Definition and Purpose of the 2017 Schedule S (540)

The 2017 Schedule S (540) - Other State Tax Credit Instructions is a tax form used by California residents to claim a credit for taxes paid to other states. This credit helps mitigate the issue of double taxation on the same income. Taxpayers who earn income in multiple states can utilize this form to report and calculate the eligible credit, ensuring they do not pay taxes twice on the same earnings.

Eligibility Criteria for Claiming the Credit

To qualify for the Other State Tax Credit, taxpayers must meet specific requirements:

- Be a full-year California resident.

- Have paid taxes on income that is also taxed by another state.

- The income must be included in the taxpayer's California return.

For example, a California resident who works part-time in Nevada and pays taxes there would be eligible to claim this credit to offset against their California tax liability. It's important to note that the credit is only available against California taxes related to the income taxed by another state.

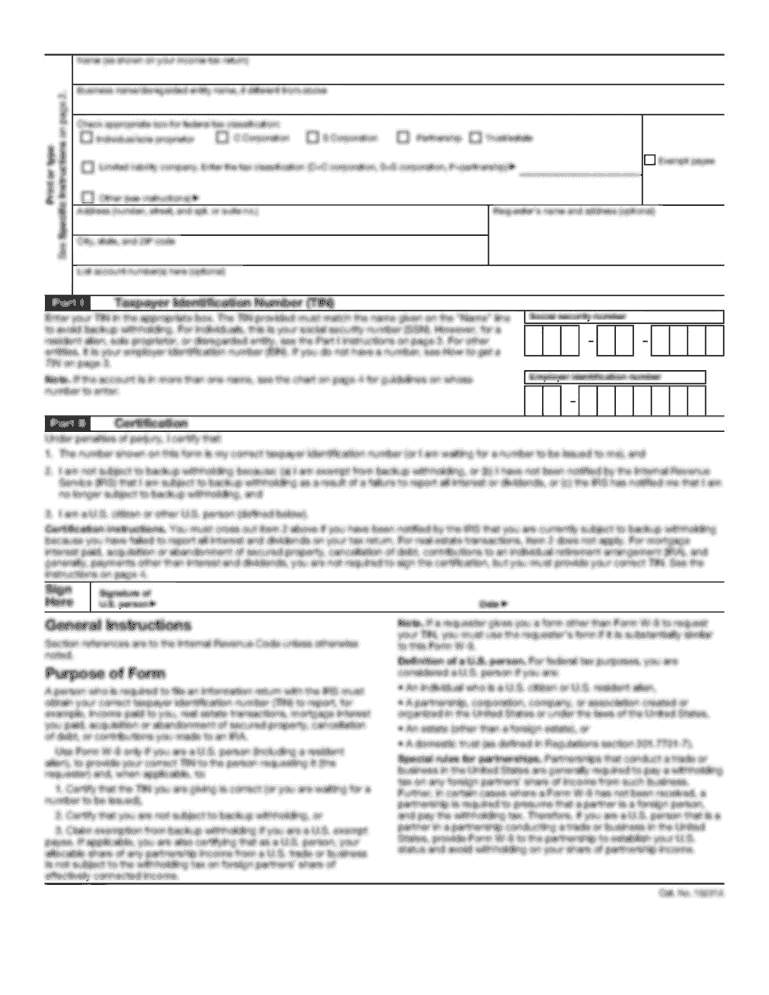

Key Elements of the 2017 Schedule S (540)

This form comprises several important sections:

- Part I: This section requires detailed information about the taxpayer's income from other states, including the nature of the income and the taxes paid.

- Part II: Here, taxpayers calculate the credit amount by reconciling taxes paid to other states against California taxes.

- Part III: Finally, this section provides space for additional information or adjustments related to the tax credit claim.

These sections ensure a comprehensive review and proper calculation of the eligible credit, accounting for all nuances and intricacies involved in inter-state income taxation.

How to Complete the 2017 Schedule S (540)

Filing the 2017 Schedule S involves precise steps:

- Gather Necessary Information: Collect W-2s, 1099s, and tax statements from other states.

- Calculate Tax paid to Other States: This involves determining the exact amount paid in taxes to another state for the same income.

- Fill Out Parts I and II: Input your details, income information, and calculate the credit using the instructions provided.

- Double-Check Entries: Verification of numbers and computations is crucial to avoid discrepancies.

- Submit with California Tax Return: Attach the completed form to your California state tax return (Form 540).

Important Terms Associated with the Form

Understanding the following terms is essential for accuracy:

- Double Taxation: Refers to being taxed by multiple jurisdictions on the same income.

- Tax Credit: A dollar amount that taxpayers can subtract from taxes owed to the state.

- Taxable Income: The portion of income subject to taxation under law.

These terms form the heart of understanding how the Schedule S operates and its impact on taxpayers' financial responsibilities.

State-Specific Rules for the Credit

Though the form is standardized, variations exist depending on specific state policies:

- Different Tax Limits: Some states have reciprocal agreements with California, impacting the amount of credit.

- Income Category Differences: The nature of income (e.g., employment versus royalty income) might affect eligibility and credit computation.

For instance, income earned from rentals in another state might be treated differently than employment income when calculating the credit.

Penalties for Non-Compliance

Failing to file the Schedule S correctly or omitting it may lead to:

- Inaccurate Tax Liabilities: Could result in paying more taxes than necessary or penalties subject to interest.

- Fines and Charges: The state may impose additional charges for filing errors or late submissions.

Ensuring compliance avoids these negative repercussions and ensures all relevant credits are appropriately applied.

Taxpayer Scenarios: Practical Applications

Taxpayers in diverse situations may use this form. Examples include:

- Self-employed Individuals: Who have clients in multiple states.

- Retirees: With pension income sourced from different states.

- Students: With internships or part-time work taxed by other states.

These scenarios illustrate how taxpayers from various walks of life can benefit from this credit when meeting the eligibility requirements.

IRS Guidelines on Double Taxation

While Schedule S pertains to state taxes, federal guidelines can provide insight into handling double taxation:

- Federal tax treaties with states.

- IRS publications on income sourced to other states.

- Recognition of state credits on federal returns.

These guidelines help taxpayers align state and federal filings, avoiding conflicting tax liabilities.

Software Compatibility and Digital Filing

Advancements in technology facilitate ease of filing:

- Software Tools: Platforms like TurboTax and QuickBooks integrate Schedule S processing into their suites.

- E-filing Benefits: Offers speed, accuracy, and immediate confirmation upon submission.

Leveraging these technological resources ensures a streamlined filing process, minimizing case-specific errors.