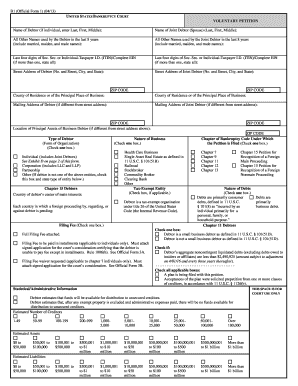

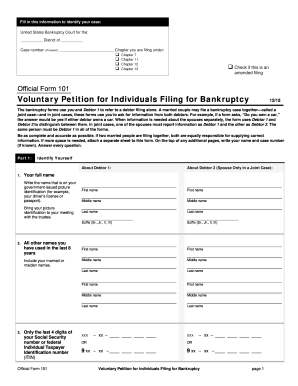

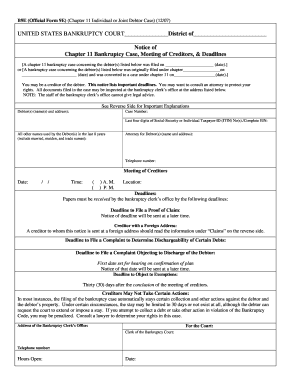

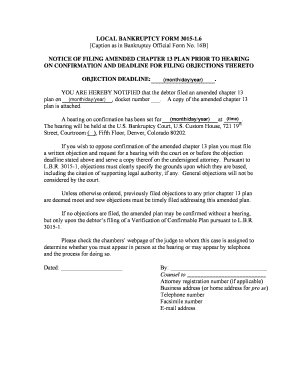

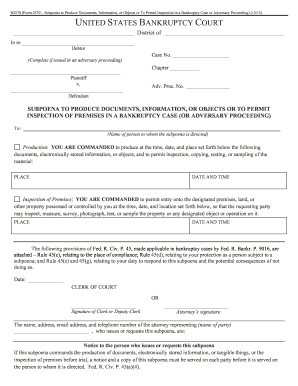

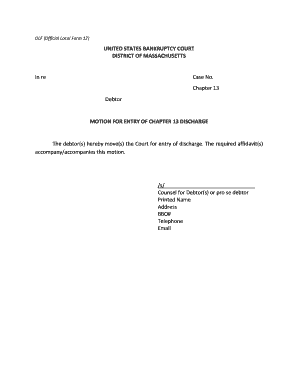

Preserve time and effort with our comprehensive library of industry-specific Bankruptcy Order Forms. Choose from a range of pre-made templates or personalize your own.

Your workflows always benefit when you can obtain all of the forms and documents you will need on hand. DocHub gives a a huge collection of documents to ease your day-to-day pains. Get hold of Bankruptcy Order Forms category and quickly browse for your form.

Begin working with Bankruptcy Order Forms in a few clicks:

Enjoy smooth record management with DocHub. Explore our Bankruptcy Order Forms online library and look for your form right now!