Understanding Billing Disputes with Citibank

Billing disputes with Citibank arise when cardholders challenge the accuracy of charges on their account statements. This process enables customers to formally contest unauthorized or erroneous transactions. Common sources of disputes include fraudulent charges, billing errors, failure to receive goods or services, and double billing. Understanding how this process works ensures cardholders can efficiently seek resolutions to their issues.

Types of Common Billing Disputes

Several distinct types contribute to the overall spectrum of billing disputes, including:

- Unauthorized Transactions: Charges made without the cardholder's consent. This often involves identity theft or card fraud scenarios.

- Billing Errors: These may involve discrepancies in the amount charged versus what was agreed upon, including incorrect pricing for products or services.

- Goods or Services Not Received: Disputes here typically arise when a customer claims that they did not receive an item they purchased.

- Recurring Charges: Instances of unexpected or unapproved subscription fees that appear on a billing statement.

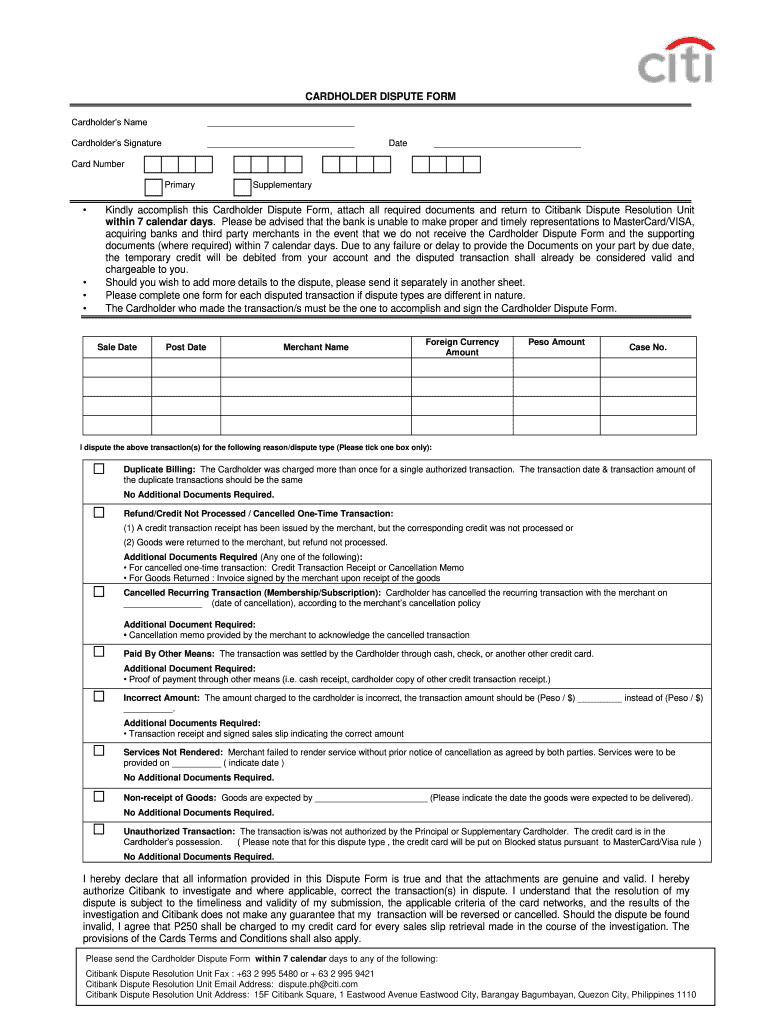

Preparing to File a Billing Dispute

Before initiating a billing dispute with Citibank, gathering all relevant information is essential. This includes:

- Account Information: Know the account number, and include your full name, contact information, and any other identifying details.

- Transaction Details: Collect evidence of the disputed transaction(s), such as the date, amount, and merchant name.

- Supporting Documentation: Assemble any receipts, correspondence, or documentation that supports your claim.

This information will expedite the process and assist in the resolution of your dispute.

Steps to Complete the Billing Dispute Process

Filing a billing dispute requires following specific steps to ensure proper handling. The outlined process can help streamline your submission:

- Identify the Charge: Review your statement carefully and pinpoint the transaction in question.

- Document Your Reasoning: Clearly articulate why the charge is being disputed, backing it with facts or supporting documents.

- Contact Customer Service: Reach out to Citibank using the customer service number on the back of your card or visit their website. This allows you to discuss your issue directly.

- Submit the Dispute Form: Depending on the nature of the claim, you may need to fill out a billing dispute form, usually found on billingdisputes.citi.com.

- Keep Records: Maintain copies of all correspondence and documents sent regarding the dispute. This is crucial for reference as the process unfolds.

Importance of Timely Submission

It is essential to submit your dispute in a timely manner. Citibank typically sets a deadline that requires disputes to be reported within 60 days of the statement date in which the disputed charge appears. Prompt action often yields better results and facilitates quicker resolutions.

Communicating with Citibank for Disputes

When addressing billing disputes, effective communication is fundamental. Here’s how to ensure your experience with customer service is productive:

- Use the Citibank Contact Channels: Reach out via official methods, such as their customer service number or the designated dispute email (e.g., billingdisputes.citi.com).

- Be Concise and Clear: Clearly state your issue, referencing specific transactions and providing necessary supporting information without excessive detail.

- Follow Up: If you do not get a response within a reasonable timeframe, do not hesitate to follow up. This helps ensure your dispute is being actively reviewed.

Understanding Relevant Terms in Billing Disputes

Familiarizing yourself with terminology associated with billing disputes can enhance your understanding of the process. Key terms include:

- Chargeback: A reversal of a credit card transaction, initiated by the issuing bank.

- Fraudulent Transaction: Unauthorized purchases made with your credit or debit account details.

- Resolution Timeframe: The period during which Citibank reviews and resolves the dispute, often dictated by banking regulations.

Knowing these terms will empower you during discussions with customer service representatives and facilitate a clearer understanding of the overall process.

Legal Context Surrounding Billing Disputes

Billing disputes are governed by consumer protection laws. In the U.S., the Fair Credit Billing Act (FCBA) provides essential rights to cardholders facing billing errors or discrepancies. Under this act:

- Cardholders have the right to dispute charges and request corrections.

- Merchants and card issuers must investigate disputes, offering timely responses.

- Customers are protected against being held responsible for unauthorized transactions under certain circumstances.

Awareness of these legal protections can enhance your confidence when addressing billing issues with Citibank.