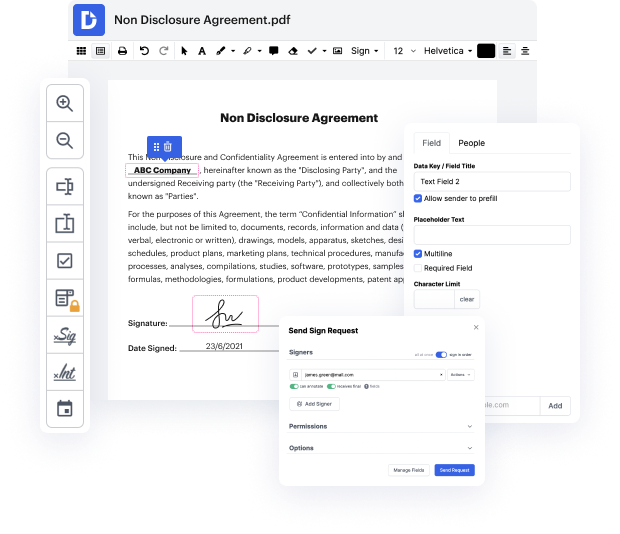

You know you are using the proper file editor when such a simple job as Limit payment notice does not take more time than it should. Modifying papers is now a part of many working operations in numerous professional areas, which is why convenience and simplicity are essential for editing resources. If you find yourself studying tutorials or looking for tips about how to Limit payment notice, you might want to get a more user-friendly solution to save time on theoretical learning. And here is where DocHub shines. No training is required. Just open the editor, which will guide you through its main functions and features.

A workflow becomes smoother with DocHub. Make use of this instrument to complete the documents you need in short time and take your productivity to another level!

welcome to employee termination tips my names christopher neufeld of new foul legal and in this particular video were going to be discussing termination pay in lieu of notice and the pros and cons associated with pursuing termination pay in lieu of notice as opposed to providing notice of termination to ones employees when they are terminated without cause thats a critical thing youre terminating someone without cause and then youre looking at the statutory requirements as to what your statutory obligations are with respect to that individual employee that you are now terminating what can you do to provide them notice and how they continue working or alternatively do you provide them with determination pay in lieu of notice or some combination of two but typically it should really be one or the other and well be discussing in the pros and cons why termination pay in lieu of notes typically tends to be preferable to providing notice and continue to have that person working there

At DocHub, your data security is our priority. We follow HIPAA, SOC2, GDPR, and other standards, so you can work on your documents with confidence.

Learn more