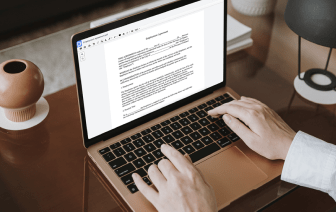

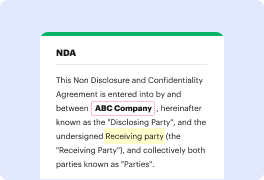

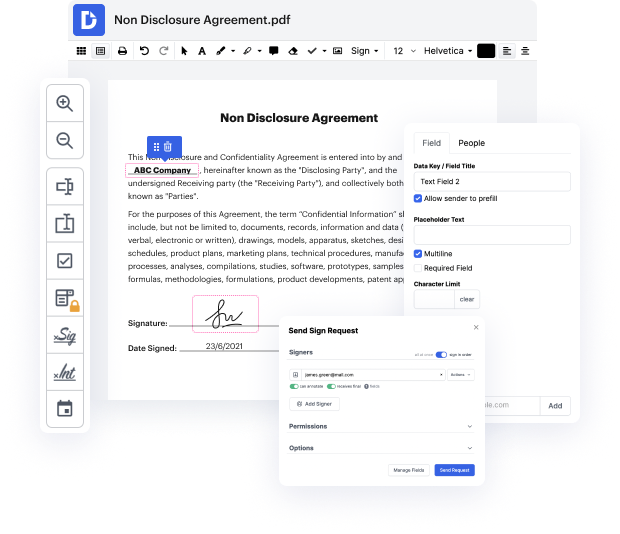

Whether you deal with documents daily or only occasionally need them, DocHub is here to assist you make the most of your document-based tasks. This platform can replace tag in VAT Invoice Template, facilitate collaboration in teams and create fillable forms and valid eSignatures. And even better, every record is kept safe with the top safety standards.

With DocHub, you can get these features from any location and using any device.

hey everybody my name is marcus and in this video ill show you a simple way how you can simply change a invoice template in xero so lets start the first thing you want to do is when youre in x0 you want to click on like lets go to business and invoices or you like when youre here you just want to i know click on whatever invoice that you got and then go to write three dots and go to invoice settings you can also get there through here settings i think but i go always this way now when youre gonna see organization setting invoice settings you can simply change the invoice template here you i have free here so i can click new branding theme and i can set up literally everything i can create a name here terms and payment advice and you can change like literally a pro and invoice title just everything here and then what you can do also is like when you have a standard created pre-created you can click edit and you can choose like change this so you dont have to actually create a new