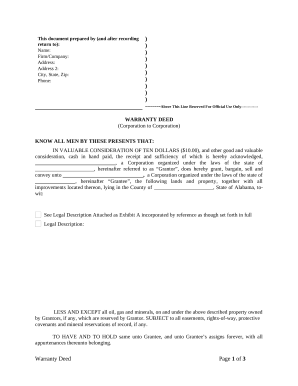

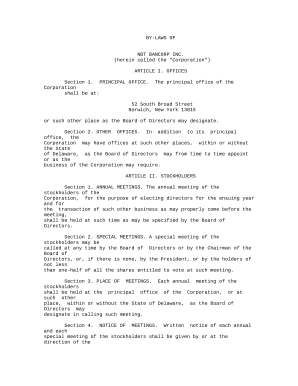

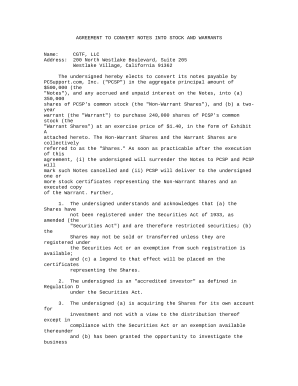

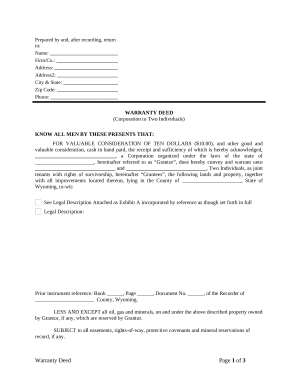

Speed up your document administration with the USA Corporate Legal Forms collection with ready-made document templates that meet your requirements. Get the document template, change it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your documents.

The best way to use our USA Corporate Legal Forms:

Examine all the opportunities for your online file administration with the USA Corporate Legal Forms. Get your totally free DocHub account right now!