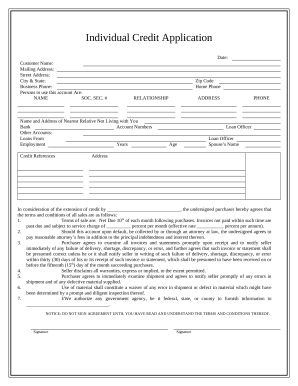

Your workflows always benefit when you are able to find all the forms and documents you require on hand. DocHub gives a vast array of form templates to alleviate your daily pains. Get hold of Personal Loan Applications category and quickly find your form.

Start working with Personal Loan Applications in several clicks:

Enjoy seamless form administration with DocHub. Discover our Personal Loan Applications online library and discover your form right now!