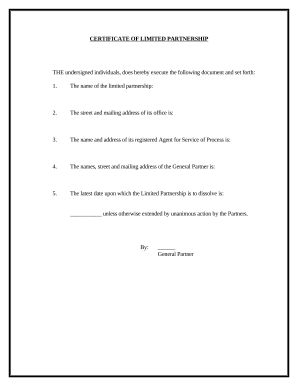

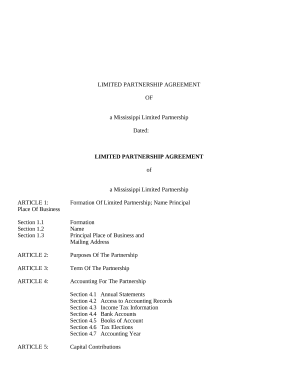

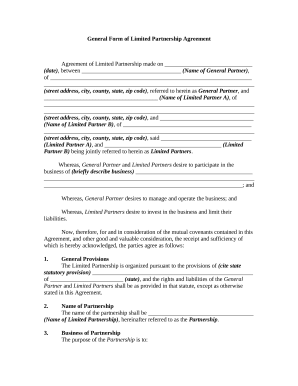

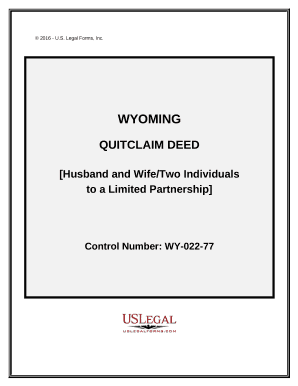

Your workflows always benefit when you are able to obtain all of the forms and files you need at your fingertips. DocHub provides a a huge library of forms to ease your day-to-day pains. Get a hold of Limited Partnership Forms category and quickly browse for your document.

Start working with Limited Partnership Forms in several clicks:

Enjoy easy form administration with DocHub. Explore our Limited Partnership Forms collection and find your form right now!