Definition and Meaning

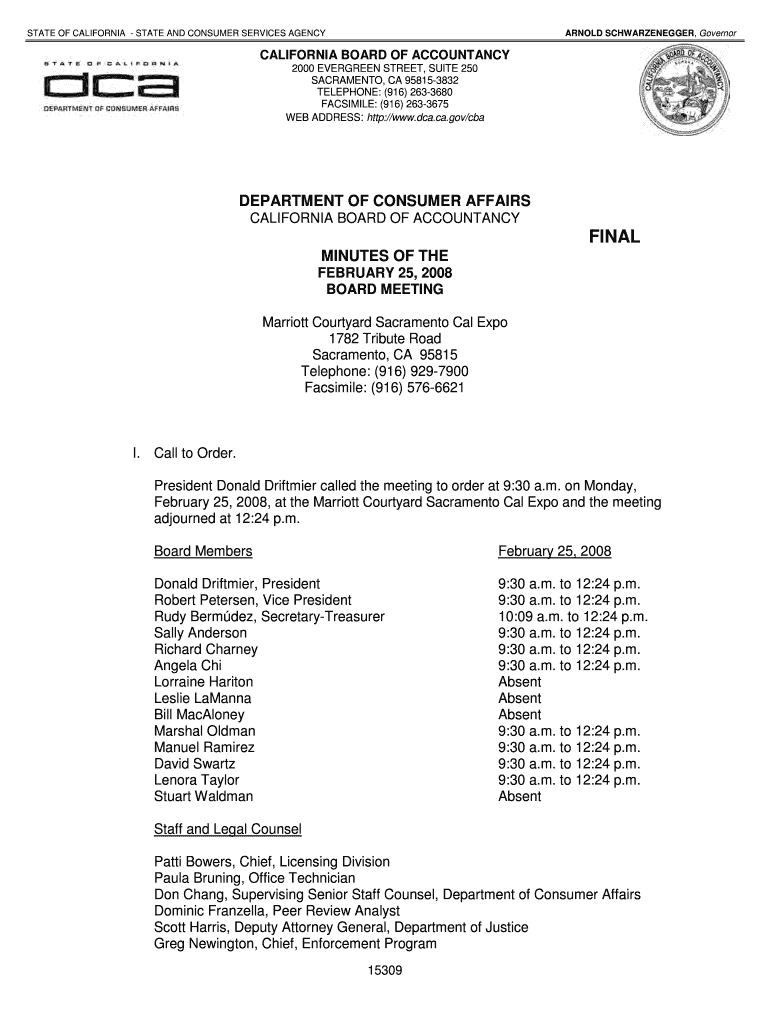

The Board Meeting Minutes from February 25, 2008, document the proceedings of the California Board of Accountancy's meeting. These minutes capture essential discussions, decisions, and actions taken during the meeting. Serving as an official record, they include significant topics such as adopting the Mobility Resolution, mandatory peer review processes, and staffing issues. Understanding these minutes helps in grasping the board's regulatory and consumer protection strategies.

Key Elements of the Minutes

- Mobility Resolution: Highlights efforts to improve Certified Public Accountant (CPA) practices across state lines, reflecting on the board's aim to streamline professional mobility.

- Mandatory Peer Review: Documents considerations for introducing compulsory peer reviews to uphold practice standards among CPAs.

- Staffing Concerns: Includes discussions about staffing challenges and salary considerations within the Enforcement Division, focusing on maintaining effective enforcement capacities.

How to Use the Minutes

These minutes are crucial for stakeholders looking to understand regulatory decisions and board strategies. They can be used by:

- Regulatory Bodies: To assess policy impacts and enforcement efficiency.

- CPAs and Accounting Firms: For compliance with new resolutions and understanding peer review requirements.

- Policy Analysts: To evaluate the board's approach to professional mobility and consumer protection.

Steps to Access the Minutes

- Visit Online Archives: Check the California Board of Accountancy's official website or relevant online repositories for public records.

- Request Through Email: Contact the board's official email address for direct access or further assistance.

- Physical Records: Visit the board's office to access printed versions if available.

Who Typically Uses the Minutes

- Accounting Professionals: CPAs and firm partners seeking to align with new resolutions and understand enforcement trends.

- Policy Makers: To study and develop further legislative support for better regulatory practices.

- Research Scholars: For academic research related to accounting standards and regulatory practices.

Important Terms Within the Minutes

- Enforcement Division: The body responsible for regulatory compliance and addressing violations.

- Peer Review Process: A quality assurance initiative for evaluating CPA practices.

- Mobility Resolution: A legal framework aimed at facilitating interstate practice of accounting professionals.

Legal Use and Implications

Minutes serve as a legal record and can be referenced in:

- Regulatory Compliance: Ensuring adherence to newly established practices and resolutions.

- Legal Proceedings: As evidence of decisions made by the board in enforcement or consumer protection cases.

- Policy Reviews: Providing a basis for evaluating existing and proposed legislative frameworks.

State-Specific Rules

The minutes reflect California's state-specific regulatory frameworks, which might differ from other states regarding accounting practices and enforcement. Understanding these nuances is essential for CPAs practicing in multiple jurisdictions.

Examples of Application

- Policy Implementation: Decisions captured in the minutes may lead to state-wide policy changes affecting CPA practices.

- Educational Purposes: Used in training sessions or seminars to illustrate real-world boardroom dynamics and decision-making.

Versions or Alternatives to the Minutes

Alternative documentation like summaries or reports might exist but would not replace the detailed and legally significant content found in the official minutes. For complete records, always refer to the primary source.

These blocks provide a comprehensive understanding of the Board Meeting Minutes from February 25, 2008, of the California Board of Accountancy, detailing how they function as an essential document for regulatory, legal, and professional purposes.