Definition and Meaning of Motor Industry Retirement Funds Reviews

Motor industry retirement funds reviews refer to comprehensive evaluations and insights regarding retirement funding options available to individuals employed within the motor industry. These funds provide financial security post-retirement, ensuring that workers can maintain their quality of life after exiting the workforce. Understanding these reviews is crucial for employees, employers, and financial advisors as they reflect performance, fees, benefits, and other critical aspects of these retirement funds.

The term encompasses both qualitative and quantitative assessments, offering potential and current fund members a detailed overview of how various funds stack up against one another. Factors influencing reviews may include historical performance, administrative fees, investment strategies, and member satisfaction ratings. These reviews serve as a guide for decision-making regarding which fund to invest in, ultimately impacting long-term financial well-being.

How to Use the Motor Industry Retirement Funds Reviews

Using motor industry retirement funds reviews effectively involves a systematic approach to evaluating available options. To maximize the benefits of these reviews, consider the following steps:

- Identify Key Metrics: Focus on factors such as fund performance, expense ratios, and historical returns over different time frames.

- Make Comparisons: Use the reviews to compare various funds. This should include differences in risk, investing philosophy, and fund management.

- Analyze Member Feedback: Member reviews and ratings provide insight into user experiences and satisfaction levels with each fund, helping to identify which are perceived as reliable.

- Consult with Financial Experts: After gathering information, discussing findings with a financial advisor may provide additional clarity on fund suitability based on individual financial goals.

By following these steps, potential contributors can make informed decisions concerning their retirement planning within the motor industry.

Steps to Obtain the Motor Industry Retirement Funds Reviews

Obtaining comprehensive reviews of motor industry retirement funds can be accomplished through the following steps:

- Research Online Resources: Utilize trusted financial websites and industry publications that specialize in retirement fund reviews.

- Access Fund Websites: Many funds provide performance data and member testimonials directly on their official website, which can be a valuable source of information.

- Engage with Professional Organizations: Professional associations within the motor industry may have access to extensive reviews and reports on various retirement plans.

- Visit Financial Forums: Online communities and forums are excellent for gathering anecdotal evidence and personal experiences related to specific funds.

- Request Reports from Fund Administrators: If more detailed reports are needed, contacting fund administrators directly can yield in-depth insights regarding their retirement plans.

Following this methodical approach will ensure you gather a robust set of reviews for informed decision-making.

Key Elements of the Motor Industry Retirement Funds Reviews

Understanding key elements of motor industry retirement funds reviews is crucial when evaluating different plans. These elements typically include:

- Performance Analysis: This examines the historical returns of a fund, typically over five, ten, and fifteen-year periods, enabling perspective on its growth potential.

- Expense Ratios and Fees: Details on any associated fees that can impact overall returns, including management fees and administrative costs.

- Investment Strategy: Insights into the fund's investment choices, such as asset allocation between stocks, bonds, and other vehicles. This may determine the level of risk involved.

- Member Benefits: A breakdown of additional benefits provided, such as disability insurance or survivor benefits, to gauge overall value.

- Customer Service Ratings: Member feedback on the responsiveness and support provided by fund representatives, affecting user experience.

By analyzing these critical components, individuals can make more informed choices regarding their retirement investment.

Important Terms Related to Motor Industry Retirement Funds Reviews

Familiarizing oneself with key terminology related to motor industry retirement funds is essential for understanding the reviews. Important terms include:

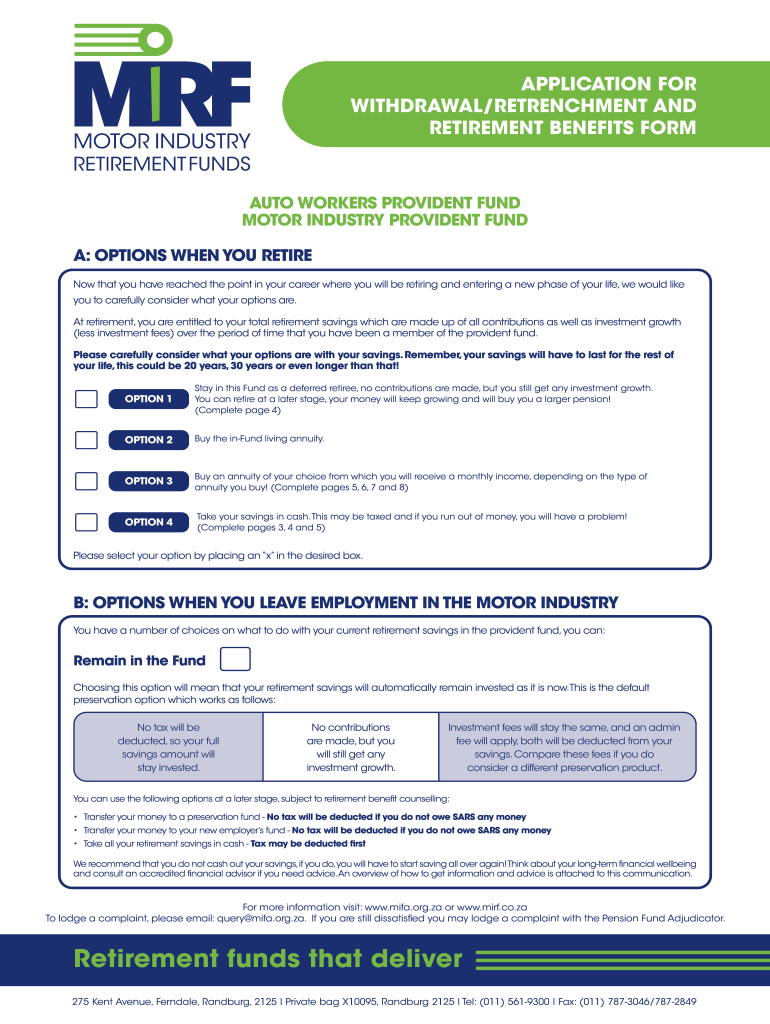

- Defined Benefit Plan: A retirement plan where benefits are calculated based on salary and years of service.

- Defined Contribution Plan: A retirement plan where the employee contributes a fixed amount or a percentage of salary, with the total benefits being based on contributions and investment gains.

- Vesting: The process by which an employee earns the right to the benefits after a certain period within the fund.

- Portability: The ability to transfer retirement savings from one fund to another without penalty, important for individuals changing jobs.

- Annuity Options: Financial products that provide income for a specified period of time, typically purchased at retirement, that can be reviewed to track their effectiveness.

Understanding these terms will enhance the ability to navigate retirement fund reviews effectively.

Examples of Using the Motor Industry Retirement Funds Reviews

Examples of how motor industry retirement funds reviews can assist in decision-making include:

- Selecting a Fund: An employee can compare two different retirement funds with performance records over the past decade, leading to an informed choice based on growth patterns.

- Evaluating Fees: Comparing the expense ratios of funds can help identify more cost-effective options, allowing more savings to remain invested.

- Assessing Member Satisfaction: By looking at reviews where members discuss their experiences with claim processes, an employee can gauge the reliability of a fund's administrative support.

These examples illustrate the practical application of reviews in selecting the most beneficial retirement funds.

IRS Guidelines Related to Retirement Funds Reviews

Understanding IRS guidelines is crucial when navigating motor industry retirement funds. The IRS provides regulations regarding contributions, withdrawal limits, and tax implications, including:

- Contribution Limits: Employees can contribute a specific percentage of salary or a dollar amount, depending on plan type and IRS annual limits.

- Withdrawal Regulations: Employees must be aware of the rules around accessing their retirement funds, including hardship withdrawals and penalties associated with early distributions.

- Tax Implications on Withdrawals: Retirees should remember that distributions from traditional retirement accounts are taxable, and knowing the implications can influence fund choice.

Adhering to IRS guidelines ensures compliance while optimizing the benefits of retirement funds.