Definition and Meaning

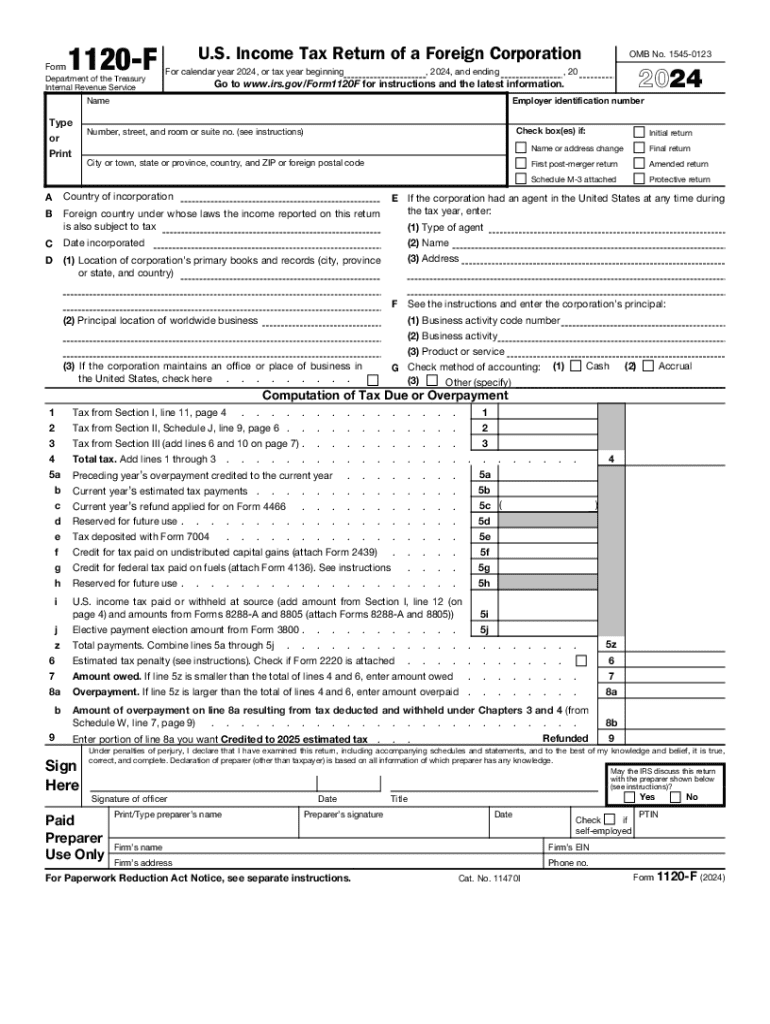

The 2024 Form 1120-F, U.S. Income Tax Return of a Foreign Corporation, is a crucial document utilized by foreign corporations with income derived from U.S. sources. It serves as the official tax return for foreign entities operating in the U.S., enabling them to report income, claim deductions, and calculate taxes owed. The form is comprehensive, requiring detailed financial disclosure to ensure compliance with U.S. tax laws.

Key Components

- Income Reporting: Captures the total income earned from U.S. operations.

- Deductions and Credits: Lists allowable deductions and tax credits applicable to foreign corporations.

- Tax Calculation: Determines the tax liability of the foreign corporation based on its U.S. income.

How to Use the 2024 Form 1120-F

Foreign corporations should carefully complete Form 1120-F to accurately report their U.S. tax obligations. It involves collecting relevant financial data and completing various schedules that correspond to specific income types and deductions. Utilizing resources such as tax preparation software or consulting tax professionals can streamline the process.

Important Considerations

- Documentation: Maintain accurate records of all U.S.-sourced income and related expenses.

- Accuracy: Double-check all calculations and entries to ensure correctness.

- Supplemental Forms: Attach additional schedules as required for complex financial situations.

Steps to Complete the 2024 Form 1120-F

- Gather Financial Records: Compile all necessary income statements, expense receipts, and other documentation.

- Complete Income and Deductions Sections: Input the required financial data and applicable deductions.

- Review Tax Calculation: Ensure that all computations are accurate and comprehensive.

- Attach Schedules: Insert any necessary schedules and forms that provide further detail on financial activity.

- Submit the Form: Follow submission instructions based on whether the online or paper version is used.

Filing Deadlines and Important Dates

The Form 1120-F must be filed by the 15th day of the sixth month after the end of the foreign corporation's tax year, typically June 15 if using a calendar year. Extensions may be granted under specific conditions, but failure to meet deadlines can result in penalties.

Deadline Extensions

- Automatic Extension: A six-month extension may be requested, requiring Form 7004 submission.

- Consequences of Late Filing: Penalties apply for late submissions without an approved extension.

Required Documents

Applicants must provide comprehensive documentation to support all information included in Form 1120-F. Required documents typically include income statements, expense reports, and other financial records related to U.S. activities.

Essential Documentation

- Income Statements: Proof of all U.S. earnings.

- Expense Logs: Detailed accounts of deductible expenses.

- Supporting Schedules: Additional forms that explain financial details.

Form Submission Methods

Foreign corporations have multiple options for submitting Form 1120-F, including online filing, mail, or in-person delivery. Electronic submission is often recommended for its speed and efficiency.

Online and Paper Submission

- E-Filing: Preferred for faster processing and confirmation.

- Mailing: Traditional submission method, requires postage and timely dispatch.

- In-Person Filing: Less common but available for certain tax situations.

IRS Guidelines

IRS guidelines provide specific instructions and regulations governing the completion and submission of Form 1120-F. Adhering to these guidelines is essential for compliance and avoiding penalties.

Compliance Requirements

- Detailed Reporting: Must adhere to all federal requirements for financial disclosure.

- Adherence to Instructions: Follow IRS instructions meticulously to avoid errors.

- Regular Updates: Monitor for regulatory changes or updates that may affect the filing requirements.

Penalties for Non-Compliance

Non-compliance with Form 1120-F filing requirements can result in penalties, including fines and interest. It's vital for foreign corporations to understand these risks and place emphasis on accuracy and timeliness.

Types of Penalties

- Late Filing Penalties: Imposed for missing the submission deadline without an extension.

- Incorrect Information Fines: Penalties for inaccuracies or omissions in the form.

- Failure to Pay Tax: Consequences for not paying the full amount of taxes owed.