Understanding the Accredited Investor Letter from CPA Template

The accredited investor letter from CPA template serves as a critical document for individuals seeking to verify their status as accredited investors under Rule 501(a) of the Securities Act of 1933. This letter is essential in various financial transactions, particularly when investing in private placements that are exempt from typical registration requirements. By providing a framework for certification, the letter helps both investors and issuers navigate complex regulatory environments while ensuring compliance with legal standards.

Key Elements of the Accredited Investor Letter from CPA Template

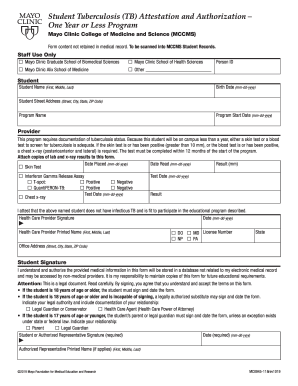

An accredited investor letter generally includes specific components to validate the investor's eligibility, such as:

- Investor Information: This section typically contains personal details of the investor, including full name, address, and financial information.

- Certification from CPA: A qualified CPA must verify that the information provided meets the criteria set forth by regulatory bodies, indicating the investor's income or net worth.

- Documentation Requirements: The letter must outline the specific documentation used for verification, such as tax returns, bank statements, or financial statements, to substantiate claims of accredited investor status.

- Affirmation of Compliance: The investor confirms their understanding and compliance with the definitions and requirements of being an accredited investor as stated in the Securities Act.

How to Obtain the Accredited Investor Letter from CPA Template

Acquiring the accredited investor letter can involve several straightforward steps. The process generally includes:

- Select a Qualified CPA: Choose a licensed CPA with experience in investor documentation and knowledge of the accredited investor criteria.

- Prepare Required Documentation: Gather necessary financial documents that demonstrate the investor's eligibility, such as tax returns for the last two years, W-2 forms, or bank statements showing asset amounts.

- Schedule a Consultation: Meet with the CPA to review your financial status and discuss the requirements for the accredited investor letter.

- Receive a Draft: After assessing the documentation, the CPA will prepare a draft of the accredited investor letter based on the information provided.

- Finalization: Review and finalize the letter with the CPA’s official signature, ensuring it meets all legal standards for investor accreditation.

Important Terms Related to the Accredited Investor Letter from CPA Template

Understanding key terms associated with the accredited investor letter is vital for both investors and issuers. Some relevant definitions include:

- Accredited Investor: An individual or entity that meets specific financial thresholds, allowing them access to certain investment opportunities not available to the general public.

- Rule 501(a): The section of the Securities Act defining the criteria for who qualifies as an accredited investor.

- Verification: The process by which a CPA confirms an individual's financial status and qualifies them as an accredited investor.

Legal Use of the Accredited Investor Letter from CPA Template

The accredited investor letter from CPA plays a crucial legal role in the investment process. By providing formal documentation, the letter serves to protect both the investor and the issuer by:

- Confirming the investor meets the necessary qualifications to participate in private capital markets.

- Reducing the liability of the issuer by ensuring that only accredited investors are involved in certain investments.

- Providing a trustworthy and verifiable source of information for investment firms, making due diligence more manageable.

Examples of Using the Accredited Investor Letter from CPA Template

The use of an accredited investor letter is prevalent in various financial scenarios. For instance:

- Venture Capital Investments: An individual looking to invest in a tech startup might need an accredited investor letter to participate in early funding rounds.

- Real Estate Syndications: Investors wishing to join real estate partnerships often require accredited status to invest in specific properties.

- Private Equity Funds: Accessing private equity opportunities typically necessitates proof of accredited investor status through an official letter, ensuring compliance with securities regulations.

These scenarios exemplify how an accredited investor letter can enable investors to engage in various lucrative investment options while complying with legal requirements.