Comprehensive Guide to the M895 Insurance Form

Definition and Purpose of the M895 Insurance Form

The M895 insurance form serves as a key document within the realm of insurance policies, primarily focusing on policy changes and beneficiary designations. It is widely used by insurance companies to facilitate modifications to existing policies, ensuring that the insured maintains control over their benefits and beneficiaries. Understanding the M895 form is essential for policyholders who need to update their information, such as changing beneficiaries or altering coverage details.

Key Elements of the M895 Insurance Form

The M895 insurance form consists of several critical sections that require careful attention:

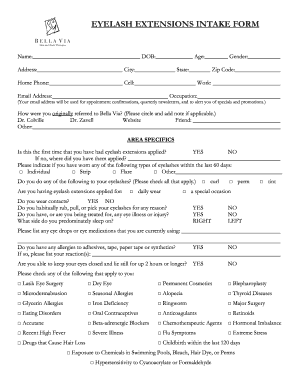

- Policyholder Information: This section includes personal details such as name, contact information, and policy number.

- Beneficiary Designation: Policyholders can specify or update their chosen beneficiaries, indicating who will receive benefits upon their passing.

- Signatures: The form requires signatures from the policyholder and any witnesses, confirming the authenticity of the provided information.

- Acknowledgments: Included are sections where insured individuals acknowledge their understanding of the changes being made to the policy.

Each element plays a significant role in ensuring the validity and enforceability of the changes made through the M895 form.

Steps to Complete the M895 Insurance Form

Filling out the M895 insurance form accurately is crucial for processing requests efficiently. Follow these steps:

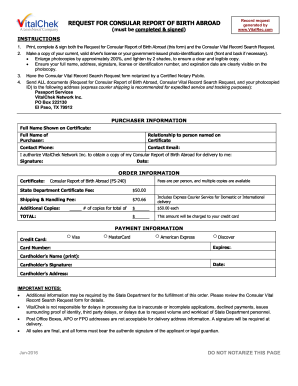

- Gather Necessary Information: Collect all relevant details, including your policy number, personal identification details, and any existing beneficiary information.

- Fill Out the Form: Input your details in the designated fields, ensuring accuracy in names, addresses, and policy specifics.

- Designate Beneficiaries: Clearly specify the beneficiaries, including full legal names and contact information, to avoid any potential disputes in the future.

- Review the Form: Double-check all entries for any errors or omissions, as inaccurate information can delay processing.

- Sign and Date: Ensure that you sign and date the form correctly, as it is a crucial step in making the changes official.

- Submit the Form: Send the completed form to your insurance provider via the specified submission method—whether online, by mail, or in person.

Following these procedural steps helps ensure that your requests will be processed without complications.

Important Legal Considerations for the M895 Form

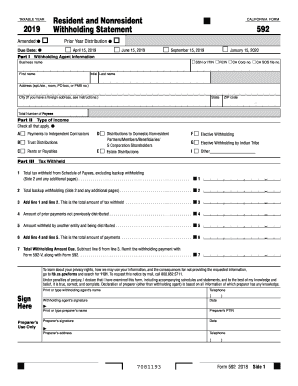

Understanding the legal implications of the M895 insurance form is vital for policyholders. The changes made through this form are legally binding and must adhere to the insurance company's policies and state regulations. Key considerations include:

- Compliance with State Laws: Each state may have specific laws related to beneficiary designations and modifications in insurance policies, so it is crucial to be aware of these.

- Impact of Changes on Coverage: Policyholders need to understand how changes affect their coverage. For instance, designating a new beneficiary may have tax implications or impact overall policy benefits.

- Potential for Disputes: Inaccuracies or unclear designations can lead to disputes among beneficiaries, making it essential to fill out the form with clarity and precision.

Examples of Common Uses of the M895 Insurance Form

The M895 insurance form is utilized in various scenarios, reflecting its versatility in managing insurance policies:

- Changing Beneficiaries After Marriage or Divorce: Many individuals use this form to ensure beneficiaries reflect current life circumstances.

- Updating Coverage Details: Policyholders may need to modify their policies due to changes in health or financial status, requiring documentation through the M895 form.

- Adding New Beneficiaries: In cases of the birth of a child or other significant life changes, policyholders often opt to add beneficiaries.

These examples illustrate the importance of the M895 form in maintaining accurate and relevant insurance coverage.

Understanding Variants of the M895 Insurance Form

While the M895 is specific, various related forms may be applicable depending on the insurance company's process. Understanding these variants can aid in ensuring accurate submission:

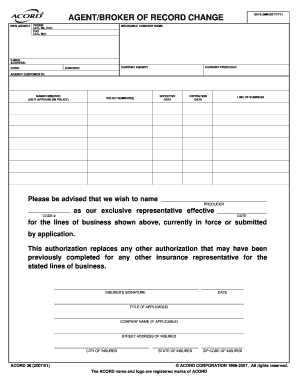

- Beneficiary Change Forms: Some companies may have specific forms just for changing beneficiaries without the comprehensive changes included in the M895.

- Policy Amendment Forms: These forms may be necessary for more extensive revisions beyond simple beneficiary updates.

- State-Specific Forms: Some states have specific versions or requirements for insurance forms, which should be identified based on the policyholder's location.

Recognizing these variants allows policyholders to navigate their insurance needs more effectively.

Deadline and Submission Methods for the M895 Insurance Form

Timeliness and proper submission methods are critical considerations for the M895 insurance form:

- Submission Methods: Policyholders can typically submit the M895 form through various channels, including online, by mail, or in person, depending on their insurance provider's protocols.

- Deadlines for Changes: Many insurance policies stipulate a specific period within which changes to beneficiaries or coverage must be made, especially before renewal dates or significant policy changes. Being aware of these deadlines helps prevent lapses or issues with coverage.

Understanding submission methods and deadlines ensures the policyholder's requests are processed promptly and effectively.