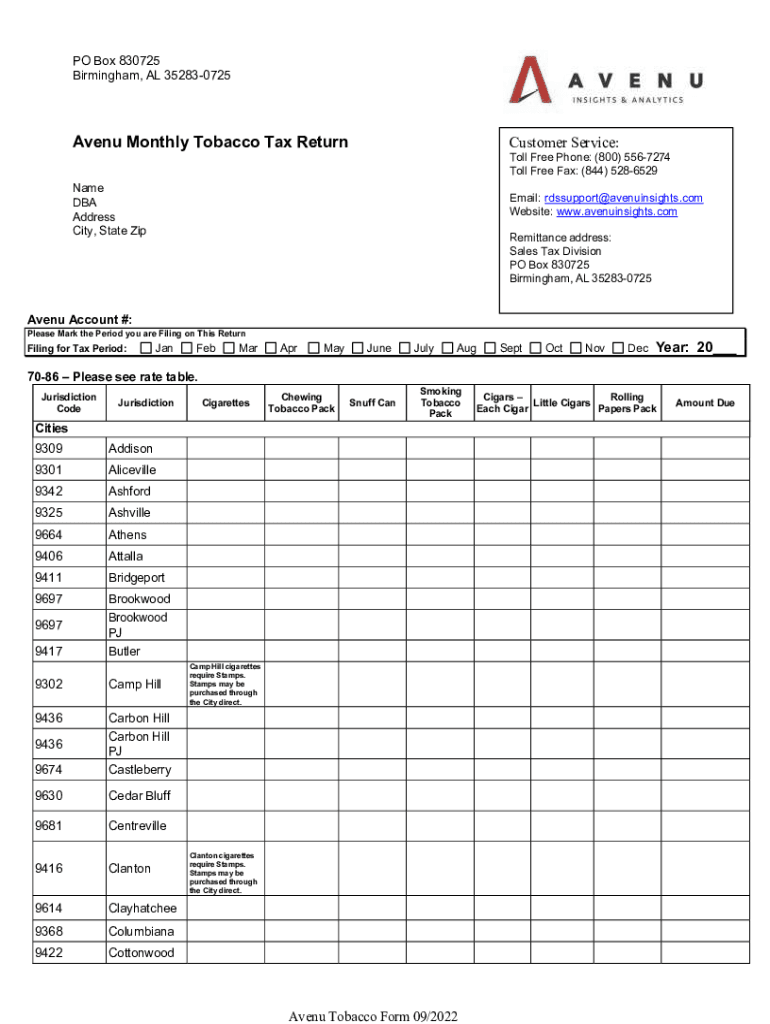

Understanding the Avenu Monthly Gasoline/Motor Fuels Tax Return

The Avenu Monthly Gasoline/Motor Fuels Tax Return serves as an essential tool for taxpayers involved in the petroleum industry in the United States. This document is pivotal for reporting gasoline and motor fuel sales, ensuring that the appropriate taxes are calculated and remitted to the relevant authorities. It includes sections for reporting product details, sales figures, and tax computations, which are vital for maintaining compliance with state and federal regulations.

Key Elements of the Form

- Business Information: This section captures the taxpayer’s identification, including name, address, and taxpayer identification number, ensuring accurate tracking and processing by tax authorities.

- Sales Data: Requires detailed accounting of gasoline and motor fuels sold, including quantities and types of products, which aids in accurate tax assessment.

- Tax Calculation: Involves determining the applicable tax based on sales data. Accurate computation is crucial to avoid underpayment or overpayment issues.

How to Use the Avenu Monthly Gasoline/Motor Fuels Tax Return

Using the form effectively involves a few structured steps:

- Gather Necessary Information: Start with collecting all relevant data related to sales, including invoices and receipts that detail fuel transactions.

- Complete Business Details: Fill in business identification information accurately.

- Record Sales and Compute Tax: Input sales data in the stipulated sections and use the form’s guidelines to calculate taxes.

- Verify and Submit: Double-check all entries for accuracy and submit the form through the appropriate channels as per state requirements.

Obtaining the Avenu Monthly Gasoline/Motor Fuels Tax Return

The form can be procured from several sources:

- Official Websites: It is often downloadable from state Department of Revenue websites, ensuring you have the most recent version.

- Tax Filing Software: Many platforms, like TurboTax and QuickBooks, might integrate with departmental sites to allow direct access to such forms.

- Mail Request: In some cases, taxpayers can request a form be mailed to their business address.

Steps to Complete the Avenu Monthly Gasoline/Motor Fuels Tax Return

Completing the form involves a series of methodical actions:

- Review the Instructions: Each form includes instructions crucial for understanding the requirements and nuances of inputting data.

- Fill in Each Section Carefully: Start with identifying information and proceed sequentially through sales data and tax calculations.

- Double-Check for Compliance: Ensure all reported figures align with your business records and state tax laws.

- Retain Copies for Your Records: Once completed and submitted, keep copies for future reference and potential audits.

State-Specific Rules and Regulations

Different states may have varied rules governing the usage and submission of this form:

- Tax Rates: State tax rates can differ dramatically, affecting the overall tax liability.

- Submission Deadlines: While deadlines commonly exist at the end of each month, some states might have specific due dates.

- Additional Documentation: Certain states may demand supplementary documentation for verification purposes.

Important Terms Related to the Tax Return Form

Understanding specific terminology is crucial:

- Exemption: Certain sales might be exempt from taxation under specific conditions.

- Remittance: Refers to the payment of taxes due, which must be timely and correct.

- Jurisdiction: The legal authority under which the tax is imposed, usually state-specific for motor fuels.

Penalties for Non-Compliance

Failing to submit the form or providing incorrect data can lead to various penalties:

- Fines: Monetary fines for late submission or inaccurate reporting.

- Interest on Unpaid Taxes: Accrued interest on taxes not paid by the due date.

- Legal Repercussions: Persistent non-compliance can lead to legal action against the taxpayer.

Form Submission Methods

Taxpayers have multiple options for submitting the completed form:

- Online Submission: Many states offer digital filing to streamline the process and ensure prompt receipt.

- Mail: Physical submission through certified mail can provide a tangible record of filing.

- In-Person: Direct submission at a designated tax office if state protocol allows or requires it.

Business Types That Benefit Most

The form is primarily used by:

- Gasoline Retailers: Businesses that sell gasoline directly to consumers.

- Fuel Distributors: Companies involved in the distribution of fuel to various end-users.

- Logistics Companies: Entities operating extensive fleets which interact with fuel sales and need to account for taxes accordingly.