Comprehensive Understanding of New Employee Forms Printable

New employee forms printable are essential documents used to collect information from new hires in an organized manner. These forms facilitate a smooth onboarding process by ensuring that employers gather all necessary data for payroll, benefits, and compliance. Below, we explore the detailed elements that encompass these forms, ensuring a thorough understanding of their purpose and utility.

Key Components of New Employee Forms

New employee forms generally include several crucial sections that capture necessary information. Each section ensures that the employer can effectively manage the employee's data and compliance responsibilities.

-

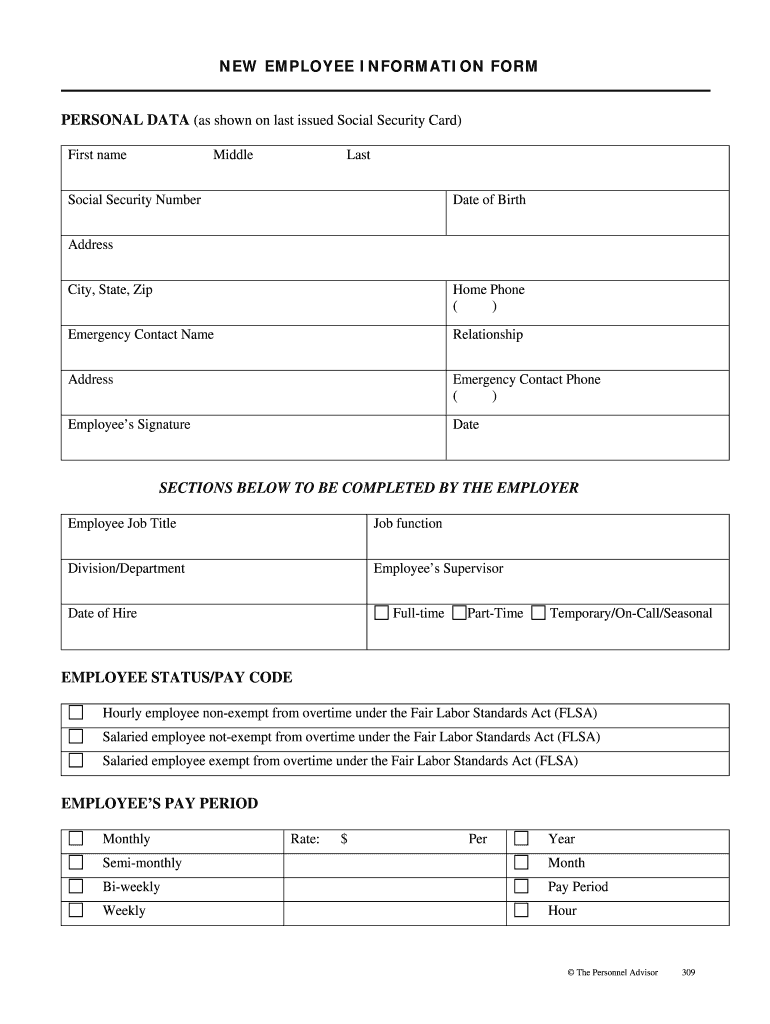

Personal Information: This section typically requires the employee's full name, Social Security number, address, contact information, and date of birth. Accurate completion of this section is important for tax reporting and to avoid issues with identification during payroll processing.

-

Employment Details: Employers include sections for job title, department, supervisor, hire date, and employment status (full-time, part-time, or temporary). This information is vital for tracking employee performance and benefits eligibility.

-

Payroll Information: Employees often must provide their preferred pay method and bank account details for direct deposit. The pay code under the Fair Labor Standards Act (FLSA) should also be indicated to determine the employee's pay classification.

-

Emergency Contact Information: This enables employers to reach someone in situations affecting the employee, such as accidents or health emergencies. Including multiple emergency contacts is often encouraged.

Types of Employee Forms and Their Uses

Employers typically utilize various forms during the onboarding phase. Each form serves a unique purpose while ensuring compliance with federal and state regulations.

-

W-4 Form: New employees must complete the W-4 to indicate their tax withholding preferences. This form is essential for the employer to determine the correct amount of federal income tax to withhold.

-

I-9 Form: The I-9 verifies an employee's eligibility to work in the United States. It requires documentation proving identity and work authorization, which is necessary to comply with immigration laws.

-

Direct Deposit Authorization: This form allows employees to authorize their employer to deposit their wages directly into their bank accounts, which simplifies the payroll process and helps employees receive their payments promptly.

-

Employee Handbook Acknowledgment: New hires should sign a document acknowledging receipt and understanding of the company policies outlined in the employee handbook. This is crucial for setting clear expectations and standard practices.

Filing New Employee Forms Effectively

To ensure that the onboarding process is effective, it is essential to adhere to a systematic approach when managing new employee forms.

-

Collect All Forms: Ensure that each new employee completes all required forms, including personal, employment, tax, and any necessary legal documents.

-

Review for Completeness: After collection, review each form to confirm that all fields are filled out correctly, signifying no missing information or errors.

-

Store Securely: Maintain all completed forms in a secure environment, whether electronically or in physical form, to ensure confidentiality and compliance with data protection laws.

-

Update Employee Records: Enter the information from the forms into your HR management system to keep accurate records and facilitate payroll processing and benefits administration.

Compliance and Regulatory Considerations

Employers must understand their responsibilities regarding new employee forms to maintain legal compliance and avoid penalties.

-

Timeliness: The IRS and Department of Homeland Security require that certain forms, like the W-4 and I-9, are completed within specific timelines after the employee's start date.

-

Confidentiality: It is essential to handle new employee information with care, following regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the Fair Credit Reporting Act (FCRA) when applicable.

-

Updates and Changes: Employers should have a procedure for employees to update their information when significant changes occur, such as a change in marital status or bank account details.

Benefits of Using Printable New Employee Forms

Utilizing printable new hire paperwork is efficient and practical for both employers and employees.

-

Accessibility: Printable forms can be easily customized to meet specific company needs while ensuring compliance with legal requirements.

-

Cost-Effective: By using free printable new employee forms, employers can significantly reduce costs associated with form creation and management.

-

Ease of Use: Printable formats allow for quick completion and submission, enhancing the onboarding experience for new hires.

-

Flexibility: Organizations can adapt their forms as needed in response to changing regulations or internal policies without significant hurdles.

By outlining these critical components, procedures, and considerations, businesses can ensure they are well-prepared to manage new employee paperwork effectively while fostering a welcoming environment for new hires.