Working with paperwork can be a challenge. Each format comes with its peculiarities, which frequently leads to complex workarounds or reliance on unknown software downloads to bypass them. Luckily, there’s a tool that will make this process more enjoyable and less risky.

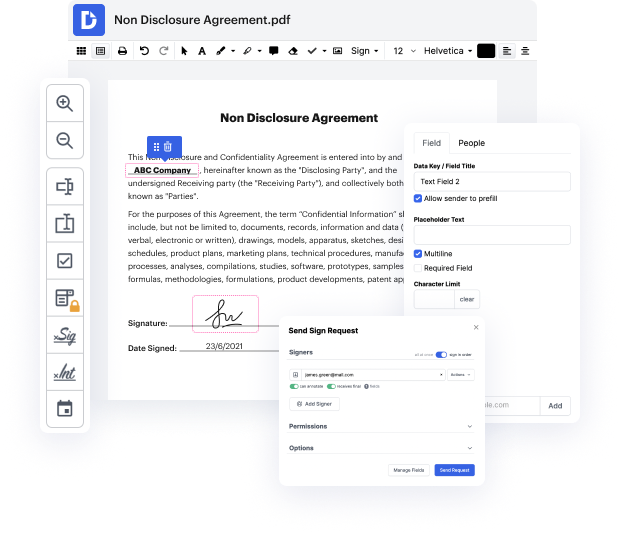

DocHub is a super simple yet full-featured document editing solution. It has a myriad of features that help you shave minutes off the editing process, and the option to Excise Numbers Work For Free is only a fraction of DocHub’s functionality.

Whether if you need a one-off edit or to edit a multi-page form, our solution can help you Excise Numbers Work For Free and apply any other desired changes easily. Editing, annotating, certifying and commenting and collaborating on files is straightforward using DocHub. Our solution is compatible with various file formats - choose the one that will make your editing even more frictionless. Try our editor for free today!