Definition & Meaning

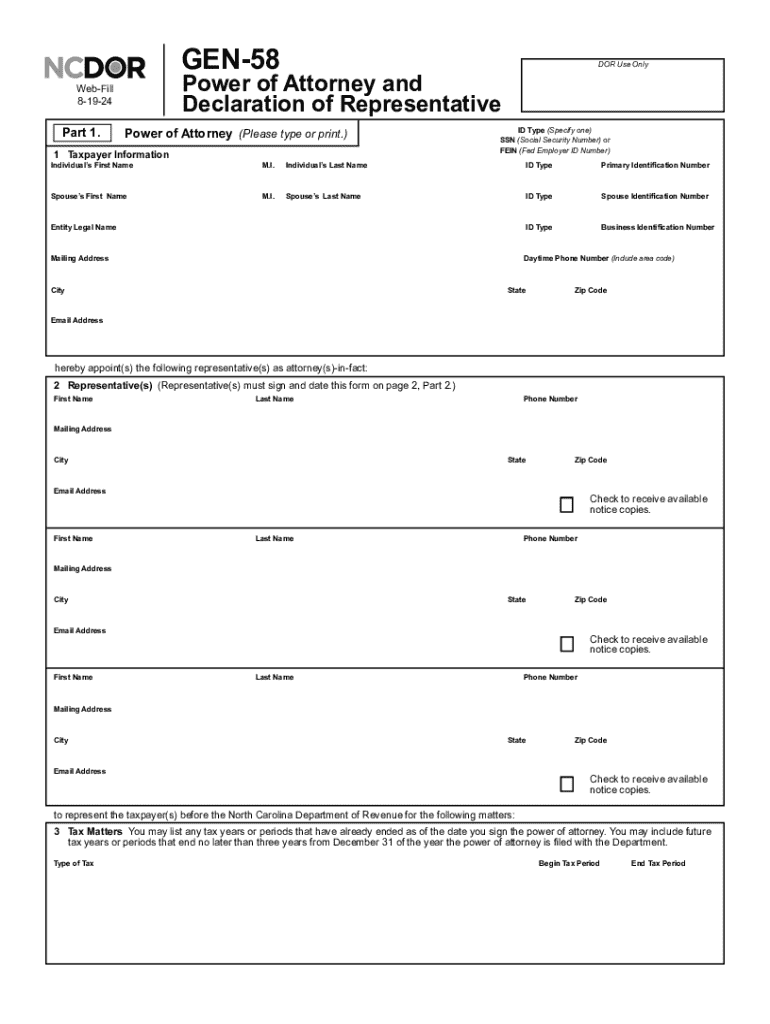

The Form GEN-58 Power of Attorney and Declaration of Representative is a pivotal document utilized for the appointment of representatives to act on a taxpayer's behalf before the North Carolina Department of Revenue. This form delineates the scope of authority granted to a representative, including rights to access confidential tax information, engage in tax discussions, and make decisions on tax matters. It ensures that taxpayers can delegate responsibilities to knowledgeable representatives, effectively facilitating interactions with tax authorities.

Key Elements of the Form GEN-58 Power of Attorney and Declaration

Taxpayer Information

- Personal Details: Includes the taxpayer's name, address, and Social Security Number or Tax Identification Number.

- Filing Status: Provides information on the taxpayer's filing status to verify identity and association with the disclosed tax matters.

Representative Details

- Authorized Representatives: Lists the names and contact information of individuals or firms designated to represent the taxpayer.

- Scope of Authority: Specifies the extent of authority granted, encompassing the ability to receive confidential tax records and perform acts stipulated in the form.

Authorized Acts

- Specific Permissions: Outlines specific actions the representative is authorized to undertake, such as negotiating tax settlements or responding to notices.

- Limitations: Clearly defines any limitations to the representative’s authority to prevent overreach.

How to Obtain the Form GEN-58 Power of Attorney and Declaration

To procure the Form GEN-58, taxpayers can access it via the official website of the North Carolina Department of Revenue. This form is available for download in PDF format, allowing for easy printing and completion. Alternatively, a physical copy can be requested by contacting the department directly, which may provide mailed copies to taxpayers upon request.

Steps to Complete the Form GEN-58 Power of Attorney and Declaration

- Fill Out Taxpayer Information: Enter your name, address, and identification number accurately.

- Designate a Representative: Clearly list each representative’s name, contact details, and firm (if applicable).

- Define Scope of Authority: Indicate the representative powers you are granting by checking the relevant boxes.

- Sign and Date the Form: Both you and the designated representative(s) must sign the document to validate it.

- Submit the Form: Mail or deliver the completed form to the designated address of the North Carolina Department of Revenue for processing.

Who Typically Uses the Form GEN-58 Power of Attorney and Declaration

This form is primarily employed by taxpayers who find themselves needing representation in dealing with tax matters. Common users include:

- Individuals seeking assistance with personal tax issues.

- Businesses represented by internal or external accountants or tax advisors.

- Tax Professionals designated by clients to handle tax affairs before the department.

Legal Use of the Form GEN-58 Power of Attorney and Declaration

Form GEN-58 is legally binding, thereby granting representatives the legal authority to act on behalf of taxpayers in specific tax-related dealings with the North Carolina Department of Revenue. It complies with state regulations governing the delegation of authority in tax matters.

Important Terms Related to Form GEN-58 Power of Attorney and Declaration

- Principal: The taxpayer authorizing a representative.

- Agent/Attorney-in-fact: The individual or firm appointed to represent the taxpayer.

- Scope of Representation: Defines the boundaries of the representative’s authority.

- Fiduciary Duty: Obligates the representative to act in the principal’s best interest.

State-Specific Rules for the Form GEN-58 Power of Attorney and Declaration

The Form GEN-58 is specific to North Carolina, operating under state statutes that dictate its execution and enforcement. It is tailored to address tax issues as per North Carolina laws, ensuring compliance with local legal standards.

Digital vs. Paper Version

Both digital and paper versions of the Form GEN-58 are recognized if they comply with the submission requirements set forth by the North Carolina Department of Revenue. The digital version ensures convenience and speed for taxpayers familiar with online processes, while the paper version is preferable for those less inclined towards digital platforms.