Definition & Meaning

The finance form is a specialized document used primarily for vehicle finance applications, designed to gather essential information from individuals or businesses seeking financial products related to automobile purchases or leases. This form serves as a comprehensive tool to collect personal, employment, financial details, and declarations necessary for evaluating creditworthiness and eligibility for financing options. Its structured format allows lenders to assess potential borrower's ability to repay loans or meet leasing obligations.

Finance forms are integral in the financial services industry, offering a standardized approach to gather crucial data. They streamline the process of applying for credit or rental facilities, ensuring that both lenders and applicants have a clear understanding of the financial commitment involved. The form typically encompasses several sections, each focusing on different aspects of the applicant's financial profile.

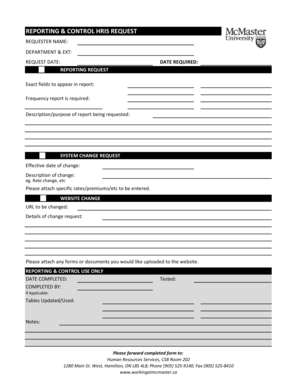

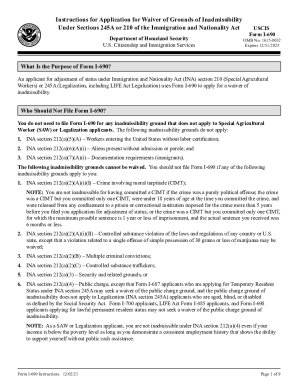

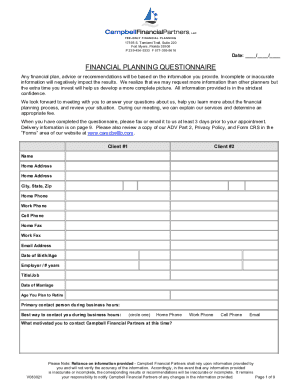

Key Elements of the Finance Form

The finance form contains multiple sections, each designed to capture detailed information about the applicant's financial situation. These sections include:

- Personal Information: Collects basic data such as name, address, contact details, and Social Security number essential for identity verification.

- Employment History: Requires details about current and previous employment, including employer names, job titles, duration of employment, and annual income.

- Financial Assets and Liabilities: Requests information on the applicant's assets like savings, investments, and properties, alongside liabilities such as existing loans, credit card debts, and other obligations.

- Monthly Income and Expenses: Encompasses a breakdown of all income sources against regular expenditures to gauge financial stability.

- Declaration of Truthfulness: A statement affirming that the provided information is accurate to the best of the applicant's knowledge, often accompanied by a signature.

The finance form’s comprehensive nature helps both the applicant and the financial institution understand and agree upon the terms of engagement.

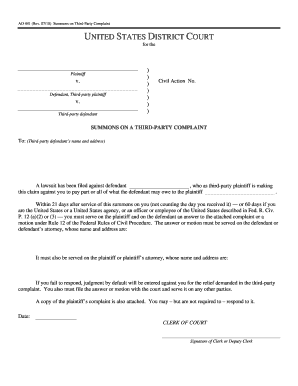

How to Use the Finance Form

Using the finance form entails following a structured approach to ensure all required information is accurately captured. Here’s how to effectively use this form:

- Download or Obtain the Form: Acquire the form from the financial institution’s website or in-person at their office.

- Read Instructions Carefully: Review the instructions to understand the requirements for each section.

- Complete All Sections: Fill out each part of the form carefully, ensuring that all mandatory fields are completed with accurate and up-to-date information.

- Attach Required Documents: Gather and attach necessary supporting documents such as pay stubs, bank statements, and identification proof.

- Review and Sign: Carefully review the completed form for any errors or omissions before signing the declaration of truthfulness.

- Submit the Form: Hand in the form to the appropriate financial institution through their preferred submission method, such as online or in-person.

This step-by-step process ensures that the finance form is used efficiently to facilitate a smooth application process.

Steps to Complete the Finance Form

To properly complete the finance form, adhere to the following detailed steps:

- Gather Necessary Information: Before starting, collect all required personal, employment, and financial information.

- Start with Personal Details: Accurately fill in personal information, ensuring name and contact details match official documents.

- Provide Employment History: List all relevant employment details, keeping in mind consistency with past applications.

- List Assets and Liabilities: Clearly enumerate all financial assets and liabilities, using precise figures from recent statements.

- Detail Monthly Income and Expenses: Provide a realistic view of monthly financial inflows and outflows, accounting for regular and atypical expenses.

- Sign the Declaration: Once all sections are complete, carefully read the declaration before signing to affirm the truthfulness of your submitted information.

Completing the form with diligence ensures that your application is processed without unnecessary delays.

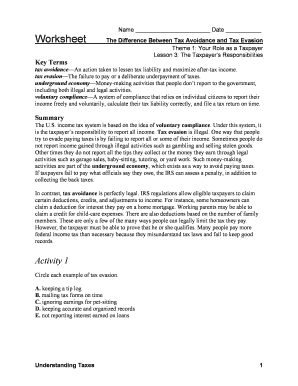

Required Documents

Completing a finance form generally requires several supporting documents to verify the information provided. These documents include:

- Proof of Identity: Such as a driver’s license, passport, or Social Security card.

- Proof of Income: Recent pay stubs, tax returns, or employer letters.

- Bank Statements: Typically from the past three to six months, reflecting account activity.

- Debt Statements: Documentation on existing loans or debts, often including credit card statements.

- Asset Proof: Evidence of assets in the form of investment and property ownership documents.

Having these documents ready helps in seamless form submission and expedites the approval process.

How to Obtain the Finance Form

The finance form can be obtained through several methods, depending on the institution providing the financial service:

- Download from Institution's Website: Most financial institutions offer the option to download the form directly from their official website.

- Request via Email: Some lenders may offer to send the form via email upon request.

- Visit the Financial Institution: Obtain a physical copy of the form by visiting the office of the lender or financier.

- Third-Party Platforms: Forms may be available through authorized third-party platforms offering financial services.

These methods ensure accessibility to the finance form, enabling applicants to choose the most convenient method based on their preferences and needs.

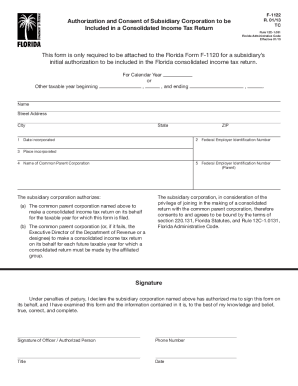

Legal Use of the Finance Form

The finance form acts as a binding document in financial dealings. There are several legal aspects to consider:

- Accuracy Compliance: Applicants are legally obligated to provide accurate information, as misrepresentation can lead to fraud charges.

- Consent Agreement: Signing the form signifies consent to the terms set forth by the lending institution, creating a legally enforceable contract.

- Privacy Protection: Financial institutions are required to keep the provided information confidential, as outlined by privacy laws and regulations.

Understanding these legal implications ensures informed consent and protects the interests of all parties involved.

Examples of Using the Finance Form

Finance forms have practical applications in various real-world scenarios, such as:

- Car Dealerships: Used during the car-buying process to secure financing for vehicle purchase.

- Leasing Companies: Utilized to assess eligibility for leasing agreements, determining monthly payment schedules.

- Banks and Credit Unions: Employed in their lending programs for both individual and corporate clients seeking vehicle loans.

These scenarios highlight the versatility and necessity of finance forms within the auto financing sector.