Definition & Meaning

The AFFIDAVIT REGARDING LIMITED PARTNERSHIP, LIMITED LIABILITY form, tax.idaho.govformsEFO0018401/05/2006, serves as a sworn statement pertinent to limited partnerships and limited liability entities in Idaho. This affidavit is designed to officially attest to specific details or facts concerning the legal structure, ownership, or changes within such entities. Typically, it could validate amendments in partnership agreements, confirm dissolution events, or address financial disclosures tied to tax obligations.

How to Obtain the Form

Acquiring the AFFIDAVIT REGARDING LIMITED PARTNERSHIP, LIMITED LIABILITY can be done through several straightforward avenues:

- Online Access: Visit Idaho’s official tax or business regulation website. Many public documents are accessible as downloadable PDFs.

- Physical Copy: Request a hard copy from the Idaho State Tax Commission or a similar regulatory office.

- Business Legal Advisors: Firms specializing in business law can often provide and help complete the necessary documentation.

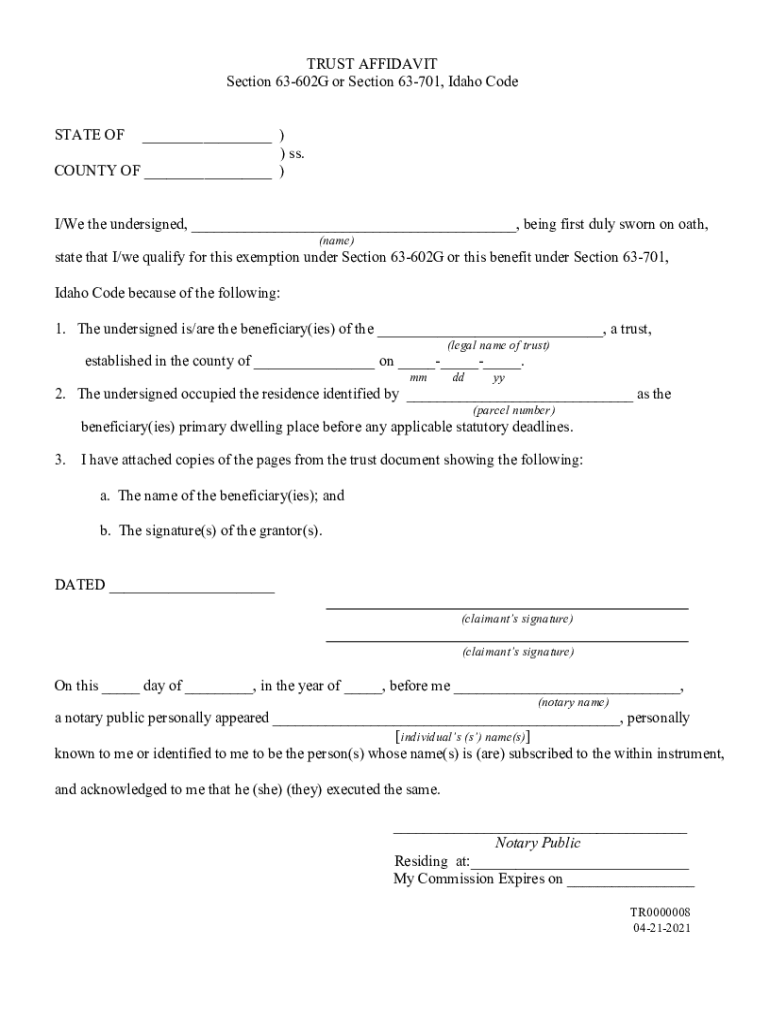

Steps to Complete the Form

When filling out the tax.idaho.govformsEFO0018401/05/2006 form, follow these structured steps to ensure accuracy:

- Identify the Entity: Clearly state the legal name and the type of business entity (e.g., LLC, Limited Partnership).

- Provide the Affidavit’s Purpose: Detail the specific fact or event the affidavit intends to address.

- Fill in Required Sections: Ensure all requested information, like dates of formation or relevant changes, is complete.

- Notarization: The affidavit requires a notary’s stamp for validity. Arrange for this step after the document is filled out.

- Review: Double-check details to prevent inaccuracies that could invalidate the affidavit.

Key Elements of the Form

Important elements of the AFFIDAVIT REGARDING LIMITED PARTNERSHIP, LIMITED LIABILITY form often include:

- Entity Name & Identification: Clearly stated at the outset to ensure identification.

- Purpose Statement: A succinct declaration of the affidavit’s intent.

- Authorized Representatives: Names and signatures of those validating the information.

- Date of Execution: The date when the affidavit is formally completed and signed.

- Notarization: This legal certification confirms the identity of signatories.

Legal Use of the Form

The primary legal function of the tax.idaho.govformsEFO0018401/05/2006 affidavit is to document formal business declarations under oath. Possible uses include:

- Confirmation of Ownership: To substantiate claims related to company stakes or shares.

- Amendment Validation: Documenting agreed changes in partnership agreements.

- Tax Documentation: Providing necessary proofs for state tax filings.

State-Specific Rules

Idaho imposes particular requirements when using the AFFIDAVIT REGARDING LIMITED PARTNERSHIP, LIMITED LIABILITY:

- Notarization: Mandatory for the recognition of affidavits.

- Record Keeping: Must be kept on file with the relevant business documentation.

- Compliance: Ensure conformity with statewide business laws affecting such entities.

Examples of Using the Form

Here are instances where the affidavit might be utilized:

- A Business Restructuring: Partners amend roles or stakes following strategic adjustments.

- Legal Compliance: An LLC provides the document to meet state filing deadlines.

- Dissolution: The affidavit helps formalize and certify the entity’s closure.

Required Documents

To complete the tax.idaho.govformsEFO0018401/05/2006 affidavit accurately, these documents can be vital:

- Business Registration Papers: Verify initial setup details.

- Partnership Agreement: If applicable, to reflect the original terms.

- Amendment Proposals: Documented changes agreed upon by partners.

- Tax Returns: Ensure tax alignment in the affidavit if necessary.

Who Typically Uses the Form

This affidavit is commonly utilized by:

- Business Owners: Especially those in partnerships or LLCs.

- Tax Professionals: Assisting clients in adhering to state requirements.

- Legal Practitioners: Facilitating legal documentation for compliance or restructuring needs.

Business Entity Types

Entities that commonly benefit from this form include:

- Limited Liability Companies (LLC)

- Limited Partnerships

- S Corporations: When partnership elements are involved.

- Trusts and Estates: Business-related.

Penalties for Non-Compliance

Failure to file or inaccurately complete the affidavit can result in:

- Legal Fines: State-imposed penalties for non-compliance.

- Operational Delays: Incomplete documentation might hinder business processes like loan applications.

- Invalidation of Changes: Non-recognition of intended partnership or business structure adjustments.

Digital vs. Paper Version

While both digital and paper versions are available:

- Digital Form: Offers ease of access, editing, and electronic storage.

- Paper Form: Necessary if original signatures are required, limiting digital editing possibilities.

Software Compatibility

For digital handling of the AFFIDAVIT REGARDING LIMITED PARTNERSHIP, LIMITED LIABILITY, the following software is commonly used:

- Adobe Acrobat: For PDF management.

- DocHub: For online editing and signing.

- Google Workspace: If interfacing with cloud services.

By understanding and applying these elements, users can effectively navigate the requirements and procedures associated with the tax.idaho.govformsEFO0018401/05/2006AFFIDAVIT REGARDING LIMITED PARTNERSHIP, LIMITED LIABILITY form in Idaho.