Definition and Meaning

The term "Equity Housing Fund - HUD - HUD" generally refers to a financial instrument or program associated with the U.S. Department of Housing and Urban Development (HUD). An equity housing fund often targets investments in affordable housing, aiming to maintain or improve housing availability for low- to moderate-income families. HUD's involvement signifies government oversight and regulation, ensuring that funds are used appropriately to support housing needs.

Real-World Scenario

For example, Equity Housing Fund XIV could be a specific initiative under HUD's umbrella, focusing on a particular set of housing projects across different regions.

How to Use the Equity Housing Fund

Understanding how to leverage an equity housing fund for housing projects requires familiarity with HUD processes. These funds typically support rehabilitation, development, or construction of residential housing.

Steps to Access a Fund

- Research Eligibility Requirements: Determine specific criteria for accessing a particular fund.

- Prepare Necessary Documentation: Gather financial reports, project proposals, and any additional documents HUD requires.

- Submit an Application: Present your proposal and documentation to HUD for approval.

How to Obtain the Equity Housing Fund

Obtaining funds from HUD involves a structured application process, often requiring collaboration between private and public entities.

Application Details

- Collaborative Proposals: Engage with local agencies to strengthen your application.

- Detailed Project Plans: Clearly outline the scope, budget, and expected outcomes.

- Compliance Certifications: Show that your project aligns with HUD objectives and regulations.

Steps to Complete the Equity Housing Fund Form

Completing forms related to HUD equity housing funds involves several key steps to ensure accuracy and compliance.

- Gather Required Information: Collect all pertinent information, including project details and financial data.

- Complete All Sections: Fill out each part of the form thoroughly; missing information can delay processing.

- Review and Validate: Double-check all entries for errors before submission.

Important Considerations

- Format Specifications: Follow HUD's formatting guidelines precisely.

- Attachments: Ensure all necessary documents are included as appendices or exhibits.

Who Typically Uses the Equity Housing Fund

These funds are typically utilized by a mix of public agencies, private developers, and non-profit organizations focusing on affordable housing projects.

Common Users

- Local Governments: Municipal entities looking to improve housing within their jurisdiction.

- Non-Profit Organizations: Entities dedicated to developing housing for underserved communities.

- Real Estate Developers: Companies invested in project that meet HUD criteria for funding.

Legal Use of the Equity Housing Fund

Equity funds under HUD's administration must comply with specific legal guidelines and regulations to ensure transparency and fairness.

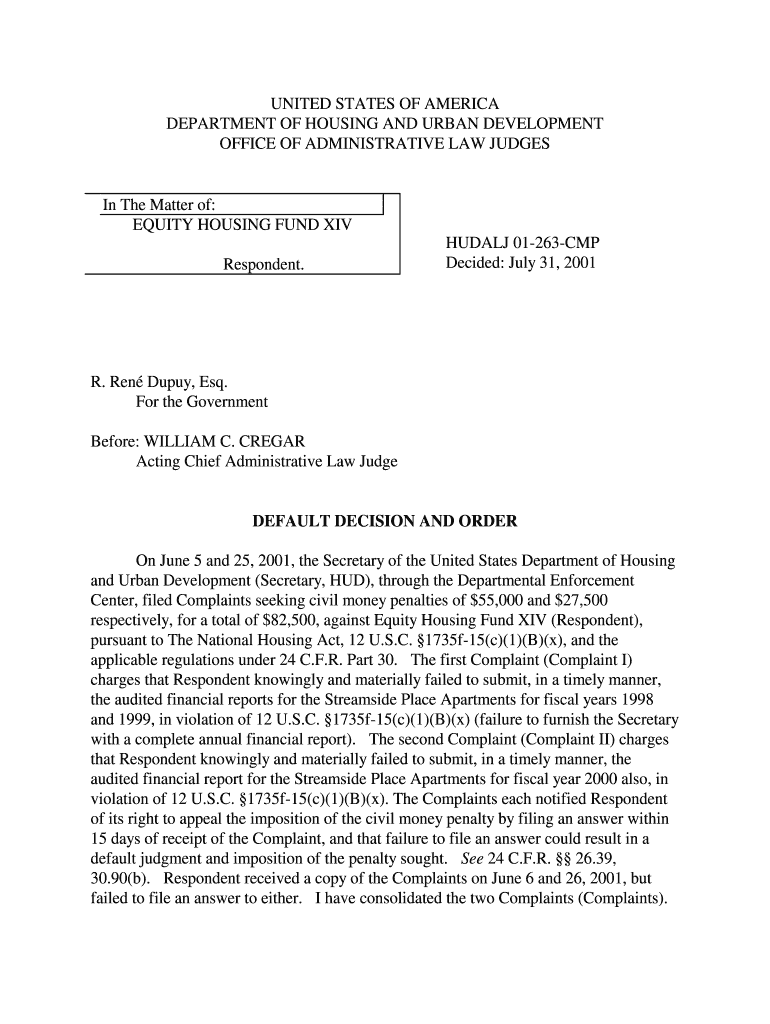

Legal Requirements

- Audited Financial Reports: Ensure that documents are submitted timely as failures could lead to penalties.

- Compliance with Housing Laws: Adherence to federal regulations to avoid sanctions or project delays.

Penalties for Non-Compliance

Failing to meet HUD's requirements can result in substantial penalties, affecting both current and future access to funds.

Examples of Penalties

- Monetary Fines: As illustrated by the $82,000 penalty against Equity Housing Fund XIV for delayed audits.

- Loss of Funding: Possible revocation of fund access if compliance issues are significant.

Required Documents for Equity Housing Fund - HUD - HUD

HUD typically requires extensive documentation to process applications for equity housing funds, ensuring accountability and proper fund allocation.

Commonly Required Documents

- Audit Reports: Past financial audits must be submitted timely.

- Project Plans: Detailed descriptions of the proposed projects.

- Compliance Certifications: Proof of adherence to housing laws and regulations.

Form Submission Methods

Submitting forms for HUD equity housing funds involves choosing the appropriate method based on HUD's guidelines and your resources.

Available Methods

- Online Submission: Convenient for many applicants, allowing digital form uploads.

- Mail Submission: Sending completed forms via postal service, which might be preferred for those without reliable internet access.

State-Specific Rules for the Equity Housing Fund

Each state might have its own additional regulations or incentives that affect how equity housing funds are accessed and utilized.

Variations by State

- Additional Incentives: Some states might offer tax breaks or additional funds for projects aligning with local housing goals.

- Different Compliance Standards: State laws can add an extra layer of compliance requirements.

Business Types that Benefit Most from Equity Housing Funds

Certain business structures can maximize the benefits from equity housing funds, especially when aligned with HUD objectives.

Benefitting Entities

- Limited Liability Companies (LLCs): Provides flexibility in managing housing projects.

- Non-Profit Corporations: Align with HUD's mission-driven approach to affordable housing.

Examples of Using the Equity Housing Fund

Case studies provide valuable insight into how these funds can be successfully utilized in various housing projects.

Successful Implementations

- Redevelopment Projects: Transforming derelict buildings into affordable housing units.

- Community Housing Programs: Collaborations between local governments and developers to build community-driven housing solutions.

Key Elements of the Equity Housing Fund - HUD - HUD

Understanding the core components of the equity housing fund ensures effective utilization and compliance.

Core Elements

- Funding Scope: Specific areas or types of projects the fund will support.

- Eligibility Criteria: Defines which entities or projects qualify for funding.

- Regulatory Compliance: Adherence to HUD and federal guidelines for fund usage.