Definition and Meaning of Hawaii RP Form

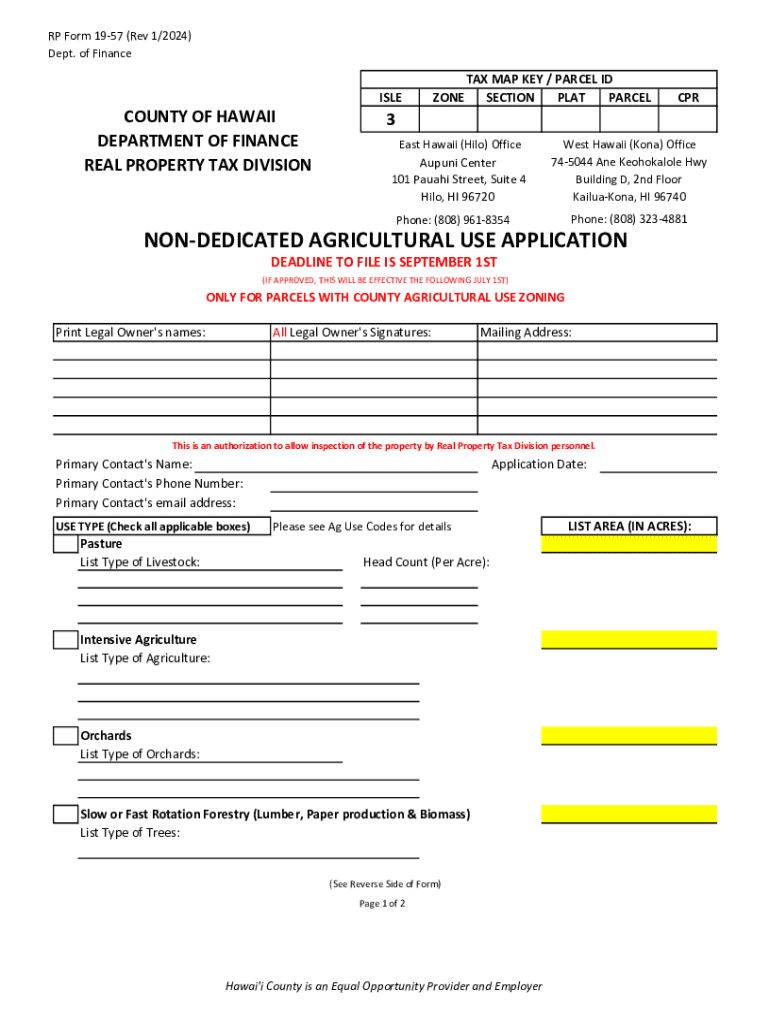

The Hawaii RP Form, specifically referred to as RP Form 19-57, is a documentation instrument used within Hawaii County to apply for non-dedicated agricultural use on parcels that are zoned for county agricultural activities. This form requires legal property owners to furnish necessary details regarding their land to qualify for certain tax considerations or other county-specific incentives. Understanding the purpose and function of this form can aid in ensuring compliance with local regulations and optimizing the use of agricultural land.

How to Use the Hawaii RP Form

Using the RP Form 19-57 effectively involves several key procedures. Property owners must gather all relevant property information, including legal ownership documentation, and details about the kinds of agricultural activities they engage in. This form is filled out with precise data, ensuring that any stated agricultural use aligns with county regulations and definitions. Familiarity with the requirements will aid applicants in ensuring their submissions are both accurate and comprehensive, thus minimizing the risk of issues arising from incomplete documentation.

Steps to Complete the Hawaii RP Form

Completing the RP Form 19-57 requires close attention to detail:

-

Gather Required Information: Obtain all necessary legal documents related to property ownership. This includes land deeds, current zoning designations, and any existing agricultural use certifications.

-

Detail Agricultural Activities: Describe the type of farming or agricultural activities taking place. This might include crop types, livestock, or other resources utilized on the parcel.

-

Review Submission Guidelines: Ensure that each section of the form is completed according to the instructions provided by Hawaii County authorities to avoid any delays or rejections.

-

Submit by Deadline: The form must be submitted by September 1st to affect tax considerations or zoning changes effective the following July 1st.

Legal Use and Compliance for Hawaii RP Form

The Hawaii RP Form is accompanied by legal stipulations ensuring that declared agricultural use complies with county and state regulations. Users must be aware of possible consequences such as deferred taxes should the land use change from its declared purpose. Additionally, adherence to zoning regulations remains crucial, as violations can lead to penalties or a revocation of benefits associated with agricultural designation.

Important Terms Related to Hawaii RP

Understanding the terminology used in RP Form 19-57 can facilitate an easier completion process:

- Non-Dedicated Agricultural Use: Refers to land that is used for agricultural purposes without long-term commitment or exclusive zoning for agriculture.

- Zoning: The process by which land designated for specific uses in compliance with local laws.

- Deferred Taxes: Taxes that are postponed due to a change in land use, potentially leading to a future liability.

Required Documents for the Hawaii RP Form

Submitting the RP Form 19-57 necessitates providing several auxiliary documents:

- Proof of Ownership: Official documents like property deeds.

- Zoning Verification: A statement or certification confirming the current zoning status of the parcel.

- Agricultural Use Documentation: Evidence or a description of the types of agricultural activities undertaken on the property.

Filing Deadlines and Important Dates

Meeting deadlines for the RP Form 19-57 is crucial in securing intended benefits:

- Submission Deadline: September 1st of the year preceding the desired effectivity date.

- Effectivity Date: July 1st following the submission year, when approved designations or considerations take effect.

Examples and Use Cases for Hawaii RP Form

Several scenarios illustrate the practical use of the RP Form 19-57:

- Small-Scale Farms: A property owner using their land for small-scale organic crop farming who wants to ensure their land's zoning aligns with agricultural needs.

- Livestock Operations: Owners raising livestock may need to declare such use officially to align with zoning and avoid misclassification.

- Community Supported Agriculture: A CSA program that requires acknowledgment of its agricultural designation for tax incentives or permits.

Penalties for Non-Compliance

Failure to comply with the guidelines and regulations linked to the RP Form 19-57 can result in several penalties:

- Deferred Tax Liabilities: Land changes in use after submission can invoke deferred taxes.

- Legal Action: Non-compliance may initiate legal consequences per county ordinances.

- Zoning Violations: Incorrect or misrepresented use can lead to fines or removal of agricultural status benefits.

Understanding these considerations can ensure proper utilization, compliance, and maximization of the benefits associated with the RP Form 19-57 in Hawaii County.