Definition and Purpose of Form 1123

Form 1123 from the Harris County Appraisal District is designed for property owners to apply for miscellaneous property tax exemptions in Harris County, Texas, as per Tax Code §11.23. This form requires applicants to provide comprehensive details about their property, including ownership, requested exemptions, and the purpose and activities of the organization associated with the property. It also ensures that applicants meet the necessary conditions for annual reapplication to maintain their exemption status.

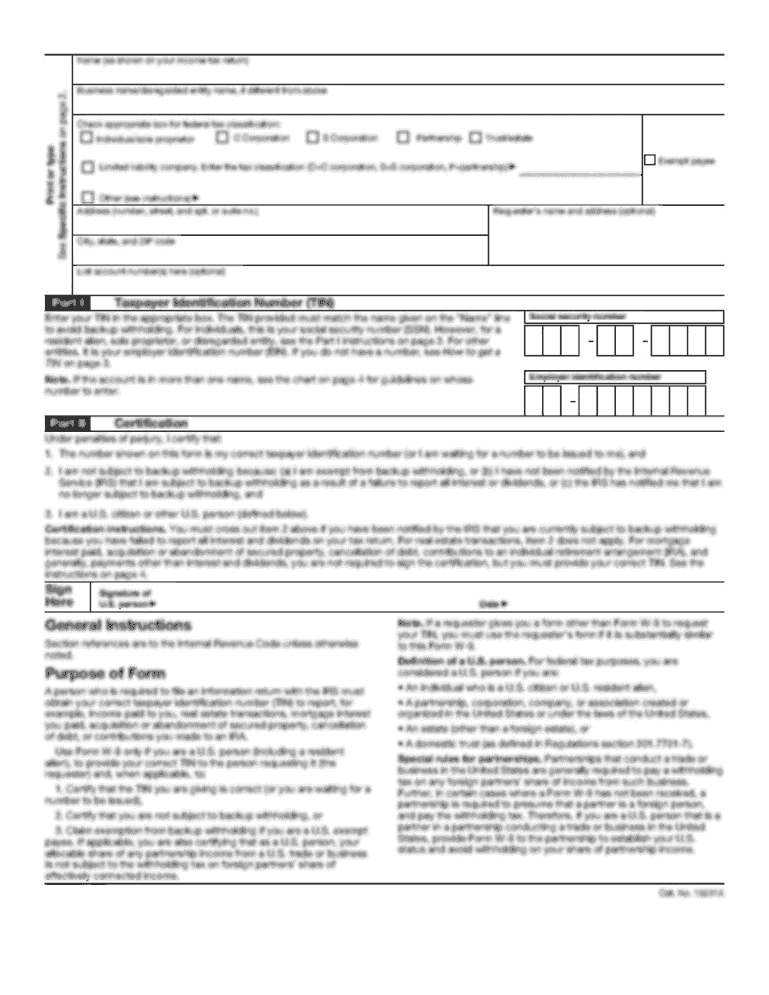

How to Use Form 1123

To effectively use the Harris County Appraisal District Form 1123, property owners need to:

- Review the form’s instructions and guidelines to understand eligibility criteria.

- Complete the form with detailed information about the property and exemption type.

- Include supportive documentation, such as proof of ownership and evidence supporting the exemption request.

The completed form and accompanying documents should reflect accurate and truthful information to avoid delays or denial.

Obtaining Form 1123

Property owners can obtain Form 1123 directly from the Harris County Appraisal District’s website or by visiting their office. It is crucial to ensure that you are using the correct version of the form, specifically the 2013 version if applicable, to comply with historical requirements or for specific exemptions relevant to that year.

Steps to Complete Form 1123

- Identify Property Details: Begin by providing the property's legal description and location.

- Owner Information: Fill in the owner's name, contact details, and any associated organization.

- Exemption Type: Specify the exemption being sought, citing the relevant section of the Texas Tax Code.

- Purpose and Activities: Detail the purpose of the organization and activities conducted on the property.

- List Real and Personal Property: Clearly describe all real and personal property for which exemptions are requested.

Each section of the form needs careful attention to detail to ensure accuracy.

Reasons to Use Form 1123

Applying for property tax exemptions using Form 1123 can result in significant tax savings for eligible property owners. This form allows exemptions for properties used for specific non-profit purposes, such as religious, educational, or charitable activities. Failing to apply or misfiling can lead to missed opportunities for financial relief.

Common Users of Form 1123

Typically, non-profit organizations, religious institutions, and educational entities use Form 1123 to claim property tax exemptions. Additionally, property owners involved in charitable activities may find this form crucial in positioning their properties for exemption status under Texas Tax Code §11.23.

Key Elements of Form 1123

- Property Owner Information: Includes detailed personal or organizational identifiers.

- Exemption Criteria: Clearly outline the type of exemption being sought and the justification.

- Supporting Documentation: Attached documents that provide substantiation for the exemption request.

- Signatures: Required from property owners or authorized representatives ensuring all information is accurate.

Understanding these elements helps streamline the completion and review process.

State-Specific Rules for Form 1123

The Texas Tax Code provides specific guidelines for exemptions that differ from other states. It's vital to ensure adherence to the legal requirements set forth by the Texas legislature to verify eligibility and ensure compliance.

Property owners should familiarize themselves with these regulations to avoid complications during the application process.

Important Dates and Filing Deadlines

Property owners need to be aware of key deadlines relevant to Form 1123 submissions. Submissions are often tied to specific calendar dates that ensure the timely processing of exemption requests. Failing to submit before these deadlines can result in a loss of exemption for the year, emphasizing the importance of prompt and organized filing.

Documentation Required with Form 1123

To complete Form 1123 effectively, property owners should prepare the following documents:

- Proof of Ownership: Such as deeds or title insurance.

- Documentation Supporting Activity: Including mission statements or summaries of property activities.

- Financial Records: If applicable, showing use of the property aligns with requested exemptions.

These documents are critical in demonstrating eligibility and should be organized and attached with the submission of the form.

Form Submission Methods

Form 1123 can typically be submitted through multiple channels, including:

- Online Submission: Via the Harris County Appraisal District's portal.

- Mail: Send physical copies to the district’s office.

- In-Person: Delivering directly to ensure receipt and avoid postal delays.

Choosing the most appropriate method of submission is important for convenience, timeliness, and receiving a submission confirmation.

Legal Use and Compliance

Form 1123 must be used in accordance with the laws governing property tax exemptions in Texas. Compliance involves not only submitting accurate information but also ensuring that the property fulfills the requirements of the claimed exemption throughout the year.

Legal misuse or provision of false information can result in penalties, removal of exemptions, or legal proceedings. Ensuring that legal advice is sought when needed can mitigate potential risks.