Understanding the IRA Withdrawal Authorization Form

The IRA Withdrawal Authorization form is crucial for facilitating distributions from Individual Retirement Accounts (IRAs). This form is designed for Traditional and SIMPLE IRAs, detailing the necessary information required from the account holder, trustee or custodian, and any designated beneficiaries. Below, we will examine key aspects of this form, including its purpose, completion requirements, and associated tax implications.

Key Components of the IRA Withdrawal Authorization Form

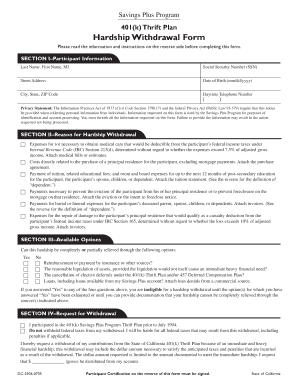

The form includes several critical sections that guide the user through the withdrawal process:

- Account Holder Information: This section requires the name, address, and Social Security number of the IRA owner to verify identity.

- Withdrawal Details: Users must specify the type of IRA account from which they are withdrawing, as well as the amount and reason for the withdrawal.

- Tax Withholding Elections: The form allows account holders to indicate their preferences for federal and state tax withholding, which is important for tax reporting and compliance.

Completing the Withdrawal Request

Follow these steps to complete the IRA Withdrawal Authorization form effectively:

- Provide Personal Information: Enter all relevant details for accurate identification.

- Select Withdrawal Type: Specify whether the withdrawal is for a distribution, transfer, or rollover.

- Sign and Date: Ensure to sign and date the form to validate the request.

- Submit to Custodian: Send the completed form to the IRA custodian or trustee by the specified method (mail, fax, or electronic submission).

Accurate completion ensures that the withdrawal is processed without delays.

Withdrawal Reasons and Associated Tax Rules

Different withdrawal reasons on the IRA Withdrawal Authorization form trigger various tax implications. Common reasons include:

- Retirement: Withdrawals made after reaching age fifty-nine and a half generally avoid the early withdrawal penalty but may still incur income tax.

- Financial Hardship: Certain early withdrawals may be exempt from penalties if the funds are used for qualifying expenses, such as medical bills or first-time home purchases.

- Education Expenses: Withdrawals used for qualified higher education costs may also have favorable tax treatment.

It is important for the account holder to consult IRS guidelines to understand any tax repercussions related to the specific withdrawal type chosen on the form.

Important Instructions for Asset Handling

The IRA Withdrawal Authorization form includes guidelines on how to handle assets after withdrawal:

- Direct Transfers: If the funds are being transferred to another retirement account, ensure that this process is categorized correctly to avoid taxes.

- Cash Withdrawals: For cash withdrawals, account holders need to be mindful of withholding amounts communicated on the form, as these will affect overall tax liability.

Proper adherence to these handling instructions can help account holders better manage their tax obligations and avoid unexpected penalties.

Reporting Requirements to the IRS

Accurate reporting is essential. The IRA custodian is typically responsible for reporting distributions to the IRS, using Form 1099-R:

- Distribution Income Reporting: This form reports the amount withdrawn and whether taxes were withheld.

- Tax Impact: Withdrawals may impact taxable income for the year, and the recipient must ensure these amounts are factored into their tax return.

Keeping thorough records of withdrawals and the corresponding forms is beneficial for future tax filings.

Legal Considerations and Penalties for Non-Compliance

Failure to comply with IRS regulations regarding withdrawals can lead to significant penalties. Understanding applicable laws is vital:

- Early Withdrawal Penality: Individuals under age fifty-nine and a half generally incur a ten percent penalty unless an exception applies.

- Tax Liabilities: Non-compliance in reporting or incorrect withdrawals may also see the IRS impose additional taxes.

Proper utilization of the IRA Withdrawal Authorization form, combined with knowledgeable handling of funds, safeguards against legal consequences and unwanted tax burdens.

Frequently Encountered Situations with IRA Withdrawals

Several typical scenarios may arise while using the IRA Withdrawal Authorization form:

- Emergency Expenses: Individuals may need to withdraw funds quickly. Awareness of the implications is key.

- Tax Planning: Some account holders may choose to withdraw strategically to minimize tax burdens, particularly during lower-income years.

Being informed of these situations can help navigate the complexities associated with IRA withdrawals successfully.

Summary of Compliance and Responsiveness

Completing the IRA Withdrawal Authorization form requires a nuanced understanding of the rules governing IRA distributions. By ensuring compliance with IRS guidelines and correctly managing withdrawals, account holders can effectively utilize their retirement assets while minimizing potential financial liabilities. Keeping these factors in mind is essential for anyone considering a withdrawal from their IRA.