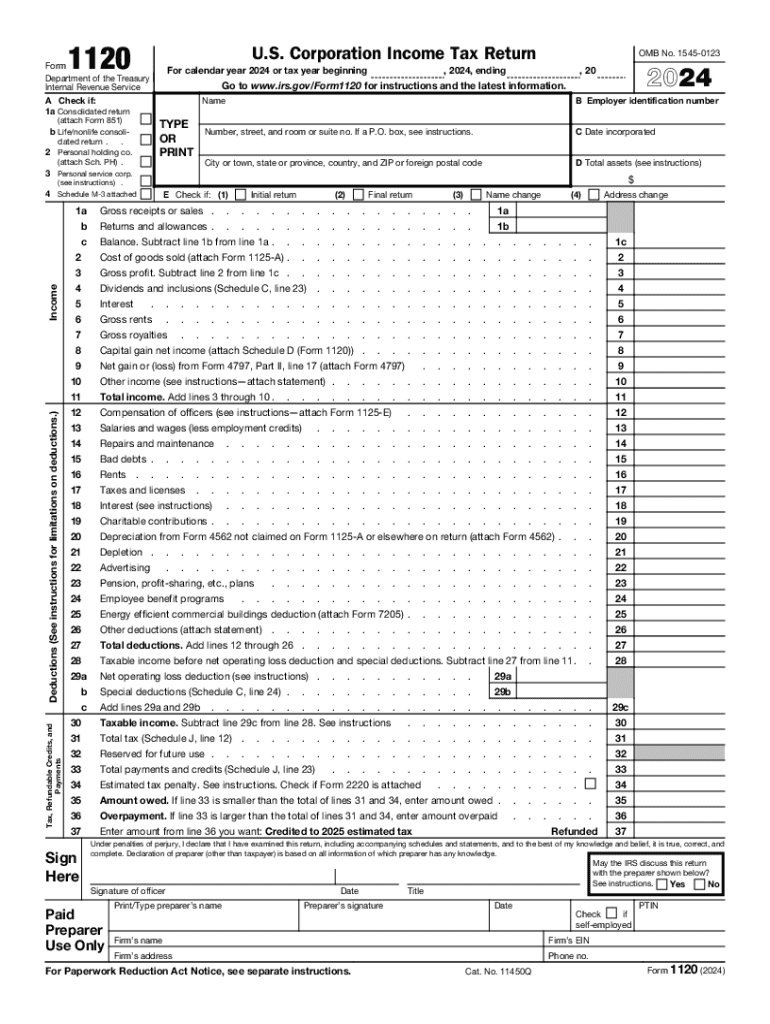

How to Use the U.S. Life Insurance Company Income Tax Return

Using the U.S. Life Insurance Company Income Tax Return involves several steps that require careful attention to detail to ensure accuracy and compliance. Companies need to gather all significant financial data for the tax year, including premium receipts, investment income, operating expenses, and dividends paid to policyholders. The form requires precise reporting of this information, with separate sections for different types of income and deductions.

- Prepare financial statements and supporting documentation ahead of filing.

- Fill out the form according to IRS guidelines, ensuring each section is complete.

- Double-check entries against financial records to avoid discrepancies.

How to Obtain the U.S. Life Insurance Company Income Tax Return

Life insurance companies can obtain the U.S. Life Insurance Company Income Tax Return directly from the IRS website or through official IRS mailings. Digital versions of tax forms, including this specific return, can be downloaded from IRS.gov, allowing organizations to complete and submit them electronically. Alternatively, a paper form can be requested for those preferring traditional mail filing.

- Visit IRS.gov to download the form.

- Contact the IRS to request a paper copy.

- Ensure updates are checked for the latest version of the form.

Steps to Complete the U.S. Life Insurance Company Income Tax Return

Completing the U.S. Life Insurance Company Income Tax Return requires following a systematic approach to input all necessary financial information accurately. The process involves:

- Gather Financial Documentation: Collect all relevant financial records, including revenue and expense reports.

- Calculate Gross Income: Sum up total premium receipts and investment returns.

- Determine Deductions: Identify eligible expenses such as operating costs and dividends paid.

- Complete Supplementary Schedules: Fill out any additional schedules required for special tax computations.

- Validate Entries: Double-check that all calculations align with company records.

- Submit the Form: Either electronically via the IRS e-filing system or by mailing the completed paper form.

Key Elements of the U.S. Life Insurance Company Income Tax Return

The U.S. Life Insurance Company Income Tax Return contains several key sections that are critical for accurate reporting:

- Premium Income: Income from policies issued, which forms the bulk of taxable revenue.

- Investment Income: Interest, dividends, and capital gains from company investments.

- Deductions: Operational costs, claims payments, and other authorized expense deductions.

- Taxes and Credits: Calculations for the applicable corporate tax and any eligible tax credits.

- Supporting Schedules: Additional required documents for specific tax considerations related to life insurance companies.

Filing Deadlines and Important Dates

Filing deadlines for the U.S. Life Insurance Company Income Tax Return are typically aligned with the fiscal year-end of the company. The standard filing due date is the 15th day of the fourth month after the end of the company’s tax year. Timely filing is essential to avoid penalties and interest on late payments.

- Confirm the exact deadline by referencing the company's fiscal schedule.

- Plan for filing months in advance to accommodate necessary adjustments.

- Consider extension options if additional time is required to complete the return.

Required Documents for the U.S. Life Insurance Company Income Tax Return

To accurately complete the U.S. Life Insurance Company Income Tax Return, companies must prepare several documents, ensuring they have supporting evidence for all reported figures. These documents typically include:

- Annual financial statements detailing income and expenditures.

- Investment portfolio statements showing earnings from securities.

- Documentation of operating expenses and administrative costs.

- Records of policyholder claims and dividend payments.

IRS Guidelines on the U.S. Life Insurance Company Income Tax Return

The IRS provides specific guidelines to ensure compliance when filing the U.S. Life Insurance Company Income Tax Return. These guidelines include instructions on accurately reporting different income streams and deductions, as well as how to complete supplementary schedules for comprehensive tax calculation.

- Refer to the IRS instructions for the precise completion of each section of the form.

- Ensure compliance by regularly checking IRS updates or revisions to the tax form.

- Engage with a tax professional if additional clarity is necessary or for complex tax matters.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the U.S. Life Insurance Company Income Tax Return can result in significant financial penalties from the IRS. These penalties may include fines for late filing or for errors and omissions within the submitted tax return. Furthermore, unpaid taxes due may incur interest rates prescribed by the IRS.

- Late filing penalties can be levied on both incomplete and delayed submissions.

- Errors in reported income or deductions often prompt additional scrutiny and possible penalties.

- Interest accumulates on unpaid tax amounts, increasing the financial liability over time.

By understanding these various aspects, life insurance companies can ensure they meet their federal tax obligations and maintain adherence to regulatory requirements. Each section of the U.S. Life Insurance Company Income Tax Return plays a vital role in accurately portraying the financial operations of a life insurance entity, facilitating proper tax assessment by the IRS.