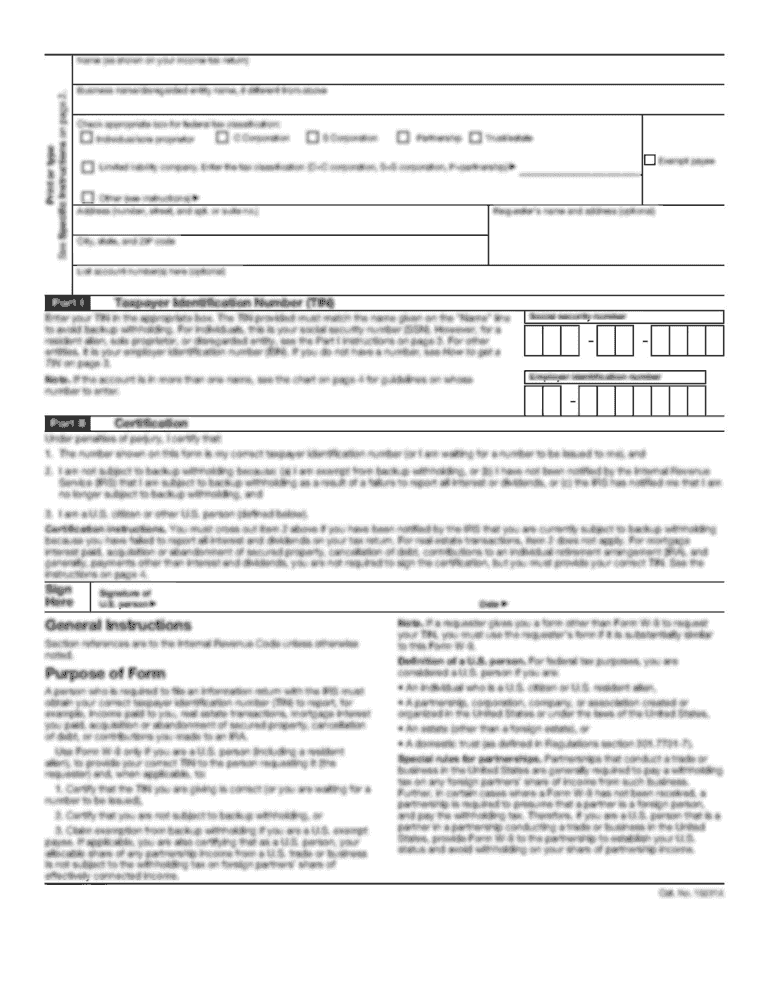

Understanding the NC-4 Spanish Form

The NC-4 Spanish form, officially termed the Employee’s Withholding Allowance Certificate, is used by employees in North Carolina to determine the appropriate amount of state income tax to withhold from their paychecks. This form is designed specifically for Spanish-speaking employees, ensuring they can easily complete it in a language they are comfortable with. The accurate completion of this form ensures compliance with state income tax laws and helps employees manage their tax withholding more effectively.

Key Elements of the NC-4 Spanish Form

The NC-4 Spanish form includes several key elements that facilitate its effective use:

- Personal Information: Employees must provide their full name, address, and Social Security number.

- Filing Status: The form includes sections for electing filing status, which impacts the number of allowances claimed.

- Allowances Claimed: Employees can specify the total number of allowances they wish to claim based on their dependents, marital status, and other factors.

- Additional Withholding: There is an option to request additional amounts to be withheld from their checks if desired.

- Signature and Date: Employees must sign and date the form to confirm that the information provided is accurate.

These elements collectively help ensure that the employee's tax situation is correctly represented, minimizing potential tax liabilities at the end of the fiscal year.

How to Complete the NC-4 Spanish Form

Completing the NC-4 Spanish form involves several steps that must be diligently followed:

- Gather Required Information: Before starting, collect necessary personal information, including your Social Security number and the number of dependents.

- Fill Personal Details: Enter your name, address, and contact information accurately in the designated sections.

- Determine Filing Status: Identify your filing status, whether single, married, or head of household, as this affects the allowances you can claim.

- Calculate Allowances: Use the guidelines provided in the form to calculate and enter the number of allowances based on your personal circumstances.

- Review for Accuracy: Double-check all entries for accuracy before signing.

- Submit the Form: Provide the completed NC-4 Spanish form to your employer, who will use the information to adjust your tax withholding accordingly.

Each step of this process ensures that the employee does not over- or under-withhold taxes, leading to a smoother income tax filing experience.

Legal Use of the NC-4 Spanish Form

The NC-4 Spanish form holds legal standing as an official document for tax withholding purposes in North Carolina. It is crucial for ensuring that state income tax is accurately withheld from a paycheck according to the employee’s specific tax situation. The form must be filled out truthfully, as any discrepancies or false information can lead to legal repercussions, including penalties or audits by state tax authorities.

In addition, because the form is available in Spanish, it provides essential access for Spanish-speaking employees, promoting equitable tax compliance among diverse populations in North Carolina.

Who Typically Uses the NC-4 Spanish Form?

The NC-4 Spanish form is primarily used by employees in North Carolina who prefer instructions and documentation in Spanish. This might include:

- New Employees: Individuals starting in new jobs, particularly if they are newly employed within the state.

- Spanish-Speaking Workers: Employees who may be more comfortable with Spanish as their primary language.

- Seasonal or Part-Time Workers: Those who may have fluctuating employment and income can use this form to adjust their withholding appropriately.

Understanding who utilizes the NC-4 Spanish form aids employers in ensuring that they provide adequate support and resources for their diverse workforce.

Important Terms Related to the NC-4 Spanish Form

Several important terms are associated with the NC-4 Spanish form that are essential for proper understanding and usage:

- Withholding Allowance: A deduction based on personal circumstances that reduces the amount of tax withheld from an employee’s paycheck.

- Tax Liability: The total amount of tax that an individual owes to the state based on income, deductions, and credits.

- Filing Status: Categories such as single, married filing jointly, and head of household that determine the taxpayer’s obligations and allowances.

- Dependents: Individuals, such as children, who rely on the taxpayer for financial support, which may affect the number of allowances claimed.

Familiarity with these terms will enhance comprehension of the form and its impacts on personal taxes.

Filing Deadlines and Important Dates

Understanding the deadlines associated with the NC-4 Spanish form is critical for compliance with tax regulations:

- Employer Submission: Employees should submit the completed form to their employers as soon as possible, particularly during hiring or when making changes to tax withholding.

- Annual Tax Filing: Employees should be aware of the annual tax filing deadline, typically April 15, to avoid penalties for late filing.

- State Tax Changes: It is imperative to stay updated on any changes in state tax laws that may affect the NC-4 Spanish form requirements or guidelines.

By adhering to these critical dates, employees can avoid complications and ensure accurate tax withholdings throughout the year.