Understanding a Property Co-ownership Agreement

A property co-ownership agreement is a legal document that outlines the rights and responsibilities of two or more individuals who share ownership of a property. This agreement is essential for clarifying ownership stakes, decision-making processes, and addressing potential disputes. It is particularly useful in joint ventures involving family members, friends, or business partners who collectively invest in real estate.

Key Components of a Property Co-ownership Agreement

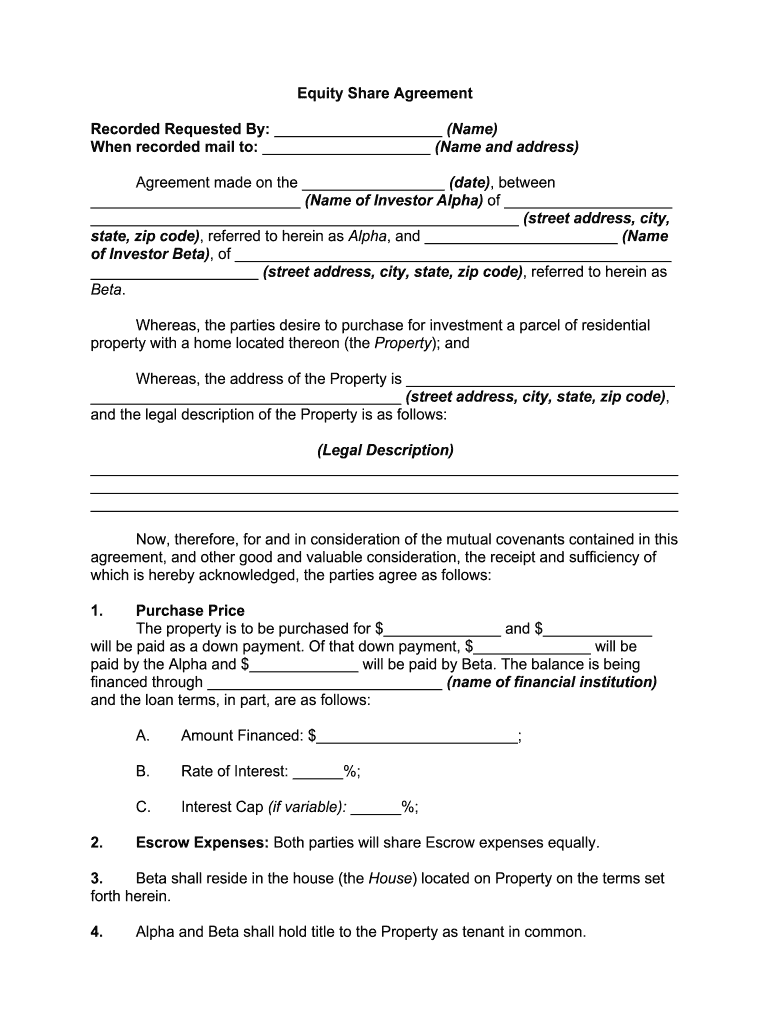

- Ownership Structure: Defines how ownership is shared among co-owners, typically specifying the percentage of ownership each party holds. This can be equal or based on investment contributions.

- Financial Contributions: Details the amounts each owner has contributed, including down payments, mortgage payments, property taxes, and maintenance costs. Clear documentation of these contributions is crucial for future financial discussions or disputes.

- Usage Rights: Establishes rules regarding the use of the property, specifying how often each owner can occupy the property or if it will be rented out. This ensures fair access and helps avoid conflicts over property usage.

Responsibilities in a Co-ownership Agreement

- Maintenance and Repairs: Outlines which co-owners are responsible for ongoing maintenance and necessary repairs, helping to prevent misunderstandings about property upkeep. Responsibilities can be divided based on ownership percentages or specific agreements.

- Decision-Making Process: Specifies how decisions regarding the property will be made, including finances, renovations, or selling the property. This may involve establishing a voting structure or requiring unanimous agreement on significant decisions.

- Dispute Resolution: Includes a method for resolving disagreements between owners. This could involve mediation, arbitration, or another agreed-upon process, thereby reducing tension and providing a pathway to resolve conflicts amicably.

Preparing the Property Co-ownership Agreement

- Consultation with Legal Professionals: Engaging a lawyer familiar with real estate law is advisable to ensure the agreement complies with local laws and adequately protects the interests of all parties involved. They can help tailor the agreement to specific circumstances, addressing potential legal pitfalls.

- Drafting the Agreement: The agreement should be carefully drafted, capturing all elements such as ownership percentages, rights, responsibilities, and dispute resolution strategies. Using templates can be a helpful starting point, but custom language is often necessary.

- Review and Agreement: All co-owners should carefully review the agreement to ensure it meets their needs and address any concerns. This collaboration fosters transparency and can help build trust among co-owners.

Legal Considerations for Co-ownership Agreements

- State Laws: Different states have varying laws regarding property ownership, including tenancy types like joint tenancy or tenancy in common. Familiarity with these laws is critical for ensuring the agreement is valid and enforceable.

- Tax Implications: Co-owners must be aware of tax responsibilities associated with property ownership, including income from rentals or capital gains from sales. It may be beneficial to consult a tax professional to understand potential tax consequences related to the property.

- Insurance Requirements: The agreement should mention how property insurance will be handled, including who is responsible for maintaining insurance coverage and how claims are processed. This protects co-owners from financial loss resulting from unforeseen incidents.

Sample Scenarios Illustrating Co-ownership Agreements

- Family Members Purchasing a Vacation Home: A family acquires a vacation property to enjoy during holidays. The agreement clarifies usage dates, maintenance duties, and how expenses will be split among family members, preventing conflicts over scheduling.

- Business Partners Investing in Rental Property: Two investors decide to buy a rental property. Their agreement outlines financial contributions, tenant management responsibilities, and profit-sharing arrangements, creating a clear path for their business venture.

- Friends Sharing a Home: A group of friends buys a house together for shared living. Their co-ownership agreement lays out each person's responsibilities for bills, chores, and the process for selling the house if one friend wants to leave.

Crafting a comprehensive property co-ownership agreement is essential for protecting the interests of all parties involved. By clearly defining roles, responsibilities, and decision-making processes, co-owners can foster a collaborative environment and reduce the likelihood of disputes as they navigate the complexities of shared property ownership.