Definition and Meaning of Payable Checks

When you encounter the phrase "please make your check payable to," it refers to the specific entity or individual to whom a check is to be issued. This designation is crucial because it dictates who has the legal authority to deposit or cash the check. Understanding how to correctly fill out this line is vital for ensuring that payments are processed smoothly.

Importance of Proper Check Payability

- Legal Implications: A check made payable to the wrong person or entity could be deemed invalid. It is important to ensure that the name exactly matches the recipient's legal name or the official name of the organization.

- Financial Transactions: Properly indicating who a check is payable to helps prevent disputes and ensures that the payment reaches the intended party.

Variations in Payable Instructions

- Individuals vs. Organizations: The check could be made payable to an individual, such as "John Doe," or a formal entity, such as "ABC Corporation." Each requires a precise approach.

- Titles and Qualifications: Sometimes, checks should include titles for clarity, such as "Mitchell College" if the check is for tuition or donations.

How to Make Your Check Payable Correctly

To ensure a check is processed without issue, there are critical steps to follow when writing one. Missteps can delay payment or cause complications that are easily avoidable.

Steps to Fill Out a Check

- Date Field: Start by writing the current date.

- Payee Line: Write “Please make your check payable to” followed by the exact name of the individual or organization.

- Dollar Amount: Write the amount clearly in both numerical form and written out in words to avoid confusion.

- Memo Field: Optionally, use this space to indicate the purpose of the payment.

- Signature: Your signature authenticates the check and provides authorization for the transaction.

Common Errors to Avoid

- Incorrect Payee Name: Always double-check the spelling of the name to minimize errors.

- Derogatory Checks: Avoid making checks payable to "cash" unless necessary, as this makes it easier for anyone to cash it.

- White-Out and Alterations: Never attempt to alter a check, as doing so can render it invalid and potentially raise suspicion of fraud.

Examples of Using “Please Make Your Check Payable To”

When you have a specific financial obligation, clarity on how to correctly issue a check is essential. The following examples illustrate common scenarios.

Personal Payments

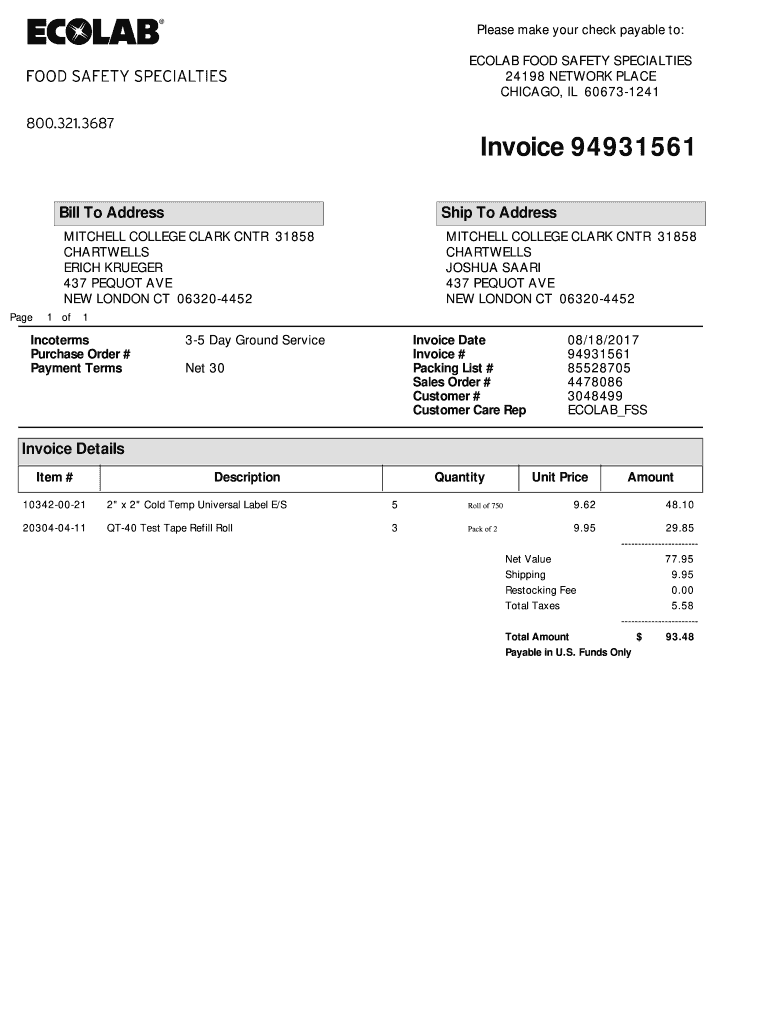

A landscape service provider may include an invoice stating, "Please make your check payable to: Lawn Care Experts, LLC." This clear instruction ensures that only the correct company receives the payment.

Donations

Non-profit organizations often request checks to be phrased as “Please make checks payable to: Helping Hands Foundation.” This language is critical for ensuring that donations are correctly allocated.

Legal Use of Checks and Payable Instructions

Understanding lawful practices concerning checks is crucial for both personal and business finances.

Legal Validity

- Written Agreements: Having a clearly defined payee helps maintain legal standing. In disputes, courts will likely favor clarity in written instructions.

- Accounting and Compliance: Businesses must adhere to financial regulations; hence, having precise check policies helps avoid legal complications.

When a Check Is Not Payable

If a check is made payable to an entity that no longer exists or an individual that has passed away, it may be deemed invalid. Always verify the status of the payee before issuing checks.

Key Elements of Check Payment Instructions

The phrase “please make your check payable to” serves several critical functions in financial transactions.

Clarity

- Specificity: Clearly stating the payee ensures that only the designated recipient can cash or deposit the check.

- Avoiding Confusion: Proper instruction prevents misdirected payments, reducing the risk of impacting cash flow.

Documentation

- Supporting Records: Having the payee’s name on the check aligns with invoicing records, aiding bookkeeping and financial reporting.

- Authorship: Clearly establishing the entity ensures that payments are traceable to legitimate contracts or agreements.

Conclusion

Accurate completion of checks makes a significant difference in financial transactions. By lining up the process and understanding the legal necessities concerning who is payable, both individuals and organizations can navigate their financial obligations more efficiently.