Definition and Meaning

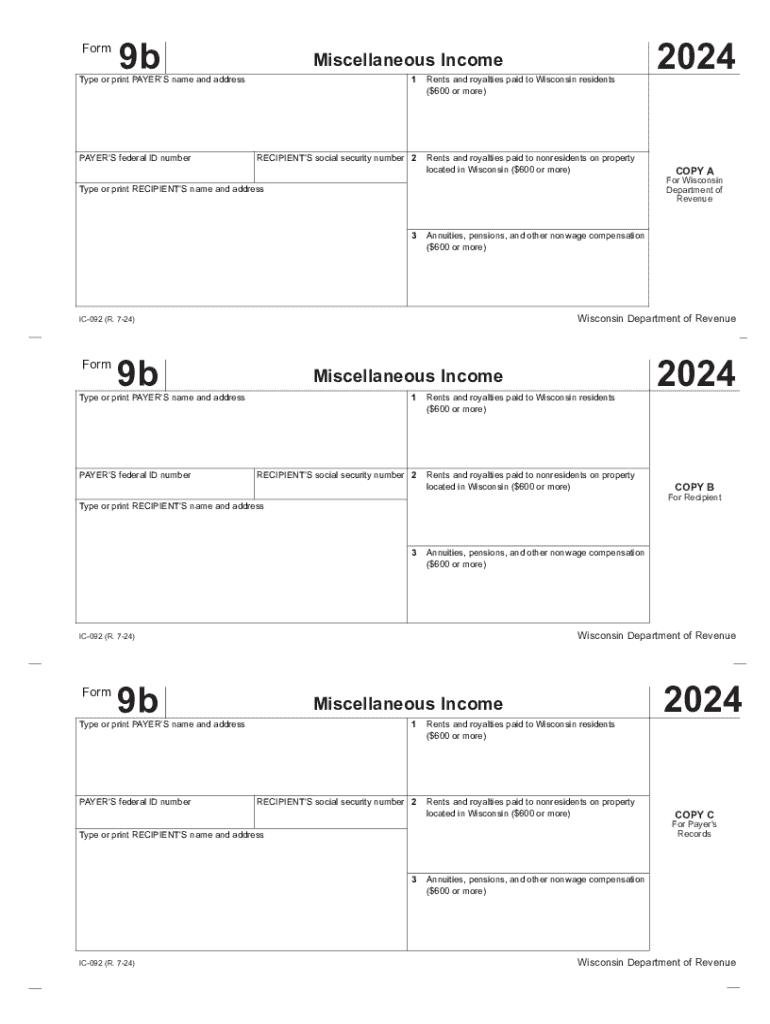

Form 9b is used to report miscellaneous income, such as rents, royalties, and nonwage compensation paid to individuals. This form is essential for individuals and businesses to accurately disclose additional income sources that do not typically fall under standard wage categories. It ensures compliance with tax regulations by capturing these varied forms of income, helping the IRS and state tax authorities maintain accurate records of income distribution.

How to Use the Form 9b

Utilizing Form 9b involves understanding the types of income that need to be reported and filling out the relevant sections of the form accurately. This document is generally used to detail amounts paid to independent contractors, freelancers, and other non-employees. It requires detailed financial information, such as payer and recipient information, the nature of the payment, and any applicable state taxes deducted or withheld.

How to Obtain the Form 9b

To acquire Form 9b, you can visit the official website of tax authorities in Wisconsin or access electronic versions through tax preparation software compatible with state filing requirements. Local tax offices may also provide physical copies on request. Additionally, many certified public accountants (CPAs) and tax advisors keep these forms available for their clients.

Steps to Complete the Form 9b

- Gather Necessary Information: Collect all relevant documents indicating payments made, including contracts, payment records, and receipts.

- Enter Payer Details: Fill out the section with the payer's name, address, and tax identification number.

- Input Recipient Information: Provide the recipient's full name, address, and taxpayer identification number.

- Specify Payment Types: Clearly outline the nature of each payment, whether it's rent, royalties, or other forms.

- Calculate Tax Deductions: Include any relevant taxes withheld or required deductions per Wisconsin's tax regulations.

- Review and Verify: Double-check all entries for accuracy to prevent submission errors or potential penalties.

Legal Use of the Form 9b

Wisconsin state laws mandate the use of Form 9b for reporting specific miscellaneous incomes as part of compliance with jurisdictional tax obligations. Failing to use this form when required can result in penalties. Therefore, understanding its legal implications, along with accurate completion and submission, is crucial for both individuals and entities engaged with these types of transactions.

Key Elements of the Form 9b

- Payer Information: Essential for identifying who is making the payment.

- Recipient Details: Critical for linking payments to their recipients.

- Payment Description: Necessary for distinguishing payment types and their purposes.

- Tax Withholding: Important for compliance with state tax codes and for calculating net incomes.

Filing Deadlines and Important Dates

Wisconsin Form 9b must be submitted by January 31, 2025. Missing this deadline could lead to fines, additional interest, or audits. It's advisable to start preparing this form well in advance, allowing adequate time to gather all necessary information and handle potential discrepancies.

Penalties for Non-Compliance

Inaccurate or late submissions of the Form 9b can result in significant penalties. These may include financial fines, increased scrutiny from tax authorities, or interest charges on unpaid taxes. To mitigate these risks, ensure the form is filled accurately and submitted within the designated timeframe.

State-Specific Rules for the Form 9b

Wisconsin may have unique guidelines for reporting and documenting miscellaneous incomes, which require precise application on Form 9b. Familiarize yourself with any nuances to the state tax code that apply to your income type and adhere strictly to these rules to ensure compliance.

Examples of Using the Form 9b

Consider a company distributing royalties to multiple authors across different states. Form 9b helps maintain compliance by consolidating income information and communicating individual tax obligations. Similarly, a real estate manager handling multiple rental properties can use this form to report rental incomes, allowing accurate bookkeeping and tax alignment.

Required Documents

When preparing Form 9b, several critical documents aid in accurate completion:

- Independent contractor agreements

- Royalty distribution statements

- Payment records detailing amounts and descriptions

- Tax withholding certificates if applicable

Form Submission Methods

There are several ways to submit Form 9b, including online, mail, or in-person delivery at designated local tax offices. Electronic submission often provides advantages like faster processing and confirmation of receipt, whereas mailed forms may need additional time for processing and verification.

Digital vs. Paper Version

Both digital and paper versions of Form 9b are available, but electronic filing is encouraged due to its convenience, environmental benefits, and quicker processing times. Digital submissions minimize errors with built-in validation and ensure almost immediate receipt confirmation.