Get your form

Make edits and annotations

Sign or request signatures from others

Share your form via email, fax, or download it

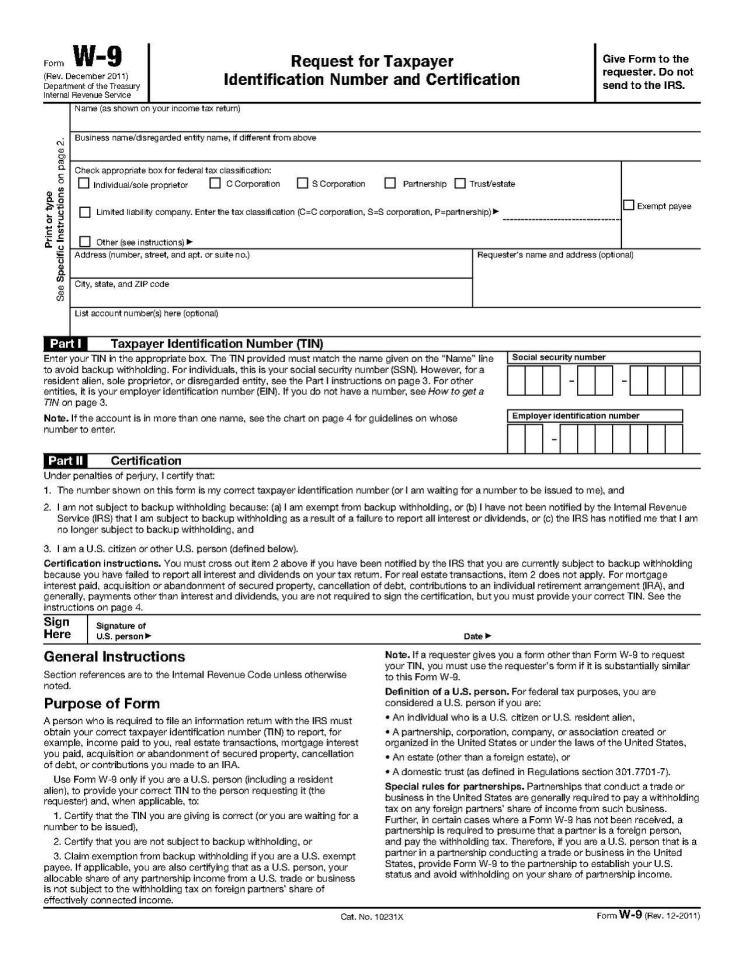

Here is a brief guide on how to complete your W-9 form:

Remember that the W-9 form is used for informational purposes only and is not sent to the IRS. Your client or business will use the information from the form to complete their 1099-MISC form, which will be filed with the IRS.

Please consult with a tax advisor or professional if you need more assistance or have more specific questions.

Line 1: Enter your full name as shown on your income tax return. If you are completing this form for a business entity, make sure to use the name of the business.

Line 2: If you have a business name, trade name, DBA name, or disregarded entity name, you can enter it here. If not, you can leave it blank.

Line 3: Check the appropriate box for your U.S. tax classification. This may be individual/sole proprietor, C Corporation, S Corporation, Partnership, Trust/estate, Limited liability company, or other. If you chose Limited liability company, you need to enter the tax classification (C=C corporation, S=S corporation, P=Partnership).

Line 4: If you are exempt from backup withholding taxes, indicate this in the exemption field.

Line 5: Enter your address (number, street, and apt. or suite no.). This should be your current address.

Line 6: Enter your city, state, and ZIP code.

Enter your Social Security Number (SSN). If you are providing the form for a business entity, enter the Employer Identification Number (EIN).

If applicable, check the box. This applies to you if you are subject to backup withholding because you have failed to report all interest and dividends on your tax return.

Sign and date the form. By doing so, you're certifying that the information is correct.

Remember to keep your W-9 updated. You should re-submit a new form if your name, business name, or TIN changes.

Also note that the W-9 form is not sent to the IRS. Instead, it is used by the person who requested it from you to complete certain tax forms they are required to file.