Definition and Meaning of the Syndicate Bank Pension Slip

The syndicate bank pension slip is a critical document provided to retirees as part of their pension disbursement process. It serves as a formal acknowledgment of the pension amount due to an individual and outlines the essential details of the pension scheme. This document is vital for ensuring that pensioners receive their entitled benefits in a timely manner and serves as proof of income for those relying on this financial support during retirement.

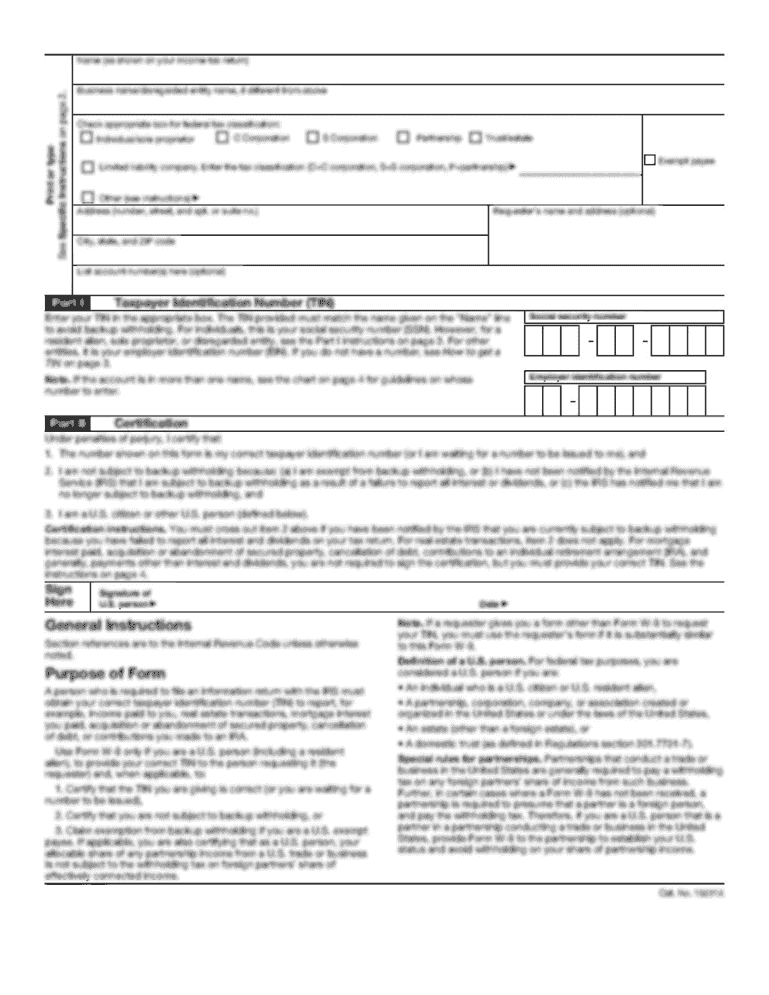

Key Components of a Pension Slip

- Pensioner Information: Name, address, and account details of the pensioner.

- Pension Amount: The total pension amount credited to the account.

- Payment Date: The date on which the pension is disbursed.

- Bank Details: Information about the syndicate bank branch, including address and contact information.

This document is foundational for the financial stability of retirees and is often required for several personal financial matters, including loan applications, tax filings, and eligibility for various government assistance programs.

How to Obtain the Syndicate Bank Pension Slip

Obtaining a syndicate bank pension slip involves a straightforward process. Here are the key steps involved:

- Visit the Syndicate Bank Branch: Pensioners can directly visit their associated syndicate bank branch.

- Online Access: If the bank offers online banking services, pensioners can log into their account through the syndicate bank's website or mobile app to download their pension slip.

- Contact Customer Service: In cases where pension slips cannot be accessed online or in-person, contacting customer service via phone or email can provide guidance on how to obtain the slip.

Additional Methods

- Email Request: Some banks allow pensioners to request their slips via email, which can expedite the process.

- Postal Mail: For those who prefer traditional methods, requesting a hard copy sent to their residential address is an option.

Ensuring that retirees have easy access to their pension slips promotes financial transparency and helps manage personal finances more effectively.

Steps to Complete the Syndicate Bank Pension Slip

Completing a syndicate bank pension slip requires careful attention to detail. Here are the critical steps to follow:

- Gather Necessary Information: Collect your pension account details, personal identification, and any other supporting documents that may be needed.

- Fill Out Personal Details: Provide accurate information, including your name, address, and contact information.

- Enter Pension Amount: Clearly state the total pension amount being received in the current payment cycle.

- Review and Submit: Double-check all entries for accuracy before submission to avoid any discrepancies.

Common Challenges in Completing the Slip

- Missing Information: Ensuring that all required fields are filled correctly helps prevent delays.

- Date Errors: Stating the correct payment date is essential for record-keeping and tax purposes.

By following these outlined steps, pensioners can ensure that their slips are completed accurately, thereby facilitating smooth transactions with their banks.

Important Terms Related to the Syndicate Bank Pension Slip

Understanding the terminology related to the syndicate bank pension slip is crucial for effective management of pension finances. Here are several key terms:

- Pensioner: The individual receiving the pension payments, often being a retired employee.

- Beneficiary: A person designated to receive benefits in the event of the pensioner’s demise.

- Disbursal Date: The scheduled date on which the pension payment is credited to the pensioner’s bank account.

- Arrears: Payments owed to the pensioner for previous periods that were missed or delayed.

- Annual Certificate: A declaration required to confirm the pensioner's continuing eligibility for receiving pension benefits.

Awareness of these terms can empower pensioners to better understand their rights and responsibilities, thereby enhancing their financial management.

Form Submission Methods for the Syndicate Bank Pension Slip

Submitting the syndicate bank pension slip can be done through various methods, depending on the individual's preferences and the bank's available options.

Available Submission Methods

- Online Submission: For those who wish to leverage technology, the bank's online portal allows for digital submissions, often resulting in quicker processing times.

- In-Person Submission: Visiting a bank branch for direct submission of the pension slip remains a popular choice, especially for those who prefer face-to-face interactions.

- Postal Submission: Mailing the completed form to the proper bank address can be an option; however, it's essential to ensure timely delivery to avoid delays.

Advantages of Each Method

- Online: Convenience and quick processing.

- In-Person: Immediate feedback and assistance from bank staff.

- Postal: Suitable for those who may not have internet access or prefer hard copies for their records.

Choosing the appropriate submission method can significantly impact how quickly a pensioner receives their benefits.

Legal Use of the Syndicate Bank Pension Slip

The syndicate bank pension slip is not just a financial document; it also has legal implications. Understanding its legal aspects is essential for retirees.

Significance of the Document

- Proof of Income: The pension slip serves as an official record of income for various purposes, including tax filings and loan applications.

- Confirming Eligibility: It acts as proof of an individual's eligibility for government benefits that require a demonstration of income.

Legal Protections

- Data Privacy: The contents of the pension slip are protected under financial privacy regulations, ensuring sensitive personal and financial information is secure.

Awareness of the legal implications surrounding the pension slip ensures retirees can effectively protect their rights and access the benefits they deserve.