Definition & Meaning of the Standard Form 35 - Annual Performance Bond - GSA

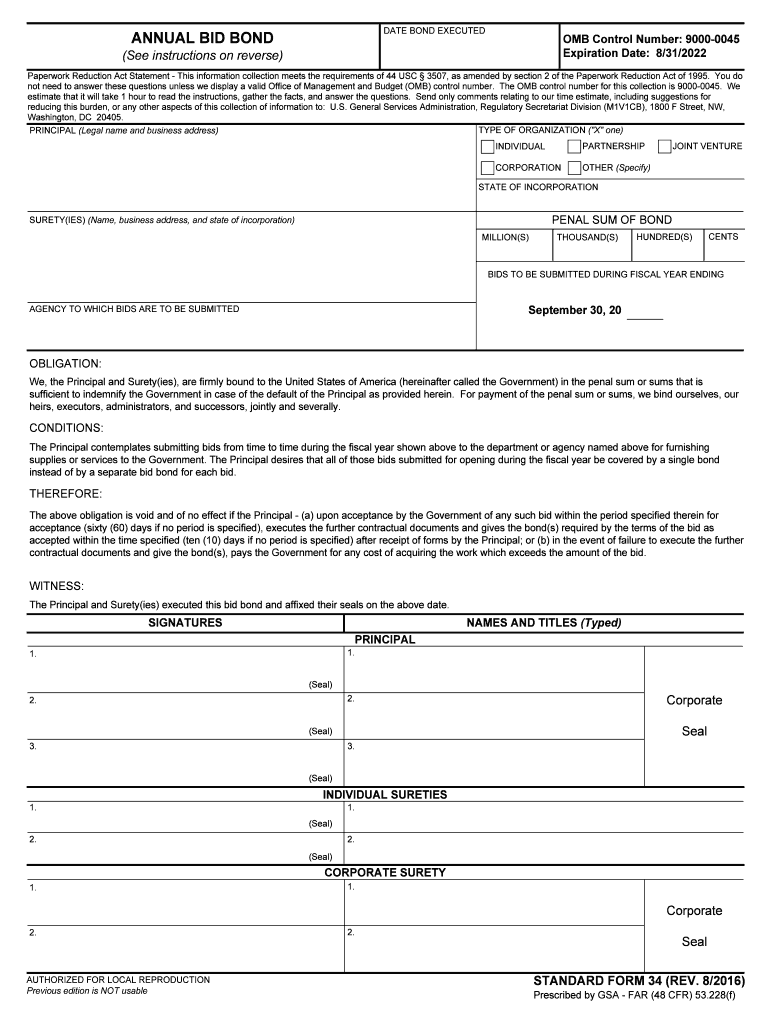

The Standard Form 35, also known as the Annual Performance Bond, is an official document used by the U.S. General Services Administration (GSA). This form serves as a legal agreement between the Principal—typically a contractor—and the Surety, which guarantees the performance of the Principal's obligations under a contract with the Federal Government. It indemnifies the government against losses stemming from the Principal's non-performance or default. The bond is essential in ensuring financial security and accountability, providing a safety net for government projects by requiring the Surety to fulfill the contract terms or compensate the client financially.

How to Use the Standard Form 35 - Annual Performance Bond - GSA

Utilizing the Standard Form 35 involves several critical steps:

- Understanding the Project Scope: Before executing the bond, all parties involved must clearly understand the project's contractual obligations.

- Filling Out the Form: The Principal must accurately complete the form, including all necessary details about the project and the involved parties.

- Securing a Surety: The Principal needs to identify and secure a surety company willing to underwrite the bond.

- Submitting the Form: After completing the form and securing a bond, the Principal submits it as part of the bid package.

- Maintaining Compliance: The Principal must adhere to all contractual obligations stipulated in both the bond and the project contract.

Steps to Complete the Standard Form 35 - Annual Performance Bond - GSA

Completing the Standard Form 35 is a detailed process requiring attention to various legal and contractual details:

- Collect Required Information: Gather all necessary information such as contractor details, project specifications, and bond amount.

- Consult with a Surety Company: Engage with a surety company to discuss the bond requirements and verify eligibility.

- Accurate Data Entry: Fill in the form meticulously to ensure all parties' names, addresses, and specifics are correct.

- Review Contract Terms: Understand and agree to all contract terms related to performance obligations.

- Obtain Required Signatures: Ensure all required signatures from the Principal, Surety, and any witnesses are obtained.

- Finalize the Form: Double-check all entries for accuracy before submitting the completed form along with any other required documents.

Who Typically Uses the Standard Form 35 - Annual Performance Bond - GSA

The Standard Form 35 is primarily used by:

- Contractors and Builders: Engaged in projects requiring performance guarantees.

- Government Agencies: To secure agreements and ensure accountability from contractors.

- Surety Companies: Offering the financial backing and support necessary for contractors to undertake significant government projects.

Important Terms Related to Standard Form 35 - Annual Performance Bond - GSA

Several important terms are associated with the Standard Form 35:

- Principal: The contractor who performs the work under the bond.

- Surety: The financial institution guaranteeing the performance of the Principal.

- Obligee: The party that benefits from the bond, typically the Federal Government.

- Bid Bond: A precursor to the performance bond, ensuring serious bidding.

- Indemnity: A principle ensuring compensation for any losses due to default.

Legal Use of the Standard Form 35 - Annual Performance Bond - GSA

Legal use of the Standard Form 35 is guided by federal regulations and laws:

- Federal Acquisition Regulation (FAR): Governs the acquisition of goods and services by Government agencies.

- Contract Law: Specific to performance obligations and remedies in the event of non-compliance or default.

- Surety Law: Rules surrounding the obligations and rights of the surety company and the Principal.

Required Documents for Completing the Standard Form 35

When completing the Standard Form 35, ensure you have the following documentation:

- Contract Details: The full contract for which the bond is being issued.

- Financial Statements: Statements that may be required by the Surety to assess risk.

- Past Performance Records: Documentation of previous project completion and compliance.

- Surety Agreements: Any agreements or terms from the surety company.

Penalties for Non-Compliance with the Standard Form 35

Non-compliance with the terms outlined in the Standard Form 35 can result in severe penalties:

- Financial Penalties: The Surety may be required to pay any outstanding obligations.

- Project Termination: Contracts may be terminated due to non-compliance.

- Legal Action: Potential lawsuits from the Federal Government for breach of contract.

- Loss of Future Opportunities: Failure to comply may result in being barred from future bids or projects with government entities.