Definition and Purpose of the Canadian Direct Assured Tax Report (Form C-FET01)

The Canadian Direct Assured Tax Report, also known as Form C-FET01, is a specialized document required for Lloyd's brokers managing insurance policies covering Canadian residents and associated risks. This form is essential to determine the applicability of the Canadian Excise Tax, a 10% levy on insurance premiums involving Canadian insureds. Proper completion of this form prevents rejections by entities such as Xchanging, an important consideration for ensuring seamless processing and compliance with regulatory requirements.

How to Use the Canadian Direct Assured Tax Report (Form C-FET01)

Using Form C-FET01 involves understanding key sections pertinent to the excise tax. Brokers must meticulously fill out information about the insurance policies, ensuring all data accurately reflects the involvement of Canadian insureds to validate the application of the 10% excise tax. Brokers should check for any exemptions or special conditions that may alter tax liabilities, requiring precise calculations and thorough documentation for compliance.

Steps to Complete the Canadian Direct Assured Tax Report (Form C-FET01)

-

Gather Necessary Information: Compile details about the insurance policies affecting Canadian insureds, including premium amounts and the extent of coverage.

-

Identify Exemptions: Determine any applicable exemptions from the Canadian Excise Tax, noting conditions that could impact tax obligations.

-

Complete the Form: Accurately fill out the required fields on Form C-FET01, ensuring all entries are correct to prevent amendments or rejections.

-

Review and Validate: Double-check all information for accuracy and completeness, particularly the sections on tax applicability and exemptions.

-

Submit to Appropriate Entity: Ensure timely submission to a designated processing entity, such as Xchanging, to facilitate the necessary legal checks and compliance verification.

Key Elements of the Canadian Direct Assured Tax Report (Form C-FET01)

- Tax Applicability: The form identifies whether the 10% excise tax applies to a given insurance policy.

- Exemption Clauses: It includes details of any exemptions that might reduce or eliminate tax liability.

- Policyholder Details: Comprehensive information about the Canadian insured, including residency and associated risks, is documented.

Important Terms Related to the Canadian Direct Assured Tax Report (Form C-FET01)

Understanding specific terminology is crucial:

- Canadian Excise Tax: A federal levy on specific insurance premiums.

- Insured: The person or entity covered by the insurance policy.

- Exemptions: Situations where tax obligations may be waived due to particular conditions.

Legal Use of the Canadian Direct Assured Tax Report (Form C-FET01)

Filling out Form C-FET01 is legally mandated for certain insurance transactions with Canadian residents. Brokers must conform to all regulatory standards to ensure the legality and validity of insurance arrangements. Non-compliance can result in penalties, emphasizing the form's crucial role in legal proceedings of insurance claims involving Canadian stakeholders.

Examples of Using the Canadian Direct Assured Tax Report (Form C-FET01)

- Case Study 1: A Lloyd's broker manages a policy covering natural disaster risks in Canada. As per regulatory requirements, the broker uses Form C-FET01 to establish whether the premium is subject to the excise tax.

- Case Study 2: A property insurance policy is issued to a Canadian real estate company. The broker completes the form to identify tax obligations and exemptions, facilitating smooth cross-border insurance operations.

Filing Deadlines and Important Dates

Timeliness is crucial in filing Form C-FET01:

- Regular Filing Periods: Typically align with fiscal quarters, matching the billing cycles of involved insurance entities.

- Amendment Deadlines: Adjustments or corrections must meet specific deadlines to avoid compliance issues.

- Renewal Dates: Often correspond with annual policy renewals, necessitating timely form submissions in continuity with policy anniversary dates.

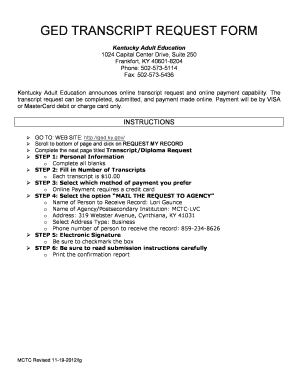

Form Submission Methods

Form C-FET01 can be submitted through multiple channels:

- Online Submission: Via online platforms supporting secure data transfer, enhancing efficiency.

- Mail: Physical submissions remain a traditional method, requiring careful handling to meet deadlines.

- In-Person Delivery: In specific cases, direct handover to processing entities may be preferred for assurance of transfer.

Penalties for Non-Compliance

Failing to properly fill out and submit Form C-FET01 can lead to significant consequences:

- Financial Penalties: Non-compliance might incur fines, affecting overall business profitability.

- Rejections: Improperly completed forms may lead to rejection by entities like Xchanging, disrupting insurance processes.

- Legal Repercussions: Continued failure to comply could lead to more severe legal actions, impacting the broker's ability to operate.