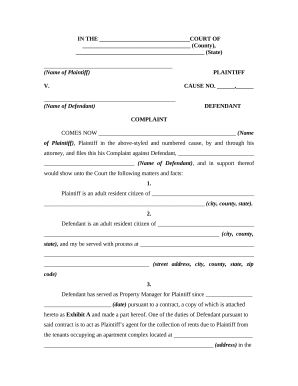

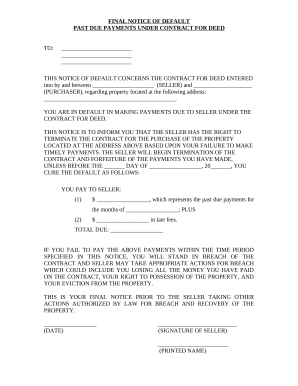

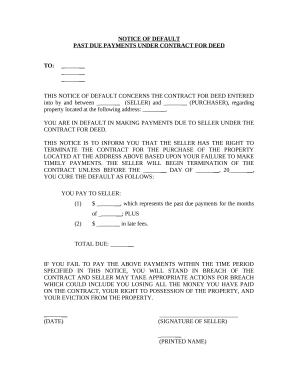

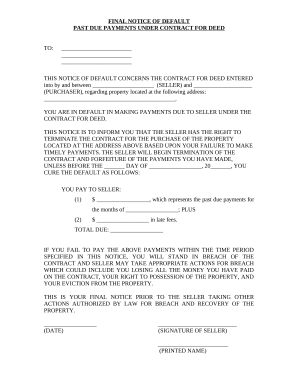

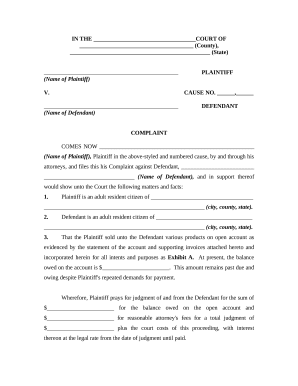

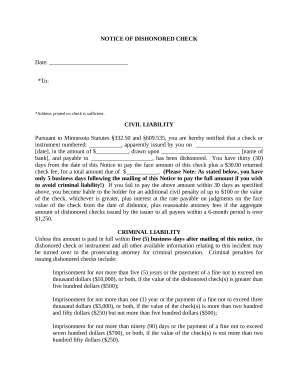

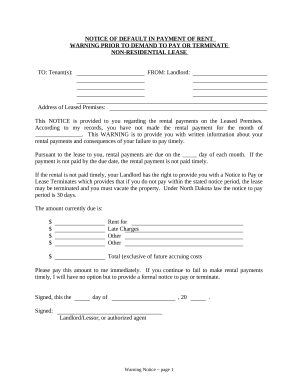

Boost your file operations with our Payment Default Legal Forms library with ready-made form templates that suit your needs. Get the document template, edit it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

The best way to manage our Payment Default Legal Forms:

Examine all the opportunities for your online document management with the Payment Default Legal Forms. Get your totally free DocHub account right now!