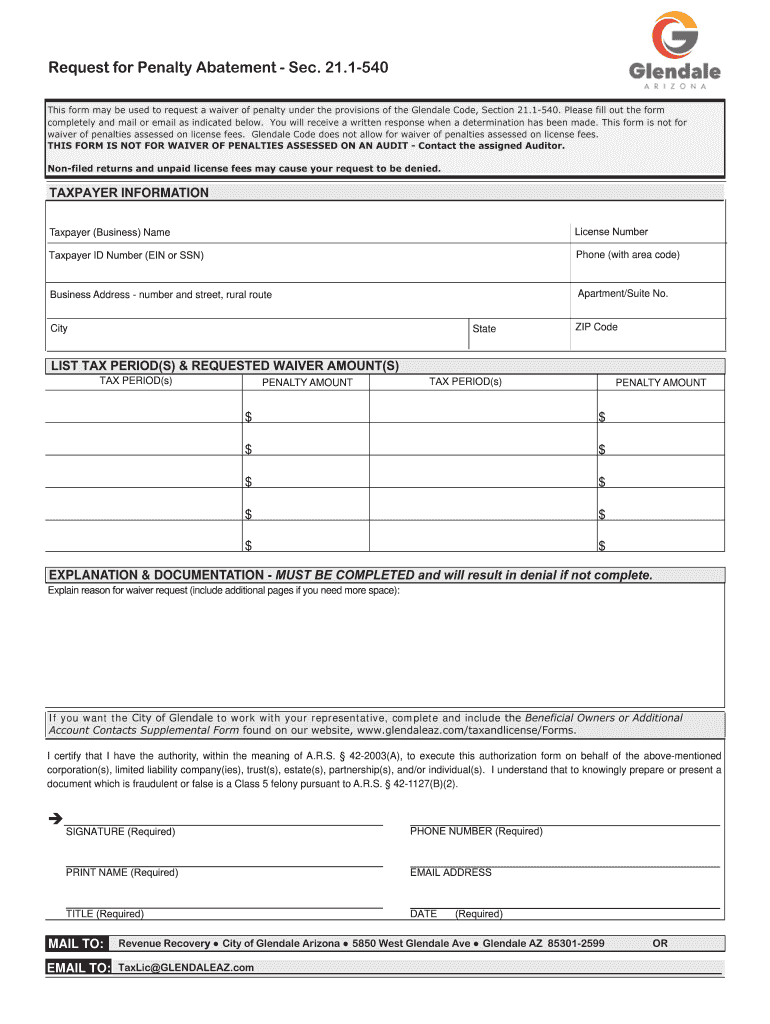

Definition and Purpose of Form 290 Arizona

Form 290 in Arizona is primarily used to request a waiver of penalties that are related to licensing fees under the Glendale Code. The form is essential for taxpayers and business entities that wish to appeal for a reduction or complete waiver of penalties incurred due to non-compliance with licensing requirements. The document serves to collect comprehensive information from the applicant, ensuring that the waiver request is processed efficiently and in full compliance with state regulations.

How to Use Form 290 Arizona

Using Form 290 involves several crucial steps to ensure that the request is processed correctly. To begin with, you must thoroughly complete the form in its entirety, providing accurate details such as your business name, license number, and contact information. Ensuring that all requested information is provided will help prevent delays in processing. Finally, it's essential to include a detailed explanation as to why the waiver should be granted, emphasizing circumstances that led to any non-compliance with tax obligations.

How to Obtain Form 290 Arizona

You can obtain Form 290 from various sources including the official Arizona tax authority’s website or directly from local municipal offices in Glendale, Arizona. Additionally, for those who prefer digital sources, the form may be available via document management platforms like DocHub, which provide digital versions for easier access and completion. Before downloading or printing the form, verify that you have the most recent version to avoid any discrepancies that may arise from using outdated documents.

Steps to Complete Form 290 Arizona

Successfully completing Form 290 requires attention to detail and accuracy. Start by filling out your business details, including name and license number. Ensure that contact information is up to date to facilitate communication. Next, carefully detail the reasons for your penalty waiver request. It's crucial to be as specific as possible, outlining the exact circumstances that led to the penalties. Supporting documents, like past tax returns or communications with the tax authority, can enhance your application’s validity. After completion, review the form to ensure all sections are accurately filled before submission.

Who Typically Uses Form 290 Arizona

Form 290 is typically utilized by business owners who are facing penalties for late payments or non-compliance with Glendale's licensing regulations. Various entities, such as corporations, partnerships, and individual business operators, find this form useful when seeking to contest penalties they believe unjust or disproportionate to their situation. It's especially beneficial for companies that have valid reasons for non-compliance, such as unforeseen circumstances or administrative errors.

Key Elements of Form 290 Arizona

The form is segmented into several critical components that must be meticulously completed. These include:

- Business Information: Name, license number, and contact data.

- Penalty Details: Specific penalties being contested and their respective amounts.

- Explanation Section: Full context of the non-compliance leading to penalties.

- Certification Statement: Declaration of the authority and truthfulness of the information provided.

By completing these sections carefully, applicants stand a better chance of having their penalty waivers granted.

Legal Use of Form 290 Arizona

The form is legally recognized under the Glendale Code, providing a structured method for taxpayers to petition against penalty fees. It must be used in good faith, with accurate and truthful information. Any misrepresentation can lead to further penalties or legal repercussions. Compliance with local law is critical, and the form serves as a formal request which may require legal consultation to ensure all documentation and explanations adhere to regulations.

Required Documents for Form 290 Arizona

Supporting documents are often necessary when submitting Form 290. These typically include:

- Recent tax returns to show compliance history.

- Licensing documents.

- Any correspondence related to the penalties in question.

- Financial records demonstrating the impact of penalties on business operations.

Including these documents can substantively support your case and facilitate a successful outcome.

Submission Methods for Form 290 Arizona

Form 290 can be submitted through various channels depending on the applicant's preference. Options generally include mail, in-person delivery at a designated municipal office, or, in some cases, online submission through authorized platforms. Each method requires verification of receipt, so ensure that confirmations are obtained, especially for submissions through mail or digital platforms. Electronic submission is increasingly preferred for convenience and efficiency.

By following these detailed instructions and guidelines for Form 290 in Arizona, applicants can effectively handle waiver requests for licensing fee penalties, ensuring compliance with local tax regulations while leveraging digital tools for streamlined document management.