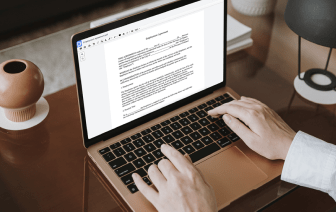

Time is an important resource that each organization treasures and attempts to change in a advantage. When choosing document management application, take note of a clutterless and user-friendly interface that empowers customers. DocHub provides cutting-edge features to improve your file management and transforms your PDF editing into a matter of one click. Insert Currency into the Allocation Agreement with DocHub in order to save a lot of time and boost your efficiency.

Make PDF editing an easy and intuitive process that saves you a lot of precious time. Easily change your files and deliver them for signing without looking at third-party alternatives. Concentrate on relevant tasks and enhance your file management with DocHub starting today.

welcome to currency forward contracts currency forward contract is an agreement between two parties to exchange a fixed amount of one currency for another at an agreed-upon future date the exchange rate for the future transactions is fixed in advance at the time of signing the agreement the currency forward contracts can be either outright forwards or non-deliverable forwards and now try forward contract calls for future transaction where the two currencies are actually exchanged a non deliverable forward contract or NDF is settled in a single currency such as the US dollar both types of forward contracts can be used for speculation or risk management this tutorial discusses outright forward contracts lets consider a US technology company that just delivered an order to a UK customer and is expecting a payment of 10 million British pounds in 90 days lets assume that the current spot rate is dollar 60 per pound so in 90 days the exporter would expect to get 16 million u.s. dollars at