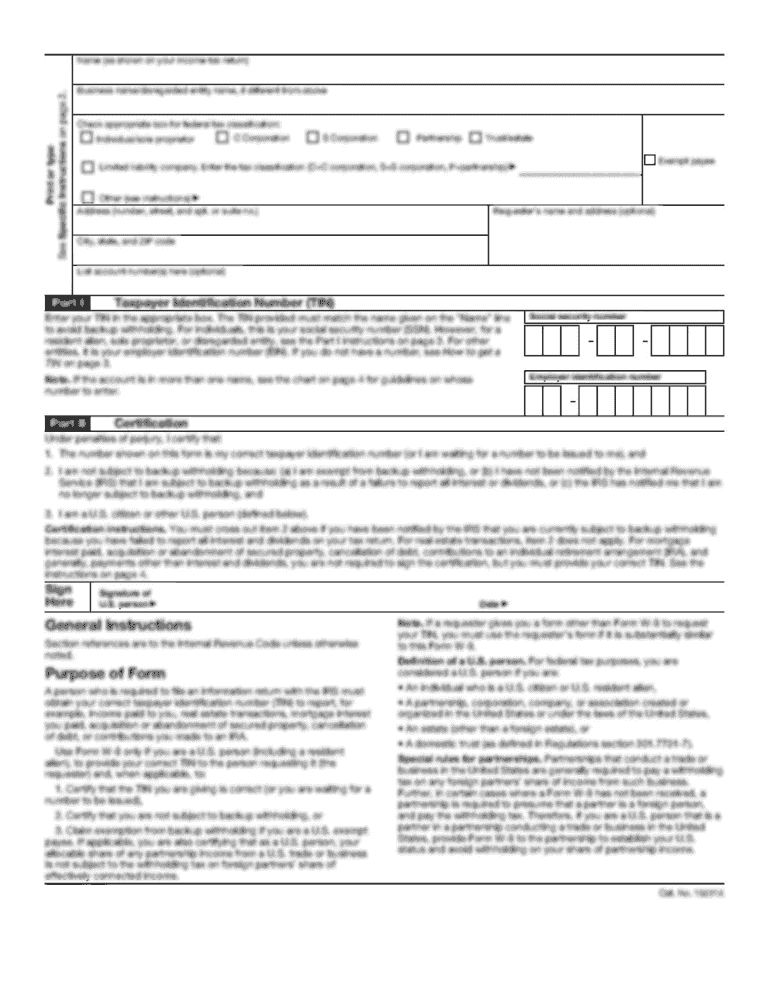

Definition and Meaning of the 1996 Form 709

Form 709, officially known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is used by taxpayers to report gifts subject to federal gift tax and certain generation-skipping transfers. The 1996 iteration of this form is specific to that fiscal year and includes the relevant instructions and tax codes applicable during that period. It helps establish the value of the transferred gifts and calculates the necessary taxes owed. Gift tax returns, although primarily for gifts exceeding the annual exclusion limit, also consider gifts made to trusts and donations to individuals beyond immediate family members.

How to Use the 1996 Form 709

Using the 1996 Form 709 involves completing various sections to accurately report gifts that exceed the annual exclusion limit. Taxpayers must report all gifts made throughout the year, calculate the total amount over the exclusion, and determine any tax liability. The form provides space to detail each gift’s description, the recipient’s relationship, and its value at the time of transfer. Proper record-keeping and thorough understanding of each section are vital for correctly completing the form. Ensuring accuracy can prevent discrepancies and potential penalties from the IRS.

How to Obtain the 1996 Form 709

The 1996 Form 709 can typically be accessed through IRS archives or third-party services that provide historical tax forms. While newer versions of Form 709 are readily available through the IRS website, archived forms may require a request for documentation or can often be found through accounting firms and online document management services like DocHub. These services offer tools not only for obtaining the form but also for filling, signing, and submitting it electronically.

Steps to Complete the 1996 Form 709

-

Gather Necessary Information: Collect details about all gifts given in 1996, including the recipient's information, gift descriptions, and valuations.

-

Fill Out Personal Information: Start with the taxpayer's personal information, including name, address, and social security number.

-

Record Gifts and Transfers: Enter each gift on the appropriate schedule within the form. Include specifics like fair market value, relationship to the recipient, and any gift-splitting agreement details.

-

Calculate Taxable Gifts: Adjust for exclusions and deductions to find the total taxable gift amount.

-

Determine Applicable Taxes: Use the provided tax tables to calculate any taxes owed on the gifts exceeding the annual exclusion limit.

-

Re-examine for Accuracy: Review all sections for completeness and accuracy, verifying the calculations and ensuring all necessary information is included.

Who Typically Uses the 1996 Form 709

The 1996 Form 709 is primarily used by individuals who have made significant gifts exceeding the annual exclusion, which mandates gift tax reporting. Estate planning professionals, tax preparers, and individual taxpayers involved in family-owned business succession, or gifting of investment properties, are common users. Married couples often utilize gift splitting to minimize potential tax liability, making this form valuable for strategic gift planning, particularly for high-net-worth individuals engaging in substantial gift-giving or generation-skipping transfers.

Key Elements of the 1996 Form 709

- Personal Information Section: Includes taxpayer details such as name and Social Security number.

- Gift List Section: Documents all gifts given over the year, each with their respective details and valuations.

- Gift Splitting: Option for married couples to divide gifts between spouses for tax purposes, effectively doubling the exclusion limit.

- Schedule A: Used to report the total value of taxable gifts.

- Generation-Skipping Transfer: Section for reporting transfers liable to additional generation-skipping transfer taxes.

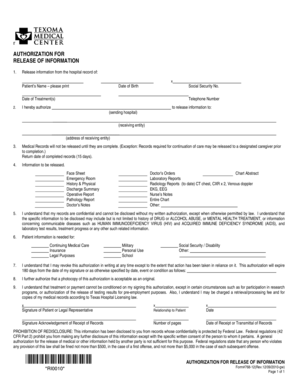

IRS Guidelines on the 1996 Form 709

The IRS guidelines for the 1996 Form 709 provide the framework within which taxpayers must operate. This includes rules around the valuation of assets gifted, determining tax liability, and the procedural nuances of gift splitting. Guidelines emphasize the importance of meeting deadlines to avoid penalties and ensure compliance with federal tax laws. The IRS also outlines procedures for calculating and reporting tax on generation-skipping transfers, as these transactions incur additional scrutiny and potential tax obligations.

Filing Deadlines and Important Dates

For the 1996 tax year, the Form 709 filing deadline was April 15, 1997. A request for an extension could provide additional time to prepare the form, typically pushing the deadline to October 15 of the same year. It's imperative for taxpayers to file by the original deadline or properly request an extension to prevent late fees or additional interest. Staying aware of these critical dates ensures compliance and avoids the complications that come with late filings.

Required Documents for Completing Form 709

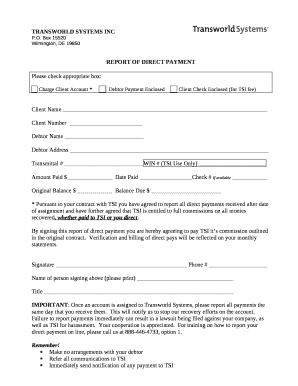

Accurate completion of the 1996 Form 709 necessitates various supporting documents:

- Appraisals for Valuation: Professional appraisals for gifts that are not cash, especially valuable items like real estate or art.

- Receipts or Transaction Records: Detailed records for each gift, including transfer dates and descriptions.

- Legal Documents: Any relevant trust agreements or contracts related to the gifts or transfers.

- Gift Splitting Consent Form: If applicable, IRS Form 709-A for splitting gifts between spouses.

Penalties for Non-Compliance

Failure to file the 1996 Form 709 can result in penalties, including a percentage of the tax owed or a flat fee if no tax is due. Ensuring punctual filing avoids additional late fees or interest. Filing a complete and accurate form protects taxpayers from other legal actions by the IRS, which may include imposing additional fines or conducting a more extensive audit on the taxpayer's financial history.

Digital vs. Paper Version of the 1996 Form 709

While the 1996 Form 709 was primarily distributed in paper form, the digitization of tax processes now allows for completion and submission digitally. Platforms like DocHub facilitate the online filling, editing, and submission of historical forms, mirroring the convenience found in the handling of contemporary tax forms. This transition from paper to digital formats offers advantages such as streamlined organization, reduced mailing times, and easier storage and retrieval of records.