Definition and Meaning of Unincorporated Business Tax (UBT)

The Unincorporated Business Tax (UBT) refers to a tax imposed on partnerships, limited liability companies (LLCs), and sole proprietorships that conduct business activities in specific jurisdictions, like New York City. Typically, it is levied on businesses that do not have corporate status under federal law. Although it predominantly applies to entities making substantial profits, understanding its nuances is crucial for all unincorporated businesses. The tax aims to ensure these entities contribute to the public services and infrastructure from which they benefit. UBT calculations are generally based on net income, with various deductions and exclusions applicable depending on the city's or state's provisions.

Who Typically Uses the Unincorporated Business Tax (UBT)

Entities subject to the UBT usually include partnerships, LLCs, and sole proprietors operating in jurisdictions that impose this tax, with New York City being the most notable example. Businesses with physical or economic presence in these areas fall under this tax's purview. Even if a business does not maintain physical premises within a UBT-imposing area, significant business activities may still incur tax obligations. Professionals like attorneys, consultants, and freelancers often encounter this tax, especially when operating within UBT zones. It's important for these entities to understand their obligations under UBT to ensure compliance and avoid potential legal complications.

Key Elements of the Unincorporated Business Tax (UBT)

Key components of the UBT encompass the taxable income base, applicable tax rates, and potential exemptions or deductions. Generally, the taxable base is derived from a business's net income, adjusted for allowable deductions. Rates can vary, but they are typically progressive, meaning higher income brackets are taxed at higher rates. Certain businesses may qualify for exemptions, like those engaging primarily in investment activities. Moreover, businesses can often deduct UBT paid to other jurisdictions to avoid double taxation, aligning with principles of fairness and competitiveness.

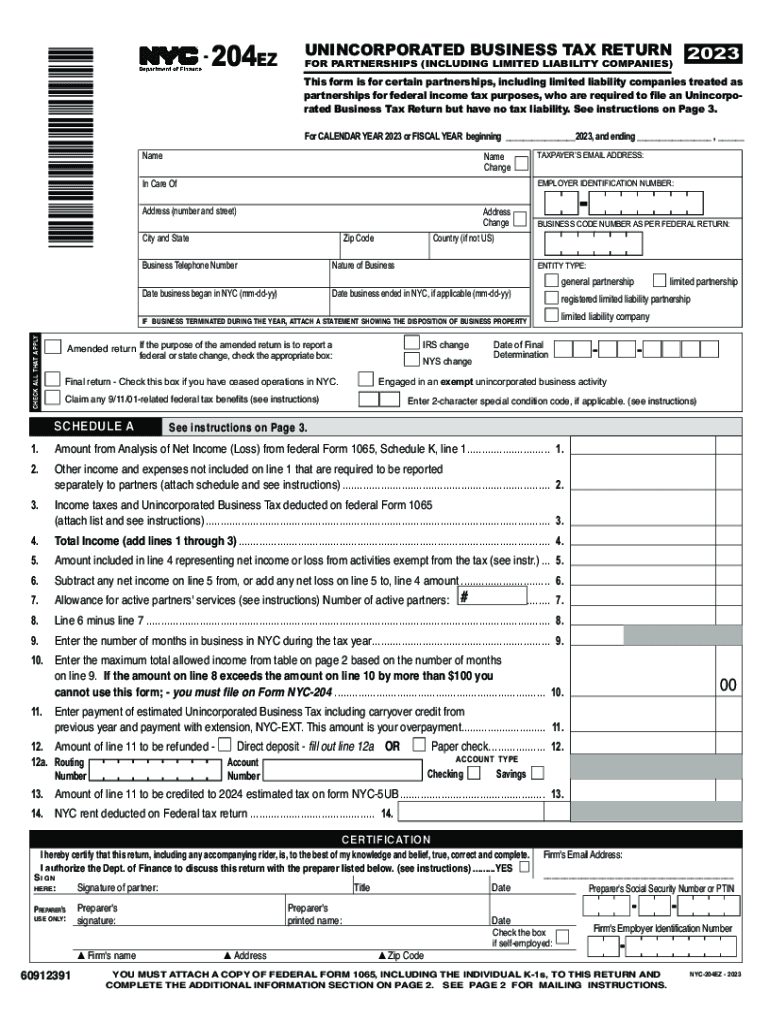

Steps to Complete the Unincorporated Business Tax (UBT)

-

Gather Relevant Documents: Before starting the UBT filing process, collect financial statements, partnership or LLC agreements, federal tax returns (e.g., Form 1065 for partnerships), and any other documents detailing the entity's financial activities.

-

Calculate Taxable Income: Adjust your net income according to UBT-specific regulations, including adding back in taxes deducted and subtracting allowances for certain expenses.

-

Determine Tax Liability: Apply the correct tax rate to the calculated taxable base to ascertain the tax due. Check for any applicable credits to minimize liability.

-

Complete Form NYC-204EZ: Accurately fill out this form, ensuring all fields related to income, deductions, and credits are completed.

-

Submit Before Deadline: Ensure submission before designated deadlines, typically aligned with federal tax timelines, to avoid penalties.

Required Documents for Unincorporated Business Tax (UBT) Filing

A comprehensive filing for the UBT demands several key documents. Top priorities include federal tax returns relevant to the entity type, such as the IRS Form 1065 for partnerships. Supporting documentation like balance sheets, profit and loss statements, and any prior years' UBT filings are essential. Entities must also provide details of any reported adjustments that affect taxable income calculations. Documentation of any tax credits claimed is similarly mandatory. Correct documentation ensures accurate tax filing and reduces the chances of an audit or penalties.

Filing Deadlines for the Unincorporated Business Tax (UBT)

The timeframe for submitting UBT returns typically aligns with federal tax deadlines, often due by April 15. Extensions may be available, granting additional time for filing but not delaying payment obligations. It’s imperative to know the local statutes on deadlines, as they can affect both filing strategies and cash flow planning for businesses.

Penalties for Non-Compliance with Unincorporated Business Tax (UBT)

Non-compliance with UBT filing responsibilities can result in financial penalties and legal challenges. These penalties generally include late filing fees, interest on unpaid taxes, and potential for an audit. Severe cases of prolonged non-compliance might escalate to legal action or additional fines imposed by jurisdictional revenue authorities. Ensuring timely and accurate filing is crucial to avoid unnecessary financial burdens and preserve business integrity.

Business Entity Types Affected by the Unincorporated Business Tax (UBT)

The UBT is relevant for numerous business entities that are not incorporated as typical C or S corporations under federal law. This includes partnerships, LLCs not electing corporation tax treatment, and sole proprietorships. Each entity must evaluate the impact of UBT in their business model, considering factors such as tax rates, available deductions, and strategic planning around tax obligations. Understanding entity-specific implications aids in financial planning and regulatory compliance.