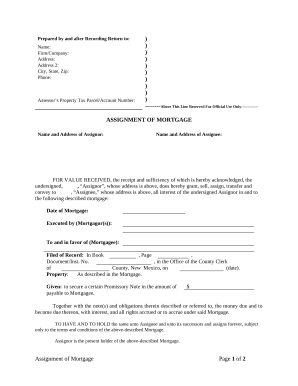

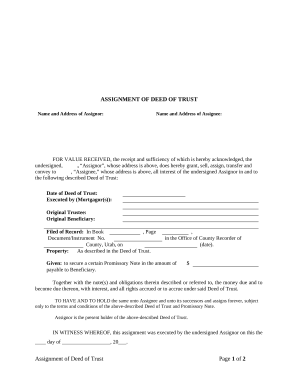

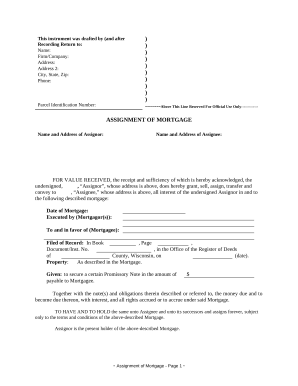

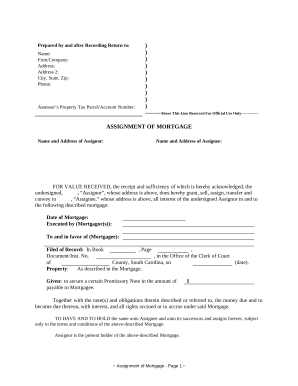

Your workflows always benefit when you can easily discover all of the forms and documents you may need on hand. DocHub supplies a a large collection templates to ease your daily pains. Get hold of Mortgage Holder Documents category and quickly browse for your document.

Start working with Mortgage Holder Documents in several clicks:

Enjoy easy record administration with DocHub. Discover our Mortgage Holder Documents online library and locate your form right now!