Definition and Purpose of the T-Mobile Receipt Template

A T-Mobile receipt template is a structured document used to verify the purchase of products or services from T-Mobile, providing vital details such as transaction amounts, service activation, and payment methods. This template serves multiple purposes within personal and business contexts, enhancing record-keeping and transaction verification.

- Verification of Purchase: It confirms that a transaction occurred, specifying dates and amounts associated with the purchase.

- Financial Records: Useful for budgeting and auditing, providing a streamlined way to track mobile expenses.

- Tax Documentation: Assists in tax preparations, especially for those who are self-employed or itemize deductions.

The standard elements in this template typically include transaction dates, itemized charges, payment method, and any applicable taxes. By using this template, users can maintain accurate and organized records for personal or professional use.

How to Use the T-Mobile Receipt Template

Utilizing the T-Mobile receipt template involves several straightforward steps that ensure proper documentation and record-keeping.

-

Download the Template: Access and download a T-Mobile receipt template from a reliable source.

-

Fill in Transaction Details:

- Customer Information: Include details such as name and contact information.

- Purchase Details: Input information about the devices or services purchased, including model names, quantities, and prices.

- Payment Information: Specify the payment method used, whether debit, credit, or cash.

-

Add Important Disclosures: Incorporate pertinent terms regarding returns and warranties that apply to the purchases.

-

Save and Share: Once completed, save the document in a suitable format (like PDF) for printing or sharing via email.

Having this template simplifies the process of creating a professional-looking receipt that accurately reflects the transaction for future reference.

Steps to Complete the T-Mobile Receipt Template

Completing a T-Mobile receipt template accurately is essential for clarity and legal compliance. Here are the key steps involved:

-

Header Information: Enter T-Mobile’s business name, address, and contact information at the top of the document.

-

Date of Purchase: Clearly indicate the date the transaction occurred; this is critical for both customer records and potential warranty claims.

-

Customer's Information:

- Full name

- Address (optional)

- Contact number

-

Itemized List of Products/Services:

- Describe each item or service.

- List quantities.

- Provide individual prices and total amounts.

-

Taxes and Discounts: Include any applicable sales tax, as well as any discounts that may have been applied.

-

Total Amount Due: Highlight the total amount due, ensuring it is prominently displayed for clarity.

-

Signature Option: Provide space for a signature if required, as this enhances the receipt's legality.

These steps ensure that all pertinent information is included, facilitating effective communication regarding the transaction.

Importance of the T-Mobile Receipt Template

The T-Mobile receipt template holds significant importance for various stakeholders, providing utility beyond mere transaction confirmation.

-

For Consumers: This template serves as a record of their mobile services and devices, eventually aiding in claims for defects, returns, or warranty services.

-

For Businesses: Companies providing mobile services can utilize this template to maintain consistent and professional record-keeping, enhancing customer trust and ensuring compliance with financial accounting practices.

-

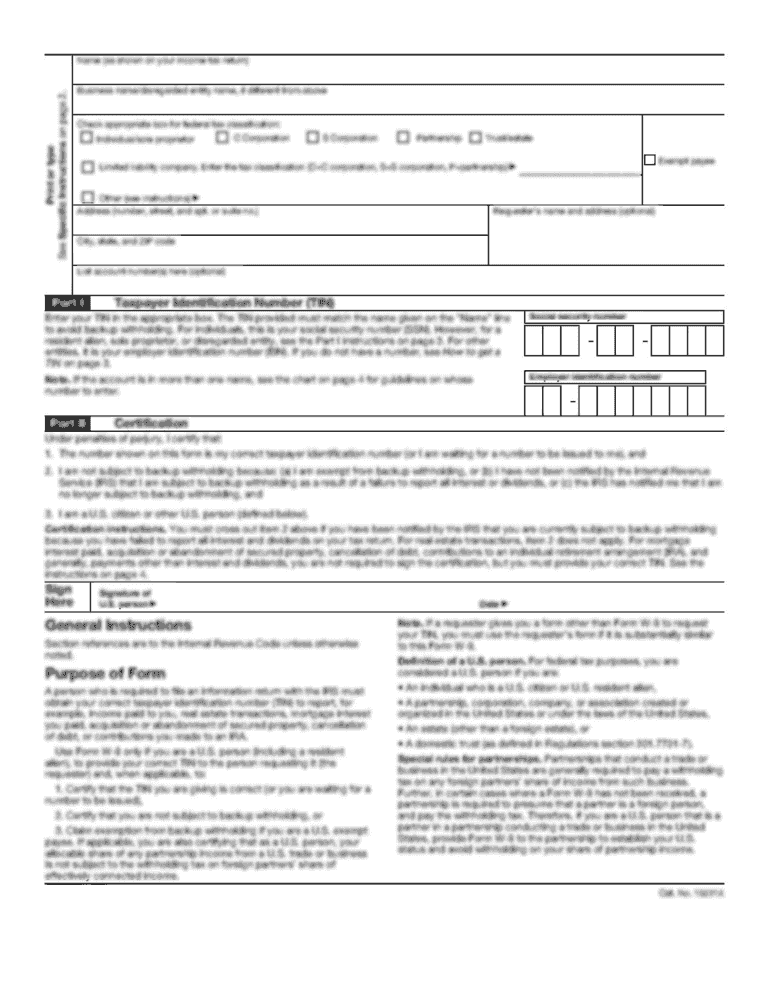

For Tax Purposes: Individuals or businesses using mobile services can claim deductions on their income tax returns. The receipt template facilitates effective tracking of expenses related to business operations.

Overall, using a standardized receipt template helps ensure accuracy and professionalism in recording transactions.

Legal Use of the T-Mobile Receipt Template

The T-Mobile receipt template is a legally binding document that can be utilized in various situations, depending on the context.

-

Proof of Purchase: This template serves as a legal proof of purchase, which is important for warranty claims and service activations. It is essential for consumers seeking to validate their rights regarding a purchase.

-

Tax Documentation: For self-employed individuals or businesses, using the receipt may be necessary for tax filings as evidence of legitimate expenses. The IRS recognizes such documentation for tax deductions when properly maintained.

-

Dispute Resolution: In case of disputes related to billing or service issues, the receipt can be presented as evidence, supporting the customer's case during resolution processes.

Important Clauses

- Include statements that clarify refund policies, service activation conditions, and other critical terms related to the transaction.

Understanding the legal implications and uses of this template helps stakeholders navigate transactions with greater confidence and clarity.