Definition and Purpose of Form 8814

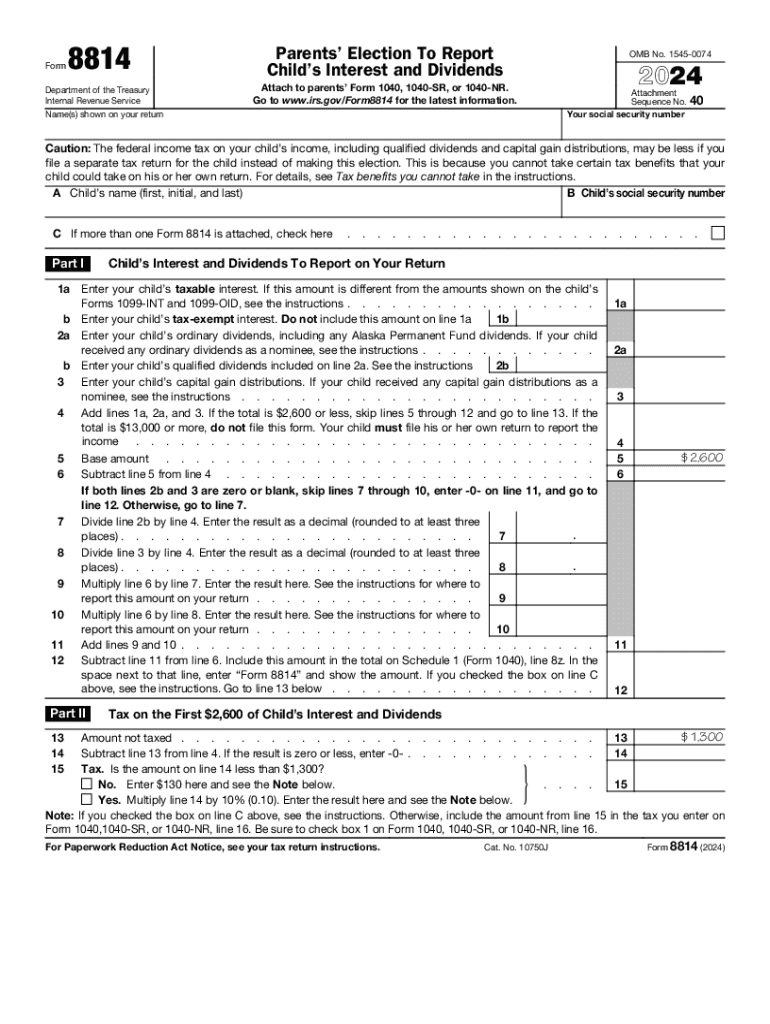

The 2024 Form 8814, known as the Parents' Election to Report Child's Interest and Dividends, allows parents to include their child's interest and dividends in their own tax return. This process simplifies filing for families by potentially eliminating the need for the child to file a separate tax return. By utilizing this form, parents assume responsibility for reporting and paying taxes on their child's unearned income, specifically interest and dividends. This method can streamline tax reporting and help in managing family financial matters efficiently.

Important Terms Related to Form 8814

Understanding specific terms is crucial to successfully completing Form 8814. Key terms include:

- Unearned Income: Income from sources other than wages or business activities, such as interest from savings accounts or dividends from investments.

- Qualified Dividends: Dividends that qualify for a lower tax rate, commonly reported on this form.

- Parent's Election: The option given to parents to report their child's income on their own tax return, using Form 8814.

Eligibility Criteria for Using Form 8814

To utilize Form 8814, certain eligibility criteria must be met:

- The child must be under age 19, or under age 24 if a full-time student, at the end of the tax year.

- The child’s income should solely comprise interest and dividends.

- The total interest and dividends earned by the child must be under a specific threshold, as determined by IRS guidelines for the tax year.

Steps to Complete the 2024 Form 8814

Completing Form 8814 involves several steps, which need careful attention:

- Gather Documentation: Obtain all documents detailing your child's interest and dividends.

- Calculate Total Income: Sum up all interest and dividends to determine if they meet IRS limits for this election.

- Fill Out Identification Information: Include personal details such as your and your child's names and social security numbers.

- Report Income: Enter the total interest and dividends on the form, following the IRS instructions.

- Validate Against Limits: Ensure the income is within limits specified for using Form 8814.

- Attach to Tax Return: Once complete, attach Form 8814 to your Form 1040, 1040-SR, or 1040-NR.

IRS Guidelines for Form 8814

The IRS provides specific guidelines for Form 8814 to ensure compliance:

- Threshold Limits: Regular updates on income thresholds determine eligibility for reporting through Form 8814.

- Tax Rate Application: Parents must calculate taxes based on their child's income detailed in IRS instructions.

- Documentation: Accurate records and supporting documents should be retained for verification and auditing purposes.

Filing Deadlines and Important Dates

Adhering to tax filing deadlines is critical:

- Annual Filing Deadline: The tax return, including Form 8814, is due by April 15, unless extensions are filed.

- Extension Filing: If more time is needed, request an extension by the April deadline, typically extending the deadline to October 15.

Legal Use of Form 8814

Form 8814 must be used in accordance with legal requirements:

- Accountability: By electing to report a child’s income, parents assume full responsibility for the accuracy and completeness of the information.

- Compliance: Ensure all IRS instructions are followed to avoid penalties or issues during an audit.

Penalties for Non-Compliance

Careful adherence to Form 8814 guidelines helps avoid penalties:

- Fines: Failure to comply with reporting requirements could result in penalties or additional taxes.

- Interest Charges: Delays or inaccuracies might incur interest on unpaid taxes.

Differences Between Digital and Paper Versions

Choosing the right format for Form 8814 can impact filing efficiency:

- Digital Submission: Allows for easier updates and recordkeeping; filing electronically may reduce errors and expedite processing.

- Paper Filing: Traditional method, suitable for those preferring hardcopy records but may require more manual verification steps.

Software Compatibility

Choosing software compatible with tax forms eases the filing process:

- TurboTax and QuickBooks: Commonly used programs that offer features simplifying the completion and submission of Form 8814.

- Integration: Ensure your chosen software is updated to accommodate any changes in form requirements or tax laws.

Use Cases and Scenarios

Form 8814 applies in various family and financial situations:

- Simplification for Families: Ideal for families wishing to consolidate filing and reporting responsibilities.

- Students with Investment Income: Assists parents of students who earn dividends but are not yet fully financially independent.

By understanding Form 8814, you can make informed decisions on how best to report your child’s income, optimizing your tax situation while ensuring compliance with IRS regulations.