Definition & Meaning of the Application for Filing Extension

The application for filing extension is a formal request filed by taxpayers to the Internal Revenue Service (IRS) or relevant state tax authorities, allowing them additional time to submit their tax returns. This process is particularly valuable for individuals who may need more time to gather necessary documents, prepare their return, or meet various filing requirements. When granted, the extension typically provides an additional six months, shifting the original deadline to a later date.

This application does not excuse the taxpayer from paying any taxes owed; it simply extends the time to file. Consequently, it's important to estimate and pay any tax liabilities by the original due date to avoid incurring penalties and interest. Extensions can apply to both individual tax returns and corporate filings, making it a critical tool for timely filing compliance.

How to Use the Application for Filing Extension

Using the application for filing extension involves several straightforward steps. First, taxpayers need to determine whether they qualify for an extension and gather any necessary information regarding their tax situation, including past returns and income details.

-

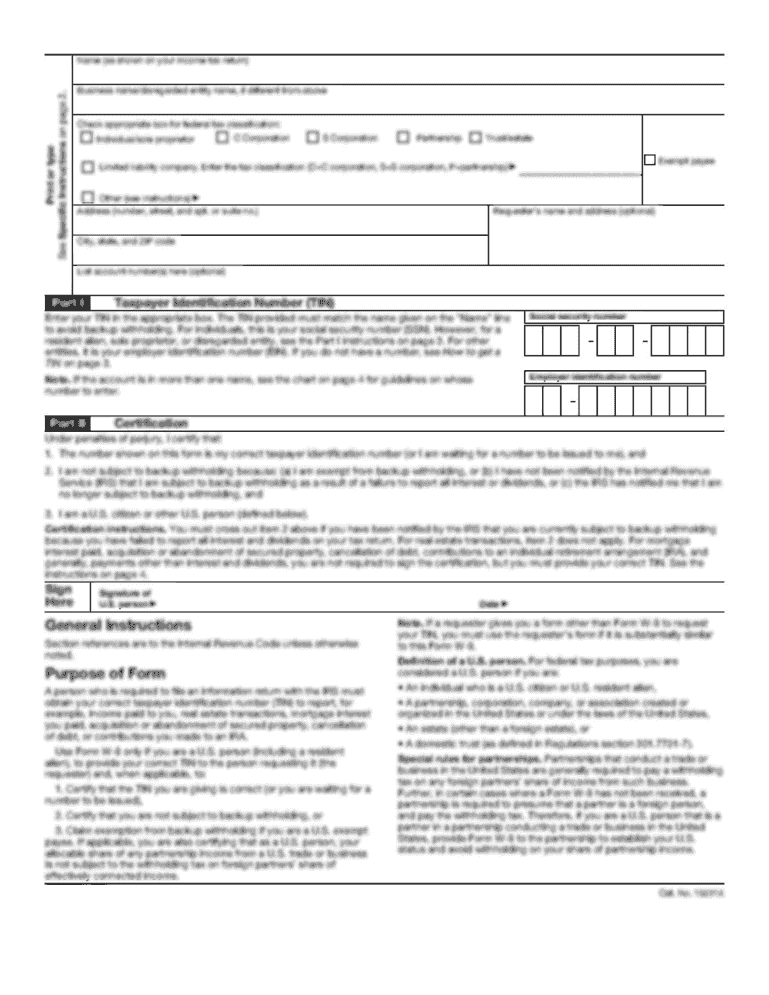

Obtain the Application: Access the particular form required for the extension. For individual taxpayers, this is typically IRS Form 4868, while businesses may use Form 7004.

-

Fill Out the Form: Complete the form with accurate personal information, including the taxpayer’s name, address, Social Security number, and estimated tax liabilities.

-

Submit the Application: File the completed application, ensuring it arrives before the original tax deadline. This can be done electronically or through traditional mail, depending on the form and specific state regulations.

-

Payment of Estimated Taxes: If applicable, it is crucial to calculate and pay any anticipated tax beforehand, as extensions do not defer payment deadlines.

-

Confirmation of Extension: After submission, taxpayers should receive confirmation from the IRS or state agency indicating that their extension request has been processed.

Steps to Complete the Application for Filing Extension

Completing the application for filing extension involves a few essential steps to ensure compliance and accuracy:

-

Choose the Correct Form:

- For individual taxpayers: Use Form 4868.

- For businesses: Use Form 7004.

-

Fill in Personal Information:

- Include your name, address, and Social Security number or Employer Identification Number (EIN).

-

Estimate Tax Obligation:

- Provide an estimate of the total tax owed for the year. Use previous year’s income figures, if necessary.

-

Payment Information:

- Indicate any payment being submitted with the form. This is crucial to avoid penalties.

-

Review and Submit:

- Double-check all entries for accuracy. Submit the form electronically via approved e-filing systems or mail it to the appropriate address.

-

Keep Records:

- Retain a copy of the submitted application for personal records along with proof of any payments made.

Important Terms Related to the Application for Filing Extension

Familiarity with key terms related to the application for filing extension can facilitate a better understanding of the process:

-

Estimated Tax: The predicted amount of tax owed after thorough calculations, typically based on previous income reports.

-

Filing Deadline: The date by which a tax return must be submitted to avoid penalties, typically falling on April 15 for individual taxpayers.

-

Extension Period: The additional six months granted for submitting an application, pushing the deadline to October 15 for individuals.

-

Penalty for Non-Compliance: The fines incurred for failing to file on time or for not paying taxes owed by due dates.

-

Form Variants: Different forms may apply based on individual situations, such as previous year forms or state-specific extensions.

Filing Deadlines / Important Dates

Timely filing is crucial in ensuring compliance and avoiding penalties. Here are some important dates for the application for filing extension:

-

Original Tax Filing Deadline: April 15 of each tax year for individual returns; for businesses, deadlines may vary.

-

Deadline to File Extended Application: Applications must be postmarked or submitted electronically by the original deadline.

-

Extended Filing Deadline: For individuals and many businesses, the new deadline will be October 15 after an extension is granted.

-

Estimated Tax Payment Deadline: Taxpayers should make any required estimated payments by the original deadline to avoid late fees.

Understanding these critical dates is essential for adherence to tax requirements and successful management of tax responsibilities.