Definition and Meaning

The 2024 Form 1040-ES (NR) is a U.S. tax form used by non-resident aliens to estimate and pay their quarterly federal income tax. It is designed to ensure that taxpayers meet their tax obligations throughout the year rather than at year-end by making estimated tax payments. This form is crucial for individuals who earn income in the U.S. but do not qualify as U.S. residents for tax purposes. Non-resident aliens who have income subject to U.S. income tax and expect to owe tax of $1,000 or more after withholding must use this form to avoid underpayment penalties.

Key Elements of the 2024 Form 1040-ES (NR)

The 2024 Form 1040-ES (NR) consists of several key sections that guide taxpayers in calculating and paying their estimated taxes. Key components include:

- Payment Vouchers: Four standard vouchers for mailing payments along with specific due dates for each quarter.

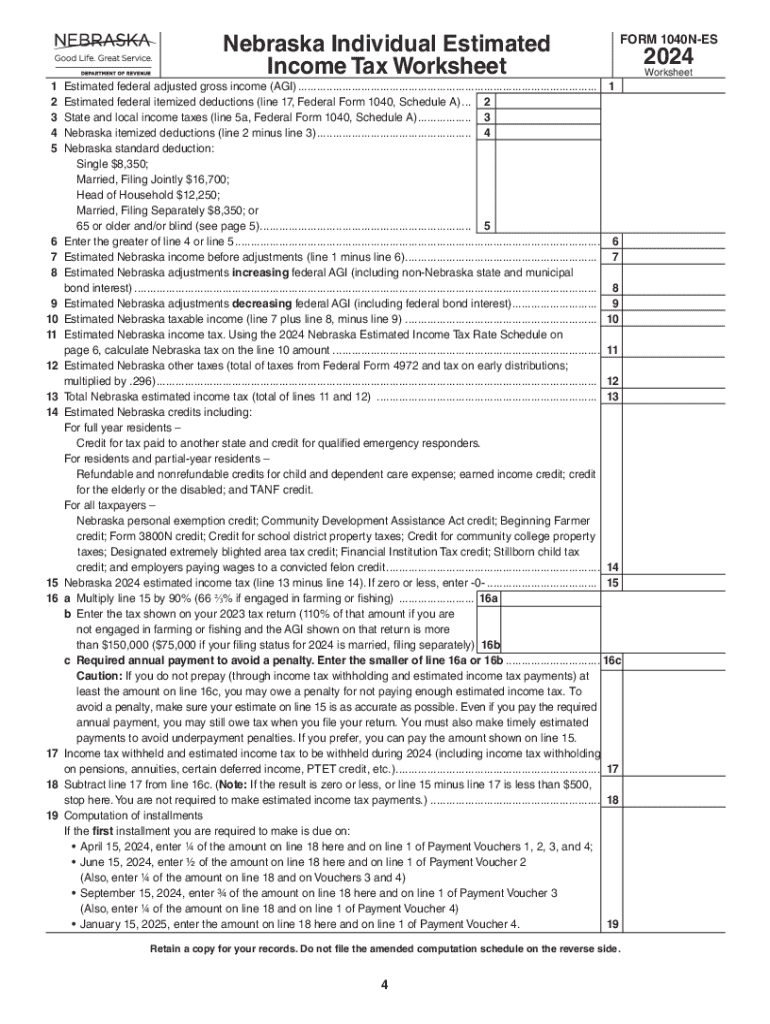

- Worksheet for Calculating Estimated Tax: Helps taxpayers compute their expected income and deductions to determine the taxable amount.

- Line Instructions: Detailed line-by-line instructions for accurately completing the form.

Steps to Complete the 2024 Form 1040-ES (NR)

- Estimate Your Income: Use reliable data sources to forecast your annual taxable income.

- Calculate Deductions and Credits: Determine your potential deductions and credits to reduce taxable income.

- Apply Tax Rates: Use the current tax rate schedule applicable to non-resident aliens.

- Determine Tax Liability: Subtract credits and prior payments from estimated tax liability to find the quarterly payment amount.

- Complete Payment Voucher: Fill out each voucher with the payment amount and personal details.

- Submit Payment: Choose a submission method, either by mail or online, ensuring adherence to the deadlines.

Filing Deadlines and Important Dates

The deadlines for the 2024 Form 1040-ES (NR) align with the standard quarterly estimated tax payment schedule:

- First Quarter: April 15, 2024

- Second Quarter: June 15, 2024

- Third Quarter: September 15, 2024

- Fourth Quarter: January 15, 2025

Meeting these deadlines is essential to avoid penalties and interest charges on late payments.

Who Typically Uses the 2024 Form 1040-ES (NR)

This form is typically used by non-resident aliens who:

- Have U.S. source income not subject to withholding.

- Are self-employed within the U.S.

- Are beneficiaries of U.S. trusts or estates.

- Are athletes or entertainers working in the U.S.

- Do not qualify for tax treaty exclusions on U.S. income.

IRS Guidelines for the 2024 Form 1040-ES (NR)

The IRS mandates that non-resident aliens use Form 1040-ES (NR) when their expected tax exceeds withholding by $1,000. Taxpayers must adhere strictly to calculation guidelines and are advised to consult IRS publications for adjustments, including deductions, exemptions, and recognized tax treaties that may impact their liability.

Penalties for Non-Compliance

Failure to file or pay the estimated tax on time results in penalties. The IRS may impose interest on underpaid taxes from the due date of each installment. Exceptions are granted if the tax is less than $1,000 after credits or if the taxpayer had no tax liability the previous year as a non-resident alien.

Form Submission Methods (Online/Mail In-Person)

Taxpayers have multiple options for submitting Form 1040-ES (NR):

- Online: Electronic payments via the IRS's EFTPS system.

- Mail: Paper vouchers and checks mailed to the IRS at designated addresses.

- In-Person: Payments made through financial institutions that facilitate tax payments with prior arrangements.

Software Compatibility

Many tax preparation software platforms like TurboTax and QuickBooks include support for the 1040-ES (NR) form, simplifying calculations and submissions for users. These platforms often offer step-by-step guidance, ensuring accuracy and compliance with IRS requirements.