Definition & Purpose of MO-FPT

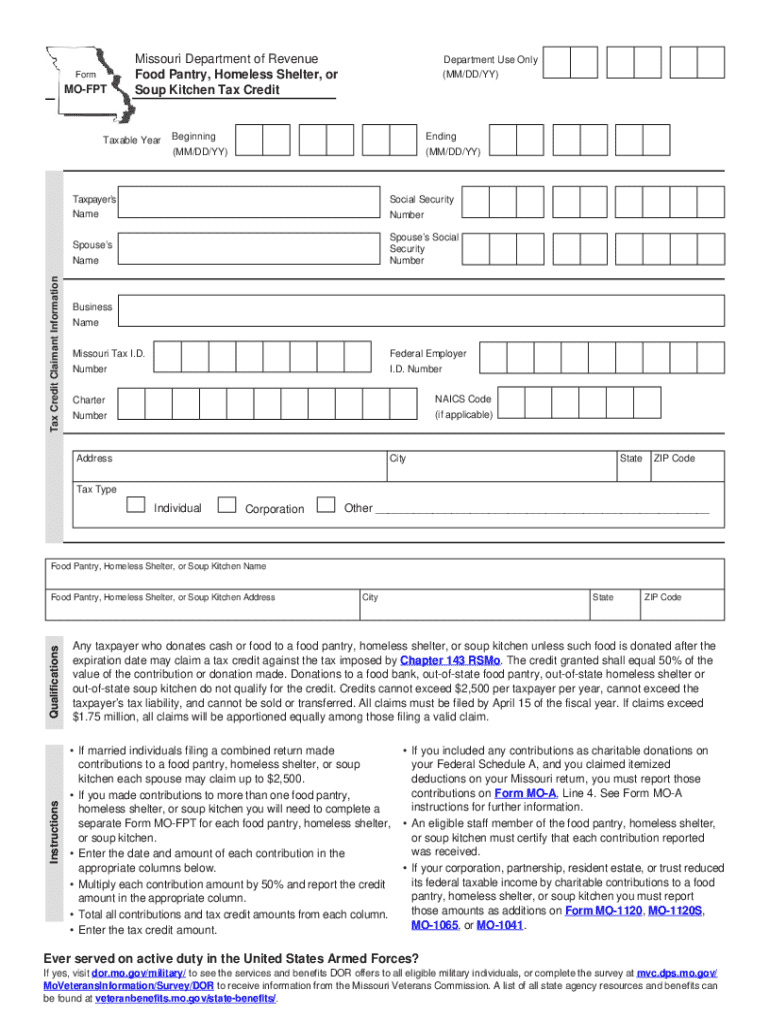

The MO-FPT, or Missouri Food Pantry Tax Credit form, enables individuals and businesses in Missouri to claim a tax credit for contributions made to local food pantries, homeless shelters, or soup kitchens. This form is instrumental in encouraging donations to organizations that offer vital services to the community. By supporting these institutions, contributors can reduce their state tax liability by 50% of the donation amount, capped at up to $2,500 per taxpayer. This initiative incentivizes charitable giving while providing a practical way to support under-resourced community programs.

Key Benefits of the Tax Credit

- Direct Tax Savings: Individuals and businesses receive a tax credit worth 50% of their donation value.

- Support for Critical Services: Contributes to the sustainability and growth of essential community programs.

- Set Contribution Cap: Helps manage individual and organizational budgets with a capped maximum credit.

- Legitimate Charitable Deduction: Aligns with both financial and philanthropic strategies for donors.

Steps to Complete the MO-FPT

Successfully completing the MO-FPT involves several steps, which ensure the form accurately reflects the donation details and adheres to submission guidelines.

Step-by-Step Instructions

- Gather Necessary Information: Collect details about the donation, including date, amount, and the recipient organization's information.

- Complete Donor Information: Fill out the taxpayer's name, address, and identification number as specified on the form.

- Document the Donation: Enter the specifics of the donation, ensuring precision in amounts and dates to avoid errors in credits.

- Calculate the Credit: Determine 50% of the donation value, maintaining the maximum allowable amount of $2,500.

- Attach Required Documentation: Include receipts or confirmation from the receiving organization as evidence of the contribution.

- Submit Form: Follow submission guidelines which may include filing along with the state tax return.

Common Mistakes to Avoid

- Incorrectly calculating the credit percentage.

- Failing to attach proper donation receipts.

- Ignoring the cap on maximum allowable credit.

How to Obtain the MO-FPT

The MO-FPT form is accessible through several avenues for convenience and ease of use.

Available Sources

- Missouri Department of Revenue Website: Direct download of the form is possible from the official site, ensuring access to the latest version.

- Tax Filing Software: Many platforms include MO-FPT as part of their state tax filing packages, offering a seamless integration process.

- Local Libraries and Community Centers: Printed forms are often available at these locations for those preferring hard copies.

Access Tips

- Always verify you are using the current year's form to avoid discrepancies.

- Consider online downloads for quick and environmentally friendly access.

Eligibility Criteria for Claiming the MO-FPT

Understanding who can claim the MO-FPT is crucial for effective tax planning.

Eligible Contributors

- Individual Taxpayers: Residents of Missouri who file state taxes and have made qualifying contributions.

- Business Entities: Corporations, LLCs, and partnerships operating within Missouri that engage in charitable donations to eligible organizations.

Contribution Requirements

- Donations must be monetary and directed towards food pantries, homeless shelters, or soup kitchens within Missouri.

- Tangible goods or services are not eligible under this credit program.

Exceptions and Considerations

- Donations made outside the state or to non-qualifying institutions do not qualify.

- It is advised to consult with a tax professional for complex situations to maximize credit utilization.

Legal Use and Compliance with MO-FPT

Ensuring legal compliance when utilizing the MO-FPT is essential to maintain eligibility and avoid penalties.

Compliance Steps

- Accurate Reporting: All donation details must be accurately recorded and reported to the Missouri Department of Revenue.

- Timely Submission: Submit the form within prescribed deadlines to prevent disqualification.

- Adherence to Rules: Follow all state-specific guidelines for valid credit claim and application.

Potential Penalties

- Incorrect Filing: Can result in denial of credit and possible penalties.

- Late Submissions: Late filing could result in forfeiting the right to claim the credit for the tax year.

Required Documentation for MO-FPT

Documentation is a crucial component to validate the donation and claim the credit.

Required Attachments

- Donation Receipts: Must detail the date, amount, and recipient organization.

- Confirmation Letters: From the receiving organization confirming the gift and its intended purpose.

Importance of Accurate Records

Proper documentation not only ensures compliance but also simplifies the audit process should the donation be questioned by tax authorities.

Examples of Using the MO-FPT

Providing practical scenarios helps clarify the process and potential benefits of the MO-FPT.

Real-World Scenarios

- Individual Donor Example: A Missouri resident donates $5,000 to a local food pantry. They can claim a tax credit of $2,500 on their state taxes.

- Business Entity Example: A Missouri-based LLC contributes to multiple shelters. The combined donation value qualifies them for the maximum $2,500 tax credit per applicable donation.

Diverse Applications

- Both small and significant contributors can benefit under the program, as long as the donation-specific requirements are met.