Understanding the Indemnity Bond Format in Word

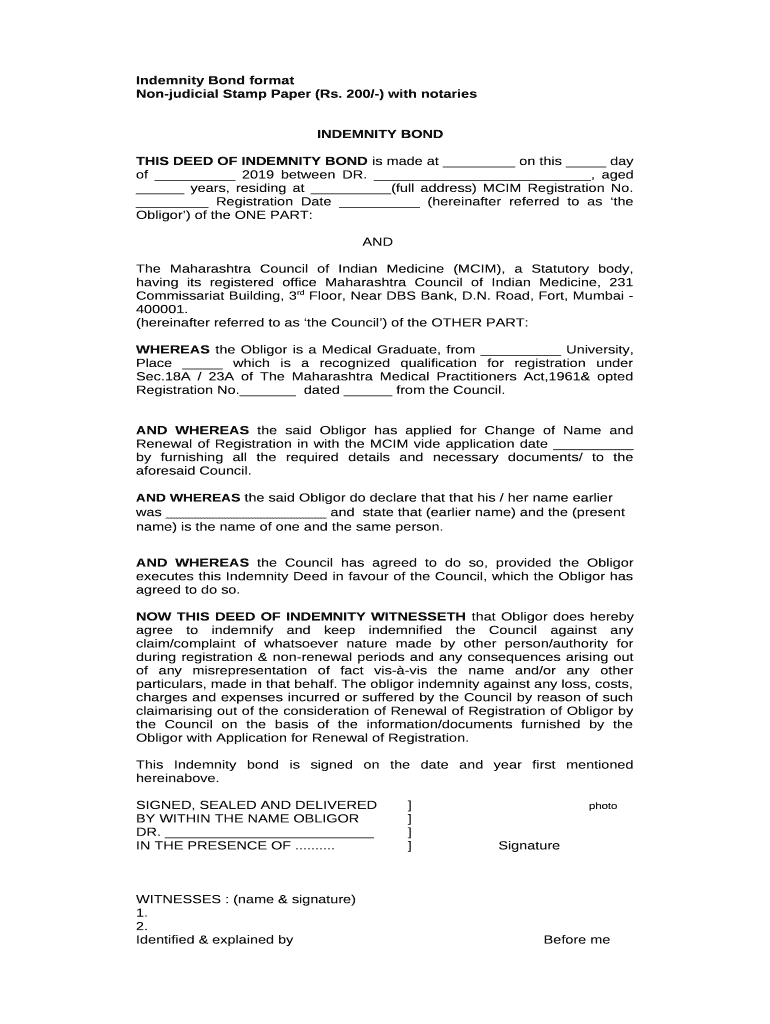

An indemnity bond is a legally binding agreement that provides a guarantee against financial loss or damages that may arise due to certain actions or transactions. The indemnity bond format in Word is a document template that allows individuals or organizations to create their own indemnity bonds. These bonds are often utilized in various situations such as securing contracts, ensuring compliance with laws, and protecting parties from legal liabilities.

The primary purpose of this document is to outline the obligations and responsibilities of the parties involved. By using a Word format, users can easily edit and customize the document to fit their specific needs, making it accessible and practical for many applications.

Key Elements of the Indemnity Bond Format in Word

The indemnity bond format typically includes the following key elements:

- Identifying Information: This includes the names and addresses of the Obligor (the person providing the indemnity) and the Obligee (the party protected by the indemnity).

- Recitals: A brief statement explaining the background of the bond and the circumstances leading to its requirement.

- Indemnity Clause: This central provision outlines the specific obligations of the Obligor, detailing what they are indemnifying against.

- Execution Details: The document will include spaces for signatures and dates from both parties, as well as any witnesses if required.

- Governing Law: Specification of the state law that will govern the terms of the bond.

How to Obtain the Indemnity Bond Format in Word

Obtaining an indemnity bond format in Word is straightforward. Various online legal resources and document creation websites offer free or paid templates. Here are some methods to obtain this format:

- Download from Online Platforms: Websites like DocHub provide a variety of document templates, including indemnity bonds that can be downloaded in Word format.

- Legal Advice Providers: Consulting legal service providers may yield specific templates tailored to individual requirements.

- Through Legal Software: Many legal and document creation software programs include templates for indemnity bonds that can be edited in Word.

Steps to Complete the Indemnity Bond Format in Word

Completing an indemnity bond in Word involves several key steps:

- Download the Template: Start by downloading an indemnity bond template compatible with Word.

- Fill in the Parties' Information: Input the names and addresses of both the Obligor and Obligee to identify the parties involved.

- Draft the Recitals: Clearly state the context of the bond to ensure all parties understand why the bond is being created.

- Define the Indemnity Obligations: Specify what the Obligor is covering under the bond, including types of losses or damages.

- Add Signatures and Dates: Ensure that all parties sign the document and date it appropriately to formalize the agreement.

Importance of Using the Correct Indemnity Bond Format

Using the proper indemnity bond format is crucial for ensuring that the document is legally enforceable. A meticulously formatted bond can help in various ways:

- Clarity of Terms: A well-structured document clearly lays out the responsibilities, which helps prevent legal disputes.

- Legal Protection: By following the appropriate format, parties ensure they are legally protected under state laws.

- Streamlined Processing: Courts and legal entities are familiar with standard formats, facilitating smoother processing if disputes arise.

Common Uses of the Indemnity Bond Format in Word

The indemnity bond format is used across multiple sectors and scenarios:

- Construction Contracts: To guarantee that contractors indemnify the project owner against specific risks.

- Loan Agreements: Often required when borrowers must assure lenders against potential default or loss.

- Business Transactions: Businesses frequently use indemnity bonds during mergers or acquisitions to cover potential future liabilities.

State-specific Rules for the Indemnity Bond Format in Word

In the United States, specific state laws may dictate the requirements or language used in indemnity bonds. It is important to be aware of these regulations, as they can affect:

- Required Content: Certain states may require explicit clauses to be included.

- Execution Formalities: Some states require notarization or additional witnesses, which must be reflected in the format.

- Limitations on Liability: Each state may have different rules regarding how far indemnities can extend, impacting the drafting process.

Real-World Examples of Indemnity Bond Use

Several practical scenarios illustrate the use of indemnity bonds:

- A medical graduate applying for name change and registration renewal may use an indemnity bond to protect against potential claims regarding misrepresentation.

- A construction firm takes on a project for a municipal government, requiring an indemnity bond to ensure that any claims arising from construction defects are covered.

- A student tenant may use an indemnity bond to protect a landlord from damages or unpaid rent during their lease term.

By utilizing the indemnity bond format in Word, users can effectively create a customized document that meets their specific needs while adhering to legal requirements.