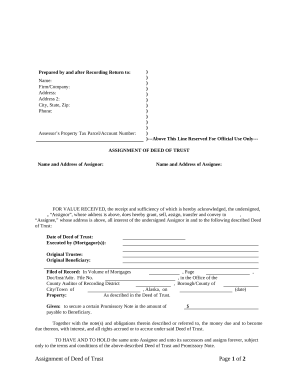

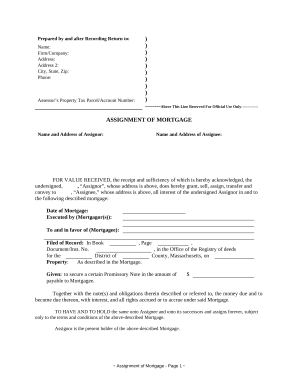

Your workflows always benefit when you can obtain all of the forms and files you will need on hand. DocHub offers a vast array of form templates to relieve your day-to-day pains. Get hold of Legal Mortgage Assignment category and quickly find your form.

Start working with Legal Mortgage Assignment in several clicks:

Enjoy easy record administration with DocHub. Explore our Legal Mortgage Assignment collection and get your form today!