Definition and Meaning

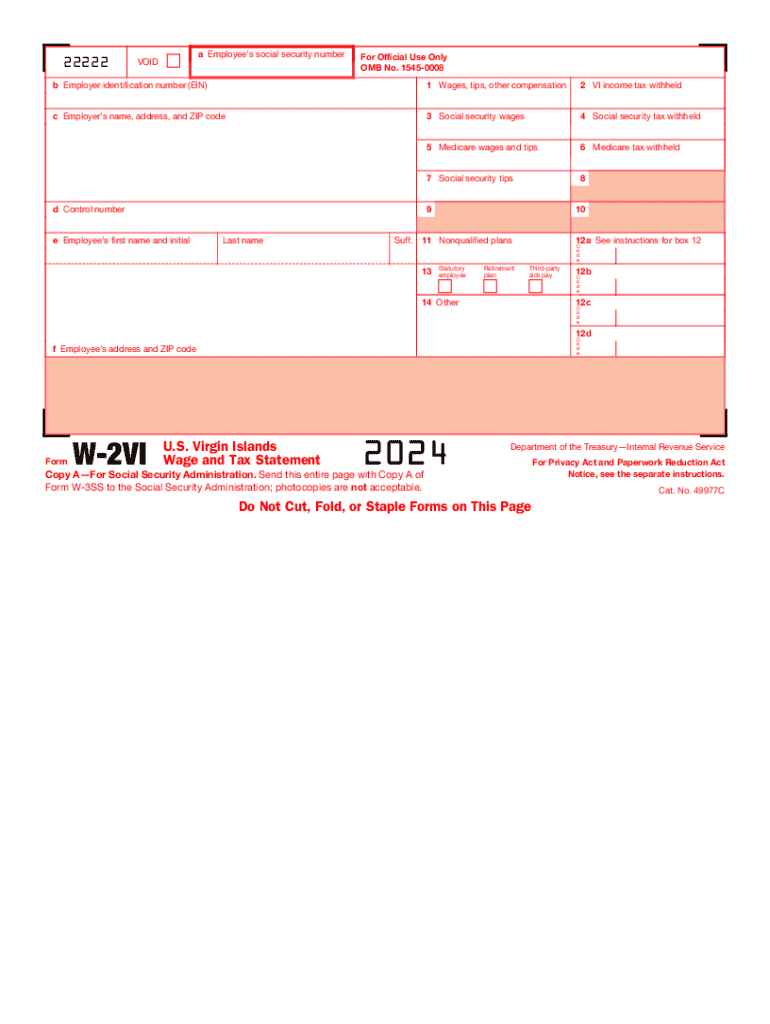

The 2024 Form W-2 VI, U.S. Virgin Islands Wage and Tax Statement, is a specialized tax document used by employers in the U.S. Virgin Islands to report wages paid to employees and taxes withheld throughout the year. It serves as a critical form for employees and the Social Security Administration (SSA), detailing income and tax contributions that impact federal tax returns. The form ensures accurate reporting of income information for tax compliance and social security purposes, facilitating seamless tax filing for individuals and ensuring adherence to relevant tax laws in the U.S. and U.S. Virgin Islands.

How to Use the 2024 Form W-2 VI

Employers use the 2024 Form W-2 VI to report employee earnings and tax withholdings for the calendar year. Upon completion, a copy of the form is provided to each employee for their records and tax filing. Employees then use this form to complete their individual tax returns, ensuring that the earnings and deductions reported match what the employer has filed with the SSA. It's also crucial for verifying income for loans or applications requiring proof of income.

- Submitting to Employees: Employers must provide the completed form by January 31.

- Filing with SSA: Employers must file Copy A of the form with the SSA by the end of February, ensuring all employee data aligns with the SSA's records.

Steps to Complete the 2024 Form W-2 VI

- Gather Employee Information: Collect personal details for each employee, including name, address, and taxpayer identification number.

- Determine Wages and Tips: Accurately calculate gross wages, tips, and other compensation for the calendar year.

- Calculate Tax Withholdings: Record federal income tax withheld along with Social Security and Medicare taxes.

- Complete Form Sections: Fill out all required fields, including state-specific data and codes that detail benefits or deductions.

- Double-Check for Accuracy: Verify all entries for accuracy to prevent discrepancies or the need for corrections.

- Distribute Forms: Provide a copy to employees and submit required copies to the SSA within the stipulated deadlines.

Key Elements of the 2024 Form W-2 VI

The W-2 VI form comprises several crucial fields and entries:

- Box 1: Wages, tips, and other compensation

- Box 2: Federal income tax withheld

- Box 3: Social Security wages

- Box 4: Social Security tax withheld

- Box 5: Medicare wages and tips

- Box 6: Medicare tax withheld

- Box 12 Codes: Reporting deferred compensation or other deductions

Understanding these components ensures compliance and accuracy during tax reporting processes.

Legal Use of the 2024 Form W-2 VI

The W-2 VI form serves several legal and compliance functions:

- Tax Reporting: Acts as an official record for employee earnings and tax withholdings, essential for federal returns.

- Verification Tool: Used to verify employee income during audits or reviews by tax authorities.

- Legal Evidence: Serves as documentation in legal disputes regarding wages or employment tax issues.

- Compliance Requirements: Ensures adherence to the Internal Revenue Code, particularly concerning U.S. Virgin Islands residents.

Filing Deadlines and Important Dates

Timely completion and submission are critical:

- January 31: Deadline for delivering the form to employees.

- February 28: If filing on paper with the SSA, forms must be submitted by this date.

- March 31: For electronic filings, this is the final submission date to the SSA.

Remaining compliant with these deadlines prevents penalties and supports tax accuracy.

Penalties for Non-Compliance

Failure to properly file or timely submit the 2024 Form W-2 VI can result in significant penalties:

- Late Filing Penalties: Fines are imposed for each late submitted form.

- Incorrect Information Penalties: Providing inaccurate data can incur additional fines and potential scrutiny from tax authorities.

- Intentional Disregard: Willful neglect in form submission results in heightened penalties, underscoring the importance of accuracy and compliance.

Employer Responsibilities

Employers hold key responsibilities concerning the W-2 VI:

- Accurate Reporting: Must ensure all income, taxes, and benefits are correctly recorded.

- Timely Distribution: Forms must be distributed to employees by the stipulated deadlines.

- Secure Filing: Maintain records and ensure safe transfer to the SSA to protect sensitive employee information.

Understanding these responsibilities is essential to mitigate risks and ensure smooth tax reporting processes.

Software Compatibility (TurboTax, QuickBooks, etc.)

For those utilizing financial software, seamless integration with systems like TurboTax or QuickBooks can simplify W-2 VI handling:

- Import Capabilities: Many systems offer direct import of tax data, reducing manual entry.

- Error Checking: Automated validation tools help identify discrepancies in reported figures.

- E-Filing Options: Numerous platforms provide electronic submission capabilities to meet SSA deadlines without paper forms.

Employers and employees leverage these tools to enhance accuracy and efficiency in managing tax obligations.

IRS Guidelines

The IRS provides guidelines to ensure adherence to tax-reporting standards:

- Form Instructions: Detailed instructions are available to aid form completion.

- Employer Assistance: The IRS offers resources to clarify obligations and requirements.

- Reporting Updates: Regularly revises guidelines to reflect changes in tax law, ensuring compliance with current statutes.

Familiarity with IRS standards supports accurate and compliant use of the W-2 VI form.